Royal Caribbean Cruise Lines 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 ANNUAL REPORT 86

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

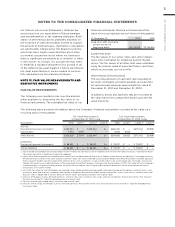

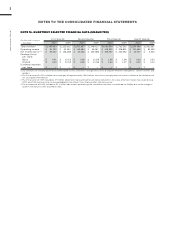

NOTE 16. QUARTERLY SELECTED FINANCIAL DATA (UNAUDITED)

(In thousands, except per First Quarter Second Quarter Third Quarter Fourth Quarter

share data)

Total revenues1

Operating income

Net income (loss)2,3,4 () ()

Earnings (Loss)

per share:

Basic () ()

Diluted () ()

Dividends declared

per share — — — — — — — —

Our revenues are seasonal based on the demand for cruises. Demand is strongest for cruises during the Northern Hemisphere’s summer months and

holidays.

2 The first quarter of 2010 included a one-time gain of approximately $85.6 million, net of costs and payments to insurers, related to the settlement of

our case against Rolls Royce.

3 The first quarter of 2009 included a $7.1 million adjustment representing the cumulative reduction in fair value of certain interest rate swaps during

2007 and 2008 due to an error in data embedded in the interest rate swap valuation software we use.

4 The third quarter of 2009 included a $12.3 million adjustment representing the cumulative reduction in a deferred tax liability due to the change in

Spanish statutory tax rates enacted in 2006.