Royal Caribbean Cruise Lines 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

ROYAL CARIBBEAN CRUISES LTD. 69

The foreign-currency transaction gain or loss of our

nonderivative financial instruments designated as

hedges of our net investment in our foreign opera-

tions or investments are recognized as a component

of accumulated other comprehensive income (loss)

along with the associated foreign currency translation

adjustment of the foreign operation.

On an ongoing basis, we assess whether derivatives

used in hedging transactions are “highly effective” in

offsetting changes in the fair value or cash flow of

hedged items. If it is determined that a derivative is

not highly effective as a hedge or hedge accounting

is discontinued, any change in fair value of the deriva-

tive since the last date at which it was determined to

be effective is recognized in earnings. In addition, the

ineffective portion of our highly effective hedges is

recognized in earnings immediately and reported in

other income (expense) in our consolidated state-

ments of operations.

Cash flows from derivative instruments that are desig-

nated as fair value or cash flow hedges are classified

in the same category as the cash flows from the

underlying hedged items. In the event that hedge

accounting is discontinued, cash flows subsequent to

the date of discontinuance are classified consistent

with the nature of the instrument.

Foreign Currency Translations and Transactions

We translate assets and liabilities of our foreign sub-

sidiaries whose functional currency is the local cur-

rency, at exchange rates in effect at the balance sheet

date. We translate revenues and expenses at weighted-

average exchange rates for the period. Equity is trans-

lated at historical rates and the resulting foreign

currency translation adjustments are included as a

component of accumulated other comprehensive

income (loss), which is reflected as a separate compo-

nent of shareholders’ equity. Exchange gains or losses

arising from the remeasurement of monetary assets

and liabilities denominated in a currency other than

the functional currency of the entity involved are

immediately included in our earnings, except for certain

liabilities that have been designated to act as a hedge

of a net investment in a foreign operation or invest-

ment. The majority of our transactions are settled in

United States dollars. Gains or losses resulting from

transactions denominated in other currencies are

recognized in income at each balance sheet date.

Exchange gains and (losses) were $(9.5) million,

$(21.1) million and $23.0 million for the years 2010,

2009 and 2008, respectively, and were recorded in

other income (expense).

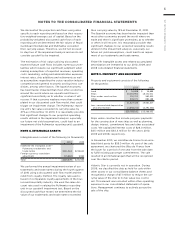

Concentrations of Credit Risk

We monitor our credit risk associated with financial

and other institutions with which we conduct signifi-

cant business and, to minimize these risks, we select

counterparties with credit risks acceptable to us and

we limit our exposure to an individual counterparty.

Credit risk, including but not limited to counterparty

nonperformance under derivative instruments, our

revolving credit facilities and new ship progress pay-

ment guarantees, is not considered significant, as we

primarily conduct business with large, well-established

financial institutions and insurance companies with

which we have long-term relationships and have credit

risks acceptable to us or the credit risk is spread out

among a large number of counterparties. In addition,

our exposure under foreign currency contracts, fuel

call options, interest rate and fuel swap agreements

that are in-the-money are limited to the incremental

cost of transacting at market prices without any hedge

offset or of replacing the contracts at market price.

We do not anticipate nonperformance by any of our

significant counterparties. In addition, we have estab-

lished guidelines regarding credit ratings and instru-

ment maturities that we follow to maintain safety and

liquidity. We do not normally require collateral or other

security to support credit relationships; however, in

certain circumstances this option is available to us.

We normally require guarantees to support new ship

progress payments to shipyards.

Earnings Per Share

Basic earnings per share is computed by dividing net

income by the weighted-average number of shares of

common stock outstanding during each period. Diluted

earnings per share incorporates the incremental shares

issuable upon the assumed exercise of stock options

and conversion of potentially dilutive securities. (See

Note 10. Earnings Per Share.)

Stock-Based Employee Compensation

We measure and recognize compensation expense at

the fair value of employee stock awards. Compensation

expense for awards and the related tax effects are

recognized as they vest. We use the estimated amount

of expected forfeitures to calculate compensation

costs for all outstanding awards.

Segment Reporting

We operate five wholly-owned cruise brands, Royal

Caribbean International, Celebrity Cruises, Pullmantur,

Azamara Club Cruises and CDF Croisières de France.

The brands have been aggregated as a single report-

able segment based on the similarity of their economic

characteristics, types of customers, regulatory envi-

ronment, maintenance requirements, supporting sys-

tems and processes as well as products and services

provided. Our Chairman and Chief Executive Officer

has been identified as the chief operating decision-

maker and all significant operating decisions including

the allocation of resources are based upon the analy-

ses of the Company as one segment.