Salesforce.com 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

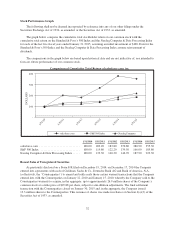

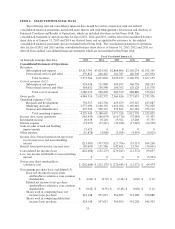

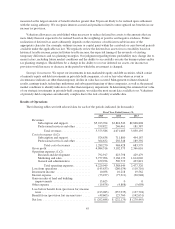

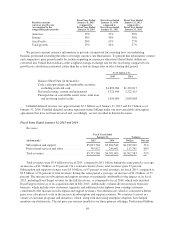

April 30,

2013

July 31,

2013

October 31,

2013

January 31,

2014

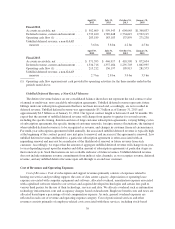

Fiscal 2014

Accounts receivable, net ................. $ 502,609 $ 599,543 $ 604,045 $1,360,837

Deferred revenue, current and noncurrent .... 1,733,160 1,789,648 1,734,619 2,522,115

Operating cash flow (1) .................. 283,189 183,183 137,859 271,238

Unbilled deferred revenue, a non-GAAP

measure ............................ 3.6bn 3.8bn 4.2bn 4.5bn

April 30,

2012

July 31,

2012

October 31,

2012

January 31,

2013

Fiscal 2013

Accounts receivable, net ................. $ 371,395 $ 446,917 $ 418,590 $ 872,634

Deferred revenue, current and noncurrent .... 1,334,716 1,337,184 1,291,703 1,862,995

Operating cash flow (1) .................. 213,212 136,197 105,915 281,573

Unbilled deferred revenue, a non-GAAP

measure ............................ 2.7bn 2.8bn 3.0bn 3.5bn

(1) Operating cash flow represents net cash provided by operating activities for the three months ended in the

periods stated above.

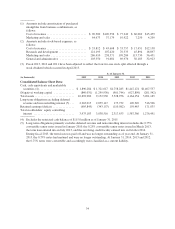

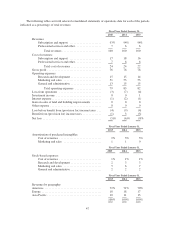

Unbilled Deferred Revenue, a Non-GAAP Measure

The deferred revenue balance on our consolidated balance sheet does not represent the total contract value

of annual or multi-year, non-cancelable subscription agreements. Unbilled deferred revenue represents future

billings under our subscription agreements that have not been invoiced and, accordingly, are not recorded in

deferred revenue. Unbilled deferred revenue was approximately $5.7 billion as of January 31, 2015 and

approximately $4.5 billion as of January 31, 2014. Our typical contract length is between 12 and 36 months. We

expect that the amount of unbilled deferred revenue will change from quarter to quarter for several reasons,

including the specific timing, duration and size of large customer subscription agreements, varying billing cycles

of subscription agreements, the specific timing of customer renewals, foreign currency fluctuations, the timing of

when unbilled deferred revenue is to be recognized as revenue, and changes in customer financial circumstances.

For multi-year subscription agreements billed annually, the associated unbilled deferred revenue is typically high

at the beginning of the contract period, zero just prior to renewal, and increases if the agreement is renewed. Low

unbilled deferred revenue attributable to a particular subscription agreement is often associated with an

impending renewal and may not be an indicator of the likelihood of renewal or future revenue from such

customer. Accordingly, we expect that the amount of aggregate unbilled deferred revenue will change from year-

to-year depending in part upon the number and dollar amount of subscription agreements at particular stages in

their renewal cycle. Such fluctuations are not a reliable indicator of future revenues. Unbilled deferred revenue

does not include minimum revenue commitments from indirect sales channels, as we recognize revenue, deferred

revenue, and any unbilled deferred revenue upon sell-through to an end user customer.

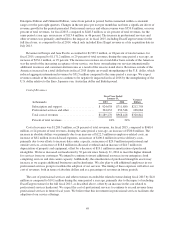

Cost of Revenues and Operating Expenses

Cost of Revenues. Cost of subscription and support revenues primarily consists of expenses related to

hosting our service and providing support, the costs of data center capacity, depreciation or operating lease

expense associated with computer equipment and software, allocated overhead, amortization expense associated

with capitalized software related to our services and acquired developed technologies and certain fees paid to

various third parties for the use of their technology, services and data. We allocate overhead such as information

technology infrastructure, rent and occupancy charges based on headcount. Employee benefit costs and taxes are

allocated based upon a percentage of total compensation expense. As such, general overhead expenses are

reflected in each cost of revenue and operating expense category. Cost of professional services and other

revenues consists primarily of employee-related costs associated with these services, including stock-based

39