Salesforce.com 2015 Annual Report Download - page 85

Download and view the complete annual report

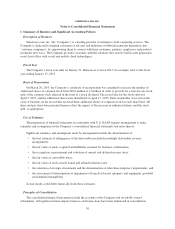

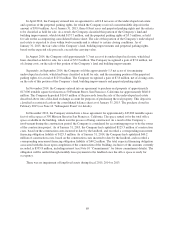

Please find page 85 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company determines BESP by considering its overall pricing objectives and market conditions.

Significant pricing practices taken into consideration include the Company’s discounting practices, the size and

volume of the Company’s transactions, the customer demographic, the geographic area where services are sold,

price lists, its go-to-market strategy, historical standalone sales and contract prices. The determination of BESP is

made through consultation with and approval by the Company’s management, taking into consideration the go-

to-market strategy. As the Company’s go-to-market strategies evolve, the Company may modify its pricing

practices in the future, which could result in changes in relative selling prices, including both VSOE and BESP.

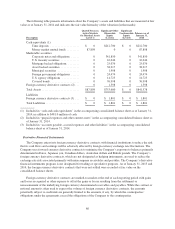

Deferred Revenue

The deferred revenue balance does not represent the total contract value of annual or multi-year, non-

cancelable subscription agreements. Deferred revenue primarily consists of billings or payments received in

advance of revenue recognition from subscription services described above and is recognized as the revenue

recognition criteria are met. The Company generally invoices customers in annual installments. The deferred

revenue balance is influenced by several factors, including seasonality, the compounding effects of renewals,

invoice duration, invoice timing, size and new business linearity within the quarter.

Deferred revenue that will be recognized during the succeeding twelve month period is recorded as current

deferred revenue and the remaining portion is recorded as noncurrent.

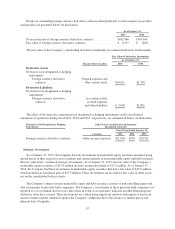

Deferred Commissions

Deferred commissions are the incremental costs that are directly associated with non-cancelable

subscription contracts with customers and consist of sales commissions paid to the Company’s direct sales force.

The commissions are deferred and amortized over the non-cancelable terms of the related customer

contracts, which are typically 12 to 36 months. The commission payments are paid in full the month after the

customer’s service commences. The deferred commission amounts are recoverable through the future revenue

streams under the non-cancelable customer contracts. The Company believes this is the preferable method of

accounting as the commission charges are so closely related to the revenue from the non-cancelable customer

contracts that they should be recorded as an asset and charged to expense over the same period that the

subscription revenue is recognized. Amortization of deferred commissions is included in marketing and sales

expense in the accompanying consolidated statements of operations.

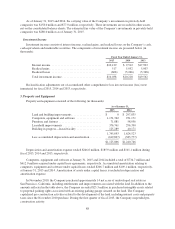

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with an original maturity of three months

or less to be cash equivalents. Cash and cash equivalents are stated at fair value.

Marketable Securities

Management determines the appropriate classification of marketable securities at the time of purchase and

reevaluates such determination at each balance sheet date. Securities are classified as available for sale and are

carried at fair value, with the change in unrealized gains and losses, net of tax, reported as a separate component

on the consolidated statements of comprehensive loss. Fair value is determined based on quoted market rates

when observable or utilizing data points that are observable, such as quoted prices, interest rates and yield curves.

Declines in fair value judged to be other-than-temporary on securities available for sale are included as a

component of investment income. In order to determine whether a decline in value is other-than-temporary, the

Company evaluates, among other factors: the duration and extent to which the fair value has been less than the

carrying value and its intent and ability to retain the investment for a period of time sufficient to allow for any

anticipated recovery in fair value. The cost of securities sold is based on the specific-identification method.

Interest on securities classified as available for sale is also included as a component of investment income.

79