Salesforce.com 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Credit Agreement contains certain customary affirmative and negative covenants, including a

consolidated leverage ratio covenant, a consolidated interest coverage ratio covenant, a limit on our ability to

incur additional indebtedness, dispose of assets, make certain acquisition transactions, pay dividends or

distributions, and certain other restrictions on our activities each defined specifically in the Credit

Agreement. We were in compliance with the Credit Agreement’s covenants as of January 31, 2015.

The weighted average interest rate on borrowings under the Credit Facility was 1.7% for the period

beginning October 6, 2014 and ended January 31, 2015. As of January 31, 2015, outstanding borrowings under

the Credit Facility were $300.0 million.

In August 2014, we sold approximately 3.7 net acres of our undeveloped real estate in San Francisco for a

total of $72.5 million. Separately, in September 2014, we sold approximately 1.5 net acres of our undeveloped

real estate for a total of $125.0 million. We have 8.8 net acres remaining for sale as of January 31, 2015.

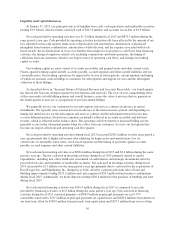

In February 2015, we acquired 50 Fremont Street, a 41-story building totaling approximately

817,000 rentable square feet located in San Francisco, California (“50 Fremont”). We acquired 50 Fremont for

the purpose of expanding our global headquarters in San Francisco. As of January 31, 2015, we were leasing

approximately 500,000 square feet of the available space in 50 Fremont. See Note 14, “Subsequent Event” in the

Notes to the Consolidated Financial Statements.

The total purchase price for 50 Fremont was $629.3 million. To pay for 50 Fremont, we used $115.0 million

of restricted cash and assumed a $200.0 million loan secured by the property with the remainder paid in cash.

Our cash, cash equivalents and marketable securities are comprised primarily of corporate notes and other

obligations, U.S. treasury securities, U.S. agency obligations, government obligations, collateralized mortgage

obligations, mortgage backed securities, time deposits, money market mutual funds and municipal securities.

As of January 31, 2015, we have a total of $63.8 million in letters of credit outstanding in favor of certain

landlords for office space. To date, no amounts have been drawn against the letters of credit, which renew

annually and expire at various dates through December 2030.

We do not have any special purpose entities, and other than operating leases for office space and computer

equipment, we do not engage in off-balance sheet financing arrangements.

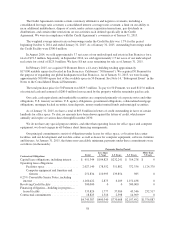

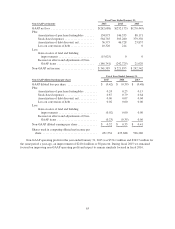

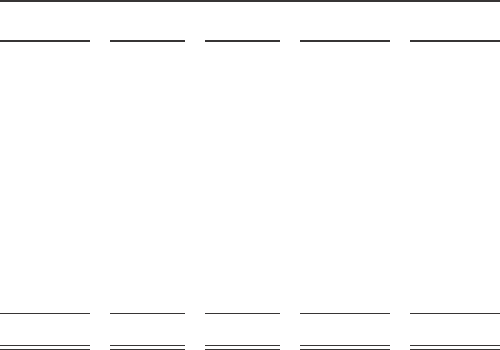

Our principal commitments consist of obligations under leases for office space, co-location data center

facilities, and our development and test data center, as well as leases for computer equipment, software, furniture

and fixtures. At January 31, 2015, the future non-cancelable minimum payments under these commitments were

as follows (in thousands):

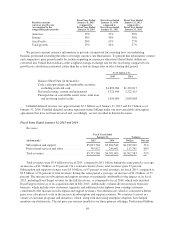

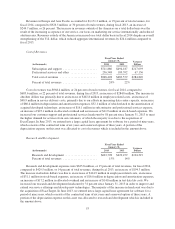

Contractual Obligations

Payments Due by Period

Total

Less than

1 Year 1-3 Years 3-5 Years

More than

5 Years

Capital lease obligations, including interest .... $ 651,344 $104,825 $232,241 $ 314,278 $ 0

Operating lease obligations:

Facilities space ...................... 2,027,140 178,552 351,882 372,336 1,124,370

Computer equipment and furniture and

fixtures ........................... 251,834 110,995 139,854 985 0

0.25% Convertible Senior Notes, including

interest ............................... 1,160,422 2,875 6,109 1,151,438 0

Revolving Credit Facility .................. 300,000 0 0 300,000 0

Financing obligation—building in progress—

leased facility .......................... 335,824 1,777 37,984 43,546 252,517

Contractual commitments .................. 18,823 1,316 2,598 14,909 0

$4,745,387 $400,340 $770,668 $2,197,492 $1,376,887

58