Royal Caribbean Cruise Lines 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 ANNUAL REPORT 68

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

activities associated with those drydocking costs can-

not be performed while the vessel is in service and, as

such, are done during a drydock as a planned major

maintenance activity. The significant deferred dry-

dock costs consist of hauling and wharfage services

provided by the drydock facility, hull inspection and

related activities (e.g. scraping, pressure cleaning,

bottom painting), maintenance to steering propulsion,

stabilizers, thruster equipment and ballast tanks, port

services such as tugs, pilotage and line handling, and

freight associated with these items. We perform a

detailed analysis of the various activities performed

for each drydock and only defer those costs that are

directly related to planned major maintenance activi-

ties necessary to maintain Class. The costs deferred

are not otherwise routinely periodically performed to

maintain a vessel’s designed and intended operating

capability. Repairs and maintenance activities are

charged to expense as incurred.

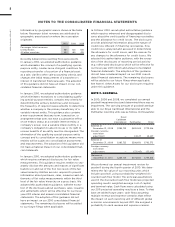

Goodwill

Goodwill represents the excess of cost over the fair

value of net tangible and identifiable intangible assets

acquired. We review goodwill for impairment at the

reporting unit level annually or, when events or cir-

cumstances dictate, more frequently. The impairment

review for goodwill consists of a two- step process of

first determining the fair value of the reporting unit

and comparing it to the carrying value of the net assets

allocated to the reporting unit. If the fair value of the

reporting unit exceeds the carrying value, no further

analysis or write-down of goodwill is required. If the

fair value of the reporting unit is less than the carrying

value of the net assets, the implied fair value of the

reporting unit is allocated to all the underlying assets

and liabilities, including both recognized and unrec-

ognized tangible and intangible assets, based on their

fair value. If necessary, goodwill is then written down

to its implied fair value.

Intangible Assets

In connection with our acquisitions, we have acquired

certain intangible assets of which value has been

assigned to them based on our estimates. Intangible

assets that are deemed to have an indefinite life are

not amortized, but are subject to an annual impair-

ment test, or when events or circumstances dictate,

more frequently. The indefinite-life intangible asset

impairment test consists of a comparison of the fair

value of the indefinite-life intangible asset with its

carrying amount. If the carrying amount exceeds its

fair value, an impairment loss is recognized in an

amount equal to that excess. If the fair value exceeds

its carrying amount, the indefinite-life intangible asset

is not considered impaired.

Other intangible assets assigned finite useful lives are

amortized on a straight-line basis over their estimated

useful lives.

Contingencies—Litigation

On an ongoing basis, we assess the potential liabilities

related to any lawsuits or claims brought against us.

While it is typically very difficult to determine the tim-

ing and ultimate outcome of such actions, we use our

best judgment to determine if it is probable that we

will incur an expense related to the settlement or final

adjudication of such matters and whether a reason-

able estimation of such probable loss, if any, can be

made. In assessing probable losses, we take into

consideration estimates of the amount of insurance

recoveries, if any. We accrue a liability when we believe

a loss is probable and the amount of loss can be rea-

sonably estimated. Due to the inherent uncertainties

related to the eventual outcome of litigation and

potential insurance recoveries, it is possible that cer-

tain matters may be resolved for amounts materially

different from any provisions or disclosures that we

have previously made.

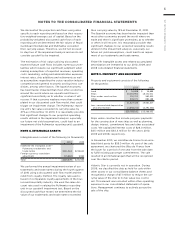

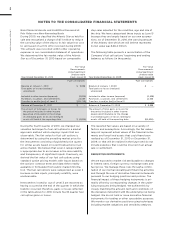

Advertising Costs

Advertising costs are expensed as incurred except

those costs which result in tangible assets, such as

brochures, which are treated as prepaid expenses

and charged to expense as consumed. Advertising

costs consist of media advertising as well as brochure,

production and direct mail costs. Media advertising

was $166.0 million, $152.2 million and $152.5 million,

and brochure, production and direct mail costs were

$104.1 million, $92.0 million and $100.0 million for the

years 2010, 2009 and 2008, respectively.

Derivative Instruments

We enter into various forward, swap and option con-

tracts to manage our interest rate exposure and to

limit our exposure to fluctuations in foreign currency

exchange rates and fuel prices. These instruments

are recorded on the balance sheet at their fair value

and the majority are designated as hedges. Our deriv-

ative instruments are not held for trading or specula-

tive purposes.

At inception of the hedge relationship, a derivative

instrument that hedges the exposure to changes in

the fair value of a recognized asset or liability, or a

firm commitment is designated as a fair value hedge.

A derivative instrument that hedges a forecasted

transaction or the variability of cash flows related to

a recognized asset or liability is designated as a cash

flow hedge.

Changes in the fair value of derivatives that are desig-

nated as fair value hedges are offset against changes

in the fair value of the underlying hedged assets,

liabilities or firm commitments. Gains and losses on

derivatives that are designated as cash flow hedges

are recorded as a component of accumulated other

comprehensive income (loss) until the underlying

hedged transactions are recognized in earnings.