Salesforce.com 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

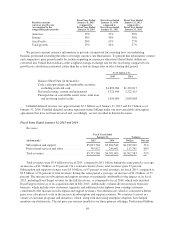

product demand plan and the service that was provided at the inception of the contract. We do not update these

allocations based on actual product usage during the term of the contract. We have allocated approximately 10

percent of our total subscription and support revenues for fiscal 2015, based on customers’ estimated product

demand plans and these allocated amounts are included in the table above.

Additionally, some of our core service offerings have similar features and functions. For example,

customers may use the Sales Cloud, the Service Cloud or our Salesforce1 Platform to record account and contact

information, which are similar features across these core service offerings. Depending on a customer’s actual and

projected business requirements, more than one core service offering may satisfy the customer’s current and

future needs. We record revenue based on the individual products ordered by a customer, and not according to

the customer’s business requirements and usage. In addition, as we introduce new features and functions within

each offering, and refine our allocation methodology for changes in our business, we do not expect it to be

practical to adjust historical revenue results by core service offering for comparability. Accordingly, comparisons

of revenue performance by core service offering over time may not be meaningful.

Our Sales Cloud service offering is our most widely distributed service offering and has historically been

the largest contributor of subscription and support revenues. As a result, Sales Cloud has the most international

exposure and foreign exchange rate exposure, relative to the other cloud service offerings. Conversely, revenue

for Marketing Cloud is primarily derived from the Americas, with little impact from foreign exchange rate

movement. We estimate that for fiscal 2016, subscription and support revenues from the Sales Cloud service

offering will continue to be the largest contributor of subscription and support revenue, and foreign currency will

continue to have a more pronounced impact on Sales Cloud subscription and support revenues than revenues

from our other cloud service offerings.

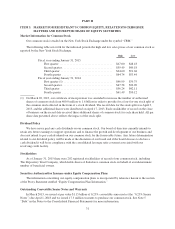

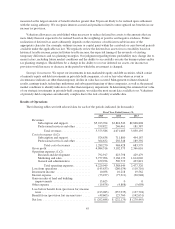

Seasonal Nature of Deferred Revenue, Accounts Receivable and Operating Cash Flow

Deferred revenue primarily consists of billings to customers for our subscription service. Over 90 percent of

the value of our billings to customers is for our subscription and support service. We generally invoice our

customers in annual cycles. Approximately 80 percent of all subscription and support invoices were issued with

annual terms during fiscal 2015 in comparison to nearly 74 percent during fiscal 2014. Occasionally, we bill

customers for their multi-year contract on a single invoice which results in an increase in noncurrent deferred

revenue. We typically issue renewal invoices in advance of the renewal service period, and depending on timing,

the initial invoice for the subscription and services contract and the subsequent renewal invoice may occur in

different quarters. This may result in an increase in deferred revenue and accounts receivable. There is a

disproportionate weighting towards annual billings in the fourth quarter, primarily as a result of large enterprise

account buying patterns. Our fourth quarter has historically been our strongest quarter for new business and

renewals. The year on year compounding effect of this seasonality in both billing patterns and overall new and

renewal business causes the value of invoices that we generate in the fourth quarter for both new business and

renewals to increase as a proportion of our total annual billings. Accordingly, because of this billing activity, our

first quarter is historically our largest collections and operating cash flow quarter.

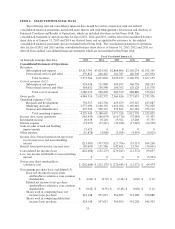

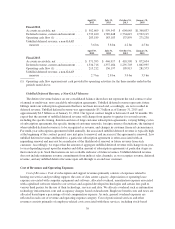

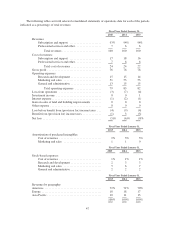

The sequential quarterly changes in accounts receivable, related deferred revenue and operating cash flow

during the first three quarters of our fiscal year are not necessarily indicative of the billing activity that occurs in

the fourth quarter as displayed below (in thousands, except unbilled deferred revenue):

April 30,

2014

July 31,

2014

October 31,

2014

January 31,

2015

Fiscal 2015

Accounts receivable, net ................. $ 684,155 $ 834,323 $ 794,590 $1,905,506

Deferred revenue, current and noncurrent .... 2,324,615 2,352,904 2,223,977 3,321,449

Operating cash flow (1) .................. 473,087 245,893 122,511 332,223

Unbilled deferred revenue, a non-GAAP

measure ............................ 4.8bn 5.0bn 5.4bn 5.7bn

38