Salesforce.com 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

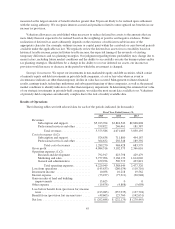

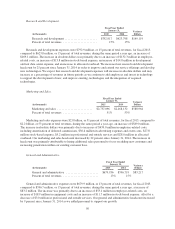

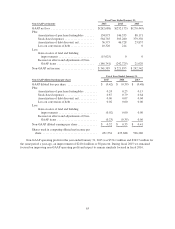

Investment income.

Fiscal Year Ended

January 31, Variance

Dollars(in thousands) 2014 2013

Investment income ............................ $10,218 $19,562 $(9,344)

Percent of total revenues ........................ 0% 1%

Investment income consists of income on cash and marketable securities balances. Investment income was

$10.2 million for fiscal 2014, and was $19.6 million during fiscal 2013. The decrease was primarily due to the

decrease in marketable securities balances.

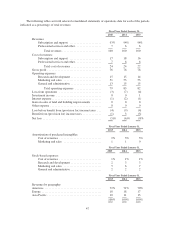

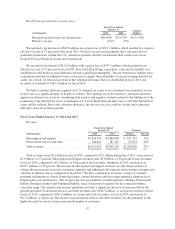

Interest expense.

Fiscal Year Ended

January 31, Variance

Dollars(in thousands) 2014 2013

Interest expense ............................... $(77,211) $(30,948) $(46,263)

Percent of total revenues ........................ (2)% (1)%

Interest expense consists of interest on our convertible senior notes, term loan and capital leases. Interest

expense, net of interest costs capitalized, was $77.2 million for fiscal 2014 and was $30.9 million for fiscal 2013.

The increase was primarily due to interest expense associated with the March 2013 issuance of $1.15 billion of

0.25% convertible senior notes, the $300.0 million term loan that was entered into in connection with the

acquisition of ExactTarget and the large capital lease agreement for software which we entered into in June 2013.

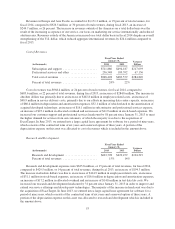

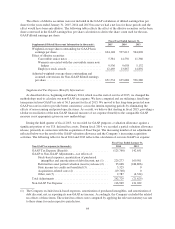

Benefit from (provision for) Income Taxes.

Fiscal Year Ended

January 31, Variance

Dollars(in thousands) 2014 2013

Benefit from (provision for) income taxes .......... $125,760 $(142,651) $268,411

Effective tax rate .............................. 35% (112)%

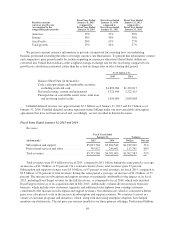

We reported a tax benefit of $125.8 million with a pretax loss of $357.9 million, which resulted in an

effective tax rate of 35 percent for fiscal 2014. Due to the ExactTarget acquisition, a deferred tax liability was

established for the book-tax basis difference related to purchased intangibles. The net deferred tax liability from

acquisitions provided an additional source of income to support the realizability of our pre-existing deferred tax

assets and as a result, we released a portion of the valuation allowance that was established in fiscal 2013 and

recorded a tax benefit of $143.1 million for fiscal 2014.

We recorded a tax provision of $142.7 million on a pretax loss of $127.8 million, which resulted in a

negative effective tax rate of 112 percent for fiscal 2013. Our effective tax rate substantially differed from the

federal statutory tax rate of 35 percent primarily due to the tax charge of $186.8 million to establish a valuation

allowance for a significant portion of our deferred tax assets.

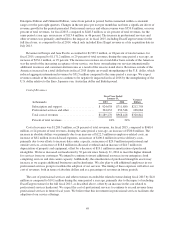

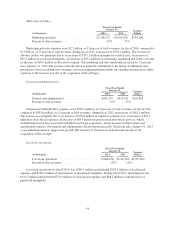

We regularly assess the need for a valuation allowance against our deferred tax assets by considering both

positive and negative evidence related to the likelihood of the realization of the deferred tax assets to determine if

it is more-likely-than-not that some or all of the deferred tax assets will be realized. In our evaluation, we

considered our cumulative loss in recent years and our forecasted future losses as significant pieces of negative

evidence. During fiscal 2013, we determined that the negative evidence outweighed the positive evidence and a

valuation allowance for a significant portion of our deferred tax assets was established that resulted in a tax

expense of $186.8 million.

55