Salesforce.com 2015 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

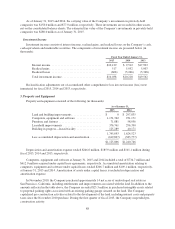

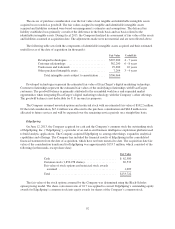

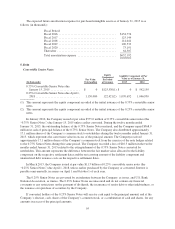

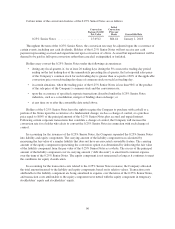

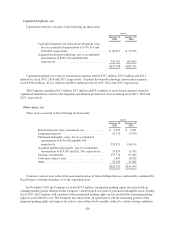

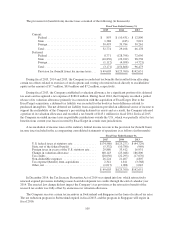

Warrants

Date

Proceeds

(in thousands) Shares

Strike

Price

0.75% Warrants ....................... January 2010 $59,300 26,943,812 $29.88

0.25% Warrants ....................... March 2013 $84,800 17,308,880 $90.40

Separately, in January 2010 and March 2013, the Company also entered into warrant transactions (the

“0.75% Warrants” and the “0.25% Warrants”, respectively) (collectively, the “Warrants”), whereby the Company

sold warrants to acquire, subject to anti-dilution adjustments, shares of the Company’s common stock. The

Warrants were anti-dilutive for the periods presented. The Warrants are separate transactions entered into by the

Company and are not part of the terms of the Notes or Note Hedges. Holders of the Notes and Note Hedges will

not have any rights with respect to the Warrants.

In December 2014, the Company entered into agreements with each of the 0.75% Warrant counterparties to

amend and settle early the 0.75% Warrants prior to their scheduled expiration beginning in April 2015. As a

result of this amendment to settle early with the 0.75% Warrant counterparties, the Company issued, in the

aggregate, approximately 13.3 million shares to the counterparties to settle, via a net share settlement, the entirety

of the 0.75% Warrants.

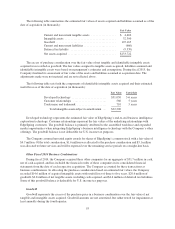

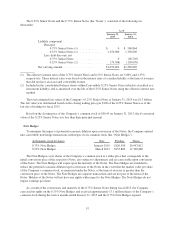

Term Loan

On July 11, 2013, the Company entered into a credit agreement (the “Prior Credit Agreement”) with Bank

of America, N.A. and certain other lenders. The Prior Credit Agreement provided for a $300.0 million term loan

(the “Term Loan”) maturing on July 11, 2016 (the “Term Loan Maturity Date”), which was entered into in

conjunction with and for purposes of funding the acquisition of ExactTarget in fiscal 2014. The Term Loan bore

interest at the Company’s option at either a base rate plus a spread of 0.50% to 1.00% or an adjusted LIBOR rate

as defined in the Prior Credit Agreement plus a spread of 1.50% to 2.00%.

The Term Loan was payable in quarterly installments equal to $7.5 million beginning on September 30,

2013, with the remaining outstanding principal amount of the Term Loan being due and payable on the Term

Loan Maturity Date. On October 6, 2014, the Company repaid the Term Loan in full and the Prior Credit

Agreement was terminated.

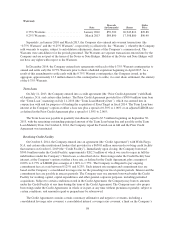

Revolving Credit Facility

On October 6, 2014, the Company entered into an agreement (the “Credit Agreement”) with Wells Fargo,

N.A. and certain other institutional lenders that provides for a $650.0 million unsecured revolving credit facility

that matures on October 6, 2019 (the “Credit Facility”). Immediately upon closing, the Company borrowed

$300.0 million under the Credit Facility, approximately $262.5 million of which was used to repay in full the

indebtedness under the Company’s Term Loan, as described above. Borrowings under the Credit Facility bear

interest, at the Company’s option at either a base rate, as defined in the Credit Agreement, plus a margin of

0.00% to 0.75% or LIBOR plus a margin of 1.00% to 1.75%. The Company is obligated to pay ongoing

commitment fees at a rate between 0.125% and 0.25%. Such interest rate margins and commitment fees are

based on the Company’s consolidated leverage ratio for the preceding four fiscal quarter periods. Interest and the

commitment fees are payable in arrears quarterly. The Company may use amounts borrowed under the Credit

Facility for working capital, capital expenditures and other general corporate purposes, including permitted

acquisitions. Subject to certain conditions stated in the Credit Agreement, the Company may borrow amounts

under the Credit Facility at any time during the term of the Credit Agreement. The Company may also prepay

borrowings under the Credit Agreement, in whole or in part, at any time without premium or penalty, subject to

certain conditions, and amounts repaid or prepaid may be reborrowed.

The Credit Agreement contains certain customary affirmative and negative covenants, including a

consolidated leverage ratio covenant, a consolidated interest coverage ratio covenant, a limit on the Company’s

98