Salesforce.com 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

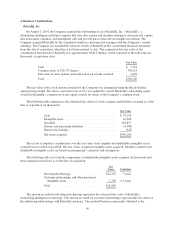

Business Combinations

The Company uses its best estimates and assumptions to accurately assign fair value to the tangible and

intangible assets acquired and liabilities assumed at the acquisition date. The Company’s estimates are inherently

uncertain and subject to refinement. During the measurement period, which may be up to one year from the

acquisition date, the Company may record adjustments to the fair value of these tangible and intangible assets

acquired and liabilities assumed, with the corresponding offset to goodwill. In addition, uncertain tax positions

and tax-related valuation allowances are initially established in connection with a business combination as of the

acquisition date. The Company continues to collect information and reevaluates these estimates and assumptions

quarterly and records any adjustments to the Company’s preliminary estimates to goodwill provided that the

Company is within the measurement period. Upon the conclusion of the measurement period or final

determination of the fair value of assets acquired or liabilities assumed, whichever comes first, any subsequent

adjustments are recorded to the Company’s consolidated statements of operations.

Leases and Asset Retirement Obligations

The Company categorizes leases at their inception as either operating or capital leases. In certain lease

agreements, the Company may receive rent holidays and other incentives. The Company recognizes lease costs

on a straight-line basis once control of the space is achieved, without regard to deferred payment terms such as

rent holidays that defer the commencement date of required payments. Additionally, incentives received are

treated as a reduction of costs over the term of the agreement.

The Company establishes assets and liabilities for the present value of estimated future costs to retire long-

lived assets at the termination or expiration of a lease. Such assets are depreciated over the lease period into

operating expense, and the recorded liabilities are accreted to the future value of the estimated retirement costs.

The Company records assets and liabilities for the estimated construction costs incurred under build-to-suit

lease arrangements to the extent it is involved in the construction of structural improvements or takes

construction risk prior to commencement of a lease.

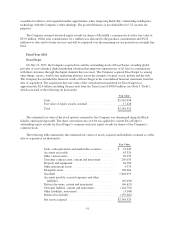

Accounting for Stock-Based Expense

The Company recognizes stock-based expenses related to stock options and restricted stock awards on a

straight-line basis over the requisite service period of the awards, which is generally the vesting term of four

years. The Company recognizes stock-based expenses related to shares issued pursuant to its 2004 Employee

Stock Purchase Plan (“ESPP”) on a straight-line basis over the offering period, which is 12 months. Stock-based

expenses are recognized net of estimated forfeiture activity. The estimated forfeiture rate applied is based on

historical forfeiture rates. The Company does not anticipate paying any cash dividends in the foreseeable future

and therefore uses an expected dividend yield of zero in the option pricing model.

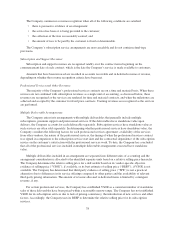

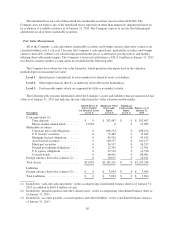

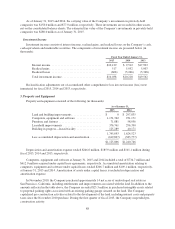

The fair value of each stock option grant was estimated on the date of grant using the Black-Scholes option

pricing model with the following assumptions and fair value per share:

Fiscal Year Ended January 31,

Stock Options 2015 2014 2013

Volatility ............................. 37% 37-43% 43-51%

Estimated life ......................... 3.6years 3.4 years 3.7 years

Risk-free interest rate ................... 1.12 - 1.53% 0.48 - 1.21% 0.43 - 0.77%

Weighted-average fair value per share of

grants .............................. $ 17.20 $ 14.08 $ 12.94

81