Salesforce.com 2016 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Revenue Recognition

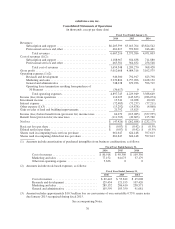

The Company derives its revenues from two sources: (1) subscription revenues, which are comprised of

subscription fees from customers accessing the Company’s enterprise cloud computing services and from

customers paying for additional support beyond the standard support that is included in the basic subscription

fees; and (2) related professional services such as process mapping, project management, implementation

services and other revenue. “Other revenue” consists primarily of training fees.

The Company commences revenue recognition when all of the following conditions are satisfied:

• there is persuasive evidence of an arrangement;

• the service has been or is being provided to the customer;

• the collection of the fees is reasonably assured; and

• the amount of fees to be paid by the customer is fixed or determinable.

The Company’s subscription service arrangements are non-cancelable and do not contain refund-type

provisions.

Subscription and Support Revenues

Subscription and support revenues are recognized ratably over the contract terms beginning on the

commencement date of each contract, which is the date the Company’s service is made available to customers.

Amounts that have been invoiced are recorded in accounts receivable and in deferred revenue or revenue,

depending on whether the revenue recognition criteria have been met.

Professional Services and Other Revenues

The majority of the Company’s professional services contracts are on a time and material basis. When these

services are not combined with subscription revenues as a single unit of accounting, as discussed below, these

revenues are recognized as the services are rendered for time and material contracts, and when the milestones are

achieved and accepted by the customer for fixed price contracts. Training revenues are recognized as the services

are performed.

Multiple Deliverable Arrangements

The Company enters into arrangements with multiple deliverables that generally include multiple subscriptions,

premium support and professional services. If the deliverables have standalone value upon delivery, the Company

accounts for each deliverable separately. Subscription services have standalone value as such services are often sold

separately. In determining whether professional services have standalone value, the Company considers the following

factors for each professional services agreement: availability of the services from other vendors, the nature of the

professional services, the timing of when the professional services contract was signed in comparison to the

subscription service start date and the contractual dependence of the subscription service on the customer’s satisfaction

with the professional services work. To date, the Company has concluded that all of the professional services included

in multiple deliverable arrangements executed have standalone value.

Multiple deliverables included in an arrangement are separated into different units of accounting and the

arrangement consideration is allocated to the identified separate units based on a relative selling price hierarchy.

The Company determines the relative selling price for a deliverable based on its vendor-specific objective

evidence of selling price (“VSOE”), if available, or its best estimate of selling price (“BESP”), if VSOE is not

available. The Company has determined that third-party evidence of selling price (“TPE”) is not a practical

82