Salesforce.com 2015 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

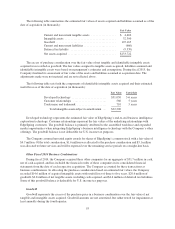

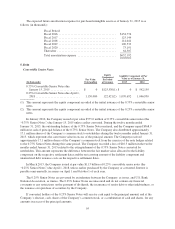

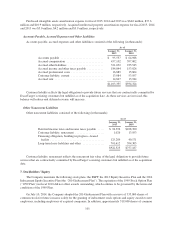

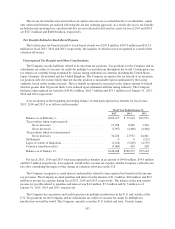

Purchased intangible assets amortization expense for fiscal 2015, 2014 and 2013 was $64.6 million, $37.6

million and $10.9 million, respectively. Acquired intellectual property amortization expense for fiscal 2015, 2014

and 2013 was $5.0 million, $4.2 million and $3.9 million, respectively.

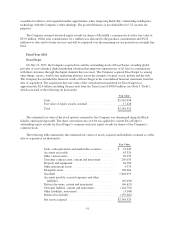

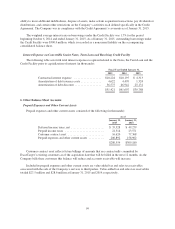

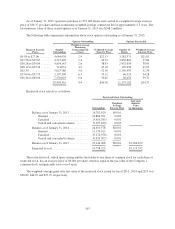

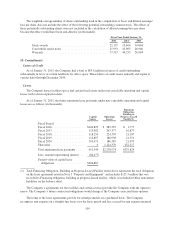

Accounts Payable, Accrued Expenses and Other Liabilities

Accounts payable, accrued expenses and other liabilities consisted of the following (in thousands):

As of

January 31,

2015

January 31,

2014

Accounts payable ............................. $ 95,537 $ 64,988

Accrued compensation ......................... 457,102 397,002

Accrued other liabilities ........................ 321,032 235,543

Accrued income and other taxes payable ........... 184,844 153,026

Accrued professional costs ...................... 16,889 15,864

Customer liability, current ...................... 13,084 53,957

Accrued rent ................................. 14,847 13,944

$1,103,335 $934,324

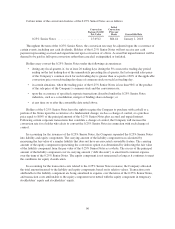

Customer liability reflects the legal obligation to provide future services that are contractually committed by

ExactTarget’s existing customers but unbilled as of the acquisition date. As these services are invoiced, this

balance will reduce and deferred revenue will increase.

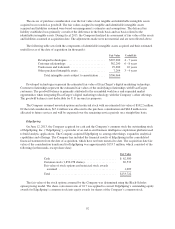

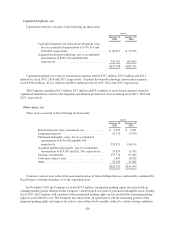

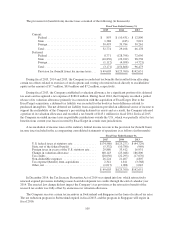

Other Noncurrent Liabilities

Other noncurrent liabilities consisted of the following (in thousands):

As of

January 31,

2015

January 31,

2014

Deferred income taxes and income taxes payable ..... $ 94,396 $108,760

Customer liability, noncurrent .................... 1,026 13,953

Financing obligation, building in progress—leased

facility ..................................... 125,289 40,171

Long-term lease liabilities and other ............... 701,612 594,303

$922,323 $757,187

Customer liability, noncurrent reflects the noncurrent fair value of the legal obligation to provide future

services that are contractually committed by ExactTarget’s existing customers but unbilled as of the acquisition

date.

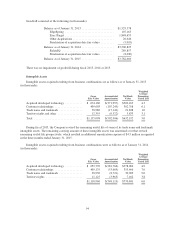

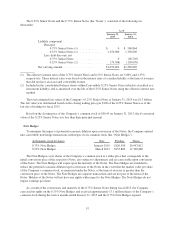

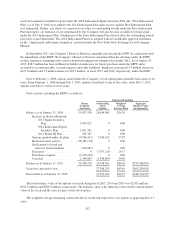

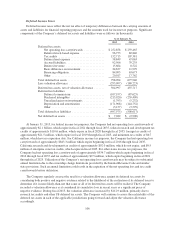

7. Stockholders’ Equity

The Company maintains the following stock plans: the ESPP, the 2013 Equity Incentive Plan and the 2014

Inducement Equity Incentive Plan (the “2014 Inducement Plan”). The expiration of the 1999 Stock Option Plan

(“1999 Plan”) in fiscal 2010 did not affect awards outstanding, which continue to be governed by the terms and

conditions of the 1999 Plan.

On July 10, 2014, the Company adopted the 2014 Inducement Plan with a reserve of 335,000 shares of

common stock for future issuance solely for the granting of inducement stock options and equity awards to new

employees, including employees of acquired companies. In addition, approximately 319,000 shares of common

101