Salesforce.com 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.customer contracts. We believe this is the preferable method of accounting as the commission charges are so

closely related to the revenue from the non-cancelable customer contracts that they should be recorded as an

asset and charged to expense over the same period that the subscription revenue is recognized.

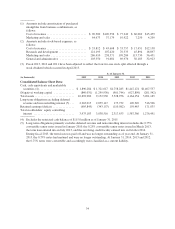

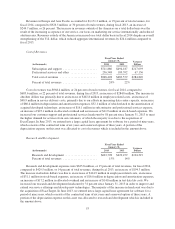

During the fiscal 2015, we deferred $320.9 million of commission expenditures and we amortized $257.6

million to sales expense. During the same period a year ago, we deferred $265.1 million of commission

expenditures and we amortized $194.6 million to sales expense. Deferred commissions on our consolidated

balance sheets totaled $388.2 million at January 31, 2015 and $324.9 million at January 31, 2014.

Capitalized Internal-Use Software Costs. We are required to follow the guidance of Accounting Standards

Codification 350 (“ASC 350”), Intangibles- Goodwill and Other in accounting for the cost of computer software

developed for internal-use and the accounting for web-based product development costs. ASC 350 requires

companies to capitalize qualifying computer software costs, which are incurred during the application

development stage, and amortize these costs on a straight-line basis over the estimated useful life of the

respective asset. We deliver our enterprise cloud computing solutions as a service via all the major Internet

browsers and on leading major mobile device operating systems. As a result of this software as a service delivery

model, we believe we have larger capitalized costs as compared to traditional enterprise software companies as

they are required to use a different accounting standard.

Costs related to preliminary project activities and post implementation activities are expensed as incurred.

Internal-use software is amortized on a straight-line basis over its estimated useful life. We evaluate the useful

lives of these assets on an annual basis and test for impairment whenever events or changes in circumstances

occur that could impact the recoverability of these assets.

Goodwill and Long-Lived Assets. We make estimates, assumptions, and judgments when valuing goodwill

and other intangible assets in connection with the initial purchase price allocation of an acquired entity, as well as

when evaluating the recoverability of our goodwill and other intangible assets on an ongoing basis. These

estimates are based upon a number of factors, including historical experience, market conditions, and information

obtained from the management of acquired companies. Critical estimates in valuing certain intangible assets

include, but are not limited to, historical and projected attrition rates, anticipated growth in revenue from the

acquired customers and acquired technology, and the expected use of the acquired assets. These factors are also

considered in determining the useful life of acquired intangible assets. The amounts and useful lives assigned to

identified intangible assets impacts the amount and timing of future amortization expense.

The value of our goodwill and intangible assets could be impacted by future adverse changes such as, but

not limited to: a substantial decline in our market capitalization; an adverse action or assessment by a regulator;

and unanticipated competition.

We evaluate and test the recoverability of our goodwill for impairment at least annually during the fourth

quarter or more often if and when circumstances indicate that goodwill may not be recoverable. Each period we

evaluate the estimated remaining useful life of our intangible assets and whether events or changes in

circumstances warrant a revision to the remaining period of amortization. We evaluate long-lived assets, such as

property and equipment, and purchased intangible assets for impairment whenever events or changes in

circumstances indicate that the carrying amount of the assets may not be recoverable. Such events or changes in

circumstances include, but are not limited to, a significant decrease in the fair value of the underlying asset, a

significant decrease in the benefits realized from the acquired assets, difficulty and delays in integrating the

business or a significant change in the operations of the acquired assets or use of an asset. A long-lived asset is

considered impaired if its carrying amount exceeds the estimated future undiscounted cash flows the asset is

expected to generate. If a long-lived asset is considered to be impaired, the impairment to be recognized is the

amount by which the carrying amount of the asset exceeds the fair value of the asset or asset group.

Business Combinations. Accounting for business combinations requires us to make significant estimates and

assumptions, especially at the acquisition date with respect to tangible and intangible assets acquired and

43