Salesforce.com 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Non-GAAP Financial Measures

Regulation S-K Item 10(e), “Use of Non-GAAP Financial Measures in Commission Filings,” defines and

prescribes the conditions for use of non-GAAP financial information. Our measures of non-GAAP gross profit,

non-GAAP operating profit, non-GAAP net income and non-GAAP earnings per share each meet the definition

of a non-GAAP financial measure.

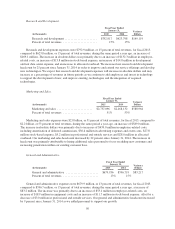

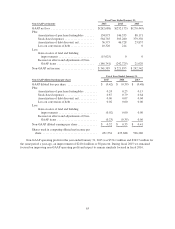

Non-GAAP gross profit, Non-GAAP operating profit and Non-GAAP net income

We use the non-GAAP measures of non-GAAP gross profit, non-GAAP operating profit and non-GAAP net

income to provide an additional view of operational performance by excluding expenses and benefits that are not

directly related to performance in any particular period. In addition to our GAAP measures we use these non-

GAAP measures when planning, monitoring, and evaluating our performance. We believe that these non-GAAP

measures reflect our ongoing business in a manner that allows for meaningful period-to-period comparisons and

analysis of trends in our business, as they exclude certain expenses and benefits. These items are excluded

because the decisions which gave rise to them are not made to increase revenue in a particular period, but are

made for our long-term benefit over multiple periods and we are not able to change or affect these items in any

particular period.

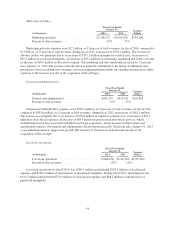

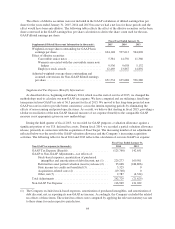

We define non-GAAP net income as our total net income excluding the following components, which we

believe are not reflective of our ongoing operational expenses. In each case, for the reasons set forth below, we

believe that excluding the component provides useful information to investors and others in understanding and

evaluating the impact of certain items to our operating results and future prospects in the same manner as us, in

comparing financial results across accounting periods and to those of peer companies and to better understand the

impact of these items on our gross margin and operating performance. Additionally, as significant, unusual or

discrete events occur, the results may be excluded in the period in which the events occur.

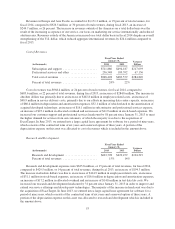

•Stock-Based Expense. The Company’s compensation strategy includes the use of stock-based

compensation to attract and retain employees and executives. It is principally aimed at aligning their

interests with those of our stockholders and at long-term employee retention, rather than to motivate or

reward operational performance for any particular period. Thus, stock-based expense varies for reasons

that are generally unrelated to operational decisions and performance in any particular period.

•Amortization of Purchased Intangibles. The Company views amortization of acquisition-related

intangible assets, such as the amortization of the cost associated with an acquired company’s research

and development efforts, trade names, customer lists and customer relationships, as items arising from

pre-acquisition activities determined at the time of an acquisition. While it is continually viewed for

impairment, amortization of the cost of purchased intangibles is a static expense, one that is not

typically affected by operations during any particular period.

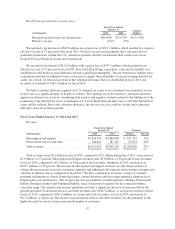

•Amortization of Debt Discount. Under GAAP, certain convertible debt instruments that may be settled

in cash (or other assets) on conversion are required to be separately accounted for as liability (debt) and

equity (conversion option) components of the instrument in a manner that reflects the issuer’s non-

convertible debt borrowing rate. Accordingly, for GAAP purposes we are required to recognize

imputed interest expense on the Company’s $575.0 million of convertible senior notes that were issued

in a private placement in January 2010 and the Company’s $1.15 billion of convertible senior notes that

were issued in a private placement in March 2013. The imputed interest rates were approximately

5.86% for the notes issued in January 2010 and approximately 2.53% for the notes issued in March

2013, while the coupon interest rates were 0.75% and 0.25%, respectively. The difference between the

imputed interest expense and the coupon interest expense, net of the interest amount capitalized, is

excluded from management’s assessment of the Company’s operating performance because

management believes that this non-cash expense is not indicative of ongoing operating performance.

Management believes that the exclusion of the non-cash interest expense provides investors an

enhanced view of the Company’s operational performance.

60