Salesforce.com 2015 Annual Report Download - page 95

Download and view the complete annual report

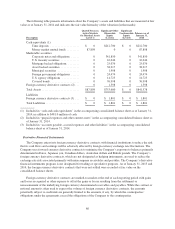

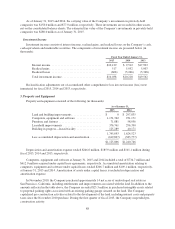

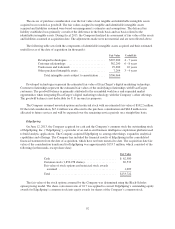

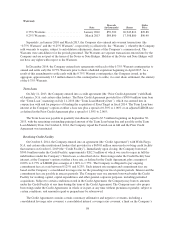

Please find page 95 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In April 2014, the Company entered into an agreement to sell 8.8 net acres of the undeveloped real estate

and a portion of the perpetual parking rights, for which the Company received a nonrefundable deposit in the

amount of $30.0 million. As of January 31, 2015, these 8.8 net acres and perpetual parking rights met the criteria

to be classified as held for sale. As a result, the Company classified this portion of the Company’s land and

building improvements, which totaled $137.7 million, and the perpetual parking rights of $5.5 million, as held

for sale on the accompanying consolidated balance sheet. The sale of this portion of the Company’s undeveloped

real estate is expected to close within twelve months and is subject to certain closing conditions. As of

January 31, 2015, the fair value of the Company’s land, building improvements and perpetual parking rights,

based on the expected sale proceeds, exceeds the carrying value.

In August 2014, the Company sold approximately 3.7 net acres of its undeveloped real estate, which had

been classified as held for sale, for a total of $72.5 million. The Company recognized a gain of $7.8 million, net

of closing costs, on the sale of this portion of the Company’s land and building improvements.

Separately, in September 2014, the Company sold the approximately 1.5 net acres of its remaining

undeveloped real estate, which had been classified as held for sale, and the remaining portion of the perpetual

parking rights, for a total of $125.0 million. The Company recognized a gain of $7.8 million, net of closing costs,

on the sale of this portion of the Company’s land, building improvements and perpetual parking rights.

In November 2014, the Company entered into an agreement to purchase real property of approximately

817,000 rentable square feet known as 50 Fremont Street, San Francisco, California for approximately $640.0

million. The Company deposited $114.9 million of the proceeds from the sale of the undeveloped real estate

described above into a like-kind exchange account for purposes of purchasing the real property. This deposit is

classified as restricted cash on the consolidated balance sheet as of January 31, 2015. The purchase closed in

February 2015 (see Note 14 “Subsequent Event” for details).

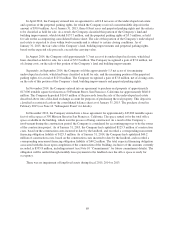

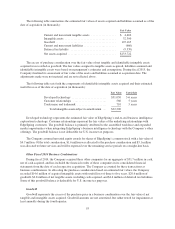

In December 2012, the Company entered into a lease agreement for approximately 445,000 rentable square

feet of office space at 350 Mission Street in San Francisco, California. The space rented is for the total office

space available in the building, which is in the process of being constructed. As a result of the Company’s

involvement during the construction period, the Company is considered for accounting purposes to be the owner

of the construction project. As of January 31, 2015, the Company had capitalized $125.3 million of construction

costs, based on the construction costs incurred to date by the landlord, and recorded a corresponding noncurrent

financing obligation liability of $125.3 million. As of January 31, 2014, the Company had capitalized $40.2

million of construction costs, based on the construction costs incurred to date by the landlord, and recorded a

corresponding noncurrent financing obligation liability of $40.2 million. The total expected financing obligation

associated with this lease upon completion of the construction of the building, inclusive of the amounts currently

recorded, is $335.8 million, including interest (see Note 10 “Commitments” for future commitment details). The

obligation will be settled through monthly lease payments to the landlord once the office space is ready for

occupancy.

There was no impairment of long-lived assets during fiscal 2015, 2014 or 2013.

89