Salesforce.com 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

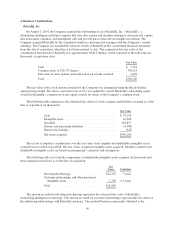

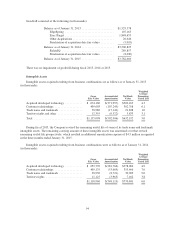

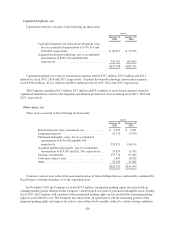

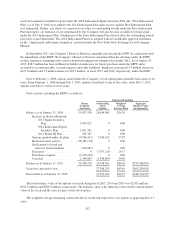

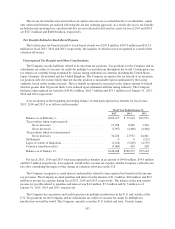

Capitalized Software, net

Capitalized software consisted of the following (in thousands):

As of

January 31,

2015

January 31,

2014

Capitalized internal-use software development costs,

net of accumulated amortization of $136,314 and

$101,687, respectively ........................ $ 96,617 $ 72,915

Acquired developed technology, net of accumulated

amortization of $392,736 and $294,628,

respectively ................................. 336,781 409,002

$433,398 $481,917

Capitalized internal-use software amortization expense totaled $35.7 million, $29.2 million and $22.1

million for fiscal 2015, 2014 and 2013, respectively. Acquired developed technology amortization expense

totaled $98.4 million, $114.7 million and $80.0 million for fiscal 2015, 2014 and 2013, respectively.

The Company capitalized $5.3 million, $3.5 million and $3.4 million of stock-based expenses related to

capitalized internal-use software development and deferred professional services during fiscal 2015, 2014 and

2013, respectively.

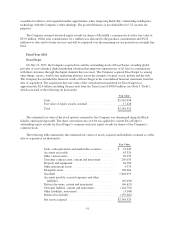

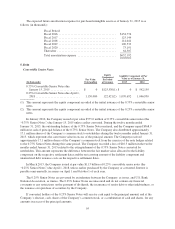

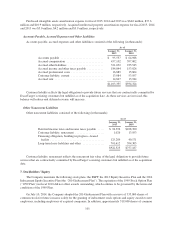

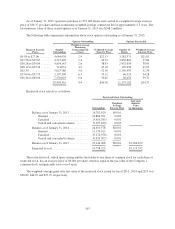

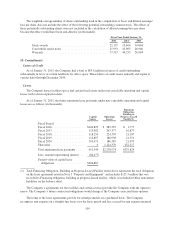

Other Assets, net

Other assets consisted of the following (in thousands):

As of

January 31,

2015

January 31,

2014

Deferred income taxes, noncurrent, net ............. $ 9,275 $ 9,691

Long-term deposits ............................. 19,715 17,970

Purchased intangible assets, net of accumulated

amortization of $130,968 and $66,399,

respectively ................................. 329,971 416,119

Acquired intellectual property, net of accumulated

amortization of $15,695 and $11,304, respectively . . 15,879 11,957

Strategic investments ........................... 175,774 92,489

Customer contract asset ......................... 1,447 18,182

Other ........................................ 76,259 47,082

$628,320 $613,490

Customer contract asset reflects the noncurrent portion of future billings that are contractually committed by

ExactTarget’s existing customers as of the acquisition date.

In November 2010, the Company recorded $23.3 million of perpetual parking rights associated with an

existing parking garage situated on the Company’s undeveloped real estate to purchased intangible assets. During

fiscal 2015, the Company sold a portion of these perpetual parking rights and reclassified the remaining parking

rights to assets held for sale. The Company has entered into an agreement to sell the remaining portion of the

perpetual parking rights and expects the sale to close within twelve months, subject to certain closing conditions.

100