Salesforce.com 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

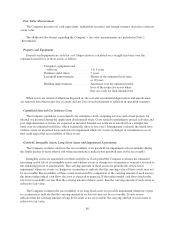

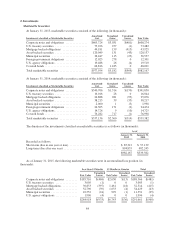

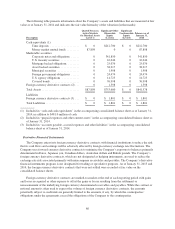

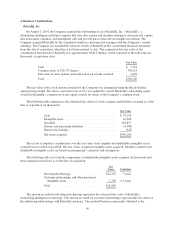

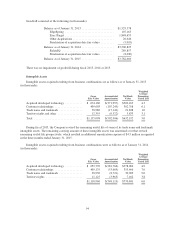

The following table presents information about the Company’s assets and liabilities that are measured at fair

value as of January 31, 2014 and indicates the fair value hierarchy of the valuation (in thousands):

Description

Quoted Prices in

Active Markets

for Identical Assets

(Level 1)

Significant Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Balances as of

January 31,

2014

Cash equivalents (1):

Time deposits .................... $ 0 $212,700 $ 0 $212,700

Money market mutual funds ......... 87,898 0 0 87,898

Marketable securities:

Corporate notes and obligations ...... 0 341,850 0 341,850

U.S. treasury securities ............. 0 16,044 0 16,044

Mortgage backed obligations ........ 0 25,076 0 25,076

Asset backed securities ............. 0 38,217 0 38,217

Municipal securities ............... 0 1,998 0 1,998

Foreign government obligations ...... 0 24,474 0 24,474

U.S. agency obligations ............ 0 14,725 0 14,725

Covered bonds . ...................

0 76,998 0 76,998

Foreign currency derivative contracts (2) . . . 0 1,598 0 1,598

Total Assets .......................... $87,898 $753,680 $ 0 $841,578

Liabilities

Foreign currency derivative contracts (3) . . .

$ 0 $ 1,801 $ 0 $ 1,801

Total Liabilities ....................... $ 0 $ 1,801 $ 0 $ 1,801

(1) Included in “cash and cash equivalents” in the accompanying consolidated balance sheet as of January 31,

2014, in addition to $481.0 million of cash.

(2) Included in “prepaid expenses and other current assets” in the accompanying consolidated balance sheet as

of January 31, 2014.

(3) Included in “accounts payable, accrued expenses and other liabilities” in the accompanying consolidated

balance sheet as of January 31, 2014.

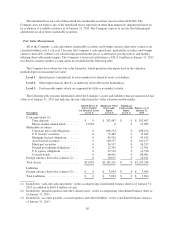

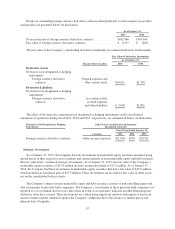

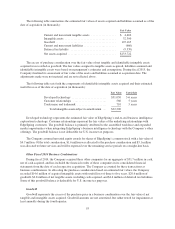

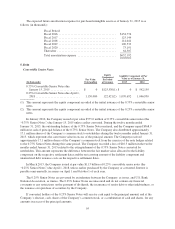

Derivative Financial Instruments

The Company enters into foreign currency derivative contracts with financial institutions to reduce the risk

that its cash flows and earnings will be adversely affected by foreign currency exchange rate fluctuations. The

Company uses forward currency derivative contracts to minimize the Company’s exposure to balances primarily

denominated in Euros, Japanese yen, Canadian dollars, Australian dollars and British pounds. The Company’s

foreign currency derivative contracts, which are not designated as hedging instruments, are used to reduce the

exchange rate risk associated primarily with intercompany receivables and payables. The Company’s derivative

financial instruments program is not designated for trading or speculative purposes. As of January 31, 2015 and

2014, the foreign currency derivative contracts that were not settled were recorded at fair value on the

consolidated balance sheets.

Foreign currency derivative contracts are marked-to-market at the end of each reporting period with gains

and losses recognized as other expense to offset the gains or losses resulting from the settlement or

remeasurement of the underlying foreign currency denominated receivables and payables. While the contract or

notional amount is often used to express the volume of foreign currency derivative contracts, the amounts

potentially subject to credit risk are generally limited to the amounts, if any, by which the counterparties’

obligations under the agreements exceed the obligations of the Company to the counterparties.

86