Salesforce.com 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

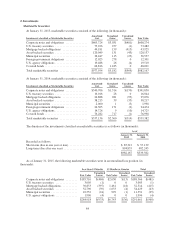

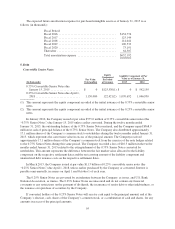

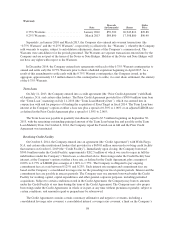

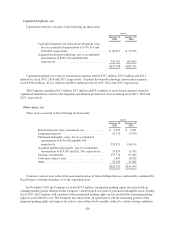

4. Business Combinations

RelateIQ, Inc.

On August 1, 2014, the Company acquired the outstanding stock of RelateIQ, Inc. (“RelateIQ”), a

relationship intelligence platform company that uses data science and machine learning to automatically capture

data from email, calendars and smartphone calls and provide data science-driven insights in real time. The

Company acquired RelateIQ for the assembled workforce and expected synergies with the Company’s current

offerings. The Company has included the financial results of RelateIQ in the consolidated financial statements

from the date of acquisition, which have not been material to date. The acquisition date fair value of the

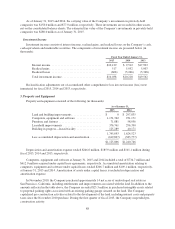

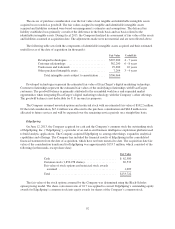

consideration transferred for RelateIQ was approximately $340.2 million, which consisted of the following (in

thousands, except share data):

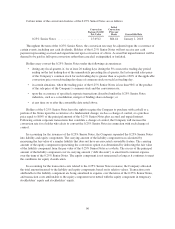

Fair Value

Cash .................................................... $ 1,123

Common stock (6,320,735 shares) ............................. 338,033

Fair value of stock options and restricted stock awards assumed ..... 1,050

Total .................................................... $340,206

The fair value of the stock options assumed by the Company was determined using the Black-Scholes

option pricing model. The share conversion ratio of 0.12 was applied to convert RelateIQ’s outstanding equity

awards for RelateIQ’s common stock into equity awards for shares of the Company’s common stock.

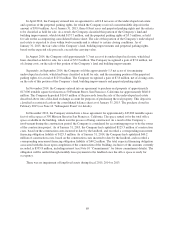

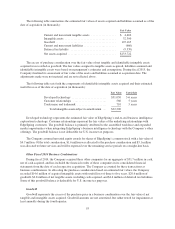

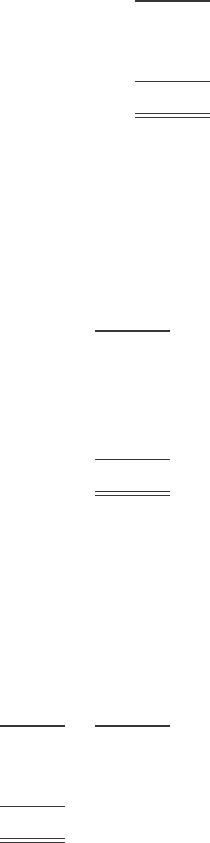

The following table summarizes the estimated fair values of assets acquired and liabilities assumed as of the

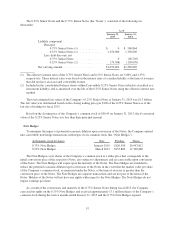

date of acquisition (in thousands):

Fair Value

Cash ............................................ $ 39,194

Intangible assets ................................... 16,200

Goodwill ......................................... 289,857

Current and noncurrent liabilities ...................... (4,700)

Deferred tax liability ............................... (345)

Net assets acquired ................................. $340,206

The excess of purchase consideration over the fair value of net tangible and identifiable intangible assets

acquired was recorded as goodwill. The fair values assigned to tangible assets acquired, liabilities assumed and

identifiable intangible assets are based on management’s estimates and assumptions.

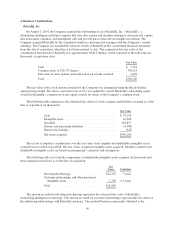

The following table sets forth the components of identifiable intangible assets acquired (in thousands) and

their estimated useful lives as of the date of acquisition:

Fair

Value Useful Life

Developed technology ..................... $14,470 7 years

Customer relationships and other purchased

intangible assets ........................ 1,730 1-3 years

Total .................................. $16,200

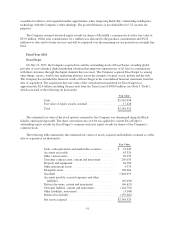

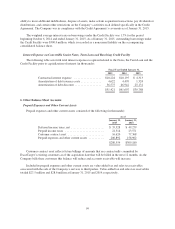

The amount recorded for developed technology represents the estimated fair value of RelateIQ’s

relationship intelligence technology. The amount recorded for customer relationships represent the fair values of

the underlying relationships with RelateIQ customers. The goodwill balance is primarily attributed to the

90