Royal Caribbean Cruise Lines 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 ANNUAL REPORT 70

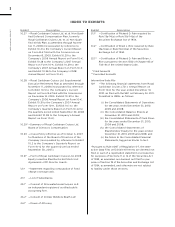

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

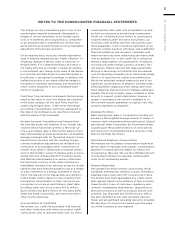

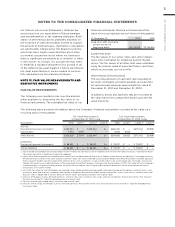

Information by geographic area is shown in the table

below. Passenger ticket revenues are attributed to

geographic areas based on where the reservation

originates.

Passenger ticket revenues:

United States

All other countries

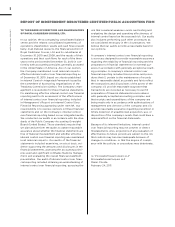

Recently Adopted Accounting Pronouncements

In January 2010, we adopted authoritative guidance

which eliminates the concept of a qualifying special-

purpose entity, creates more stringent conditions for

reporting a transfer of a portion of a financial asset

as a sale, clarifies other sale-accounting criteria, and

changes the initial measurement of a transferor’s

interest in transferred financial assets. The adoption

of this guidance did not have an impact on our con-

solidated financial statements.

In January 2010, we adopted authoritative guidance

which eliminates exceptions to consolidating qualify-

ing special-purpose entities, contains new criteria for

determining the primary beneficiary and increases

the frequency of required reassessments to determine

whether a company is the primary beneficiary of a

variable interest entity. This guidance also contains

a new requirement that any term, transaction, or

arrange ment that does not have a substantive effect

on an entity’s status as a variable interest entity, a

company’s power over a variable interest entity or a

company’s obligation to absorb losses or its right to

receive benefits of an entity must be disregarded. The

elimination of the qualifying special-purpose entity

concept and its consolidation exceptions means more

entities will be subject to consolidation assessments

and reassessments. The adoption of this guidance did

not have a material impact on our consolidated finan-

cial statements.

In January 2010, we adopted authoritative guidance

which requires enhanced disclosures for fair value

measurements. This guidance requires entities to sep-

arately disclose the amounts and reasons of significant

transfers in and out of the first two levels of the fair

value hierarchy. Entities are also required to present

information about purchases, sales, issuances and set-

tlements of fair value measurements within the third

level of the fair value hierarchy on a gross basis. We

adopted this authoritative guidance, with the excep-

tion of the disclosures about purchases, sales, issuance

and settlements which will be effective for our fiscal

year 2011 interim and annual consolidated financial

statements. The adoption of this guidance did not

have an impact on our 2010 consolidated financial

statements. The remaining disclosures will be added

to our future filings when applicable.

In October 2010, we adopted authoritative guidance

which requires enhanced and disaggregated disclo-

sures about the credit quality of financing receivables

and the allowance for credit losses. The disclosures

provide additional information about the nature of

credit risks inherent in financing receivables, how

credit risk is analyzed and assessed in determining

the allowance for credit losses, and the reasons for

any changes to the allowance for credit losses. We

adopted this authoritative guidance, with the excep-

tion of the disclosures of reporting period activity

(e.g. rollforward disclosures) which will be effective for

our fiscal year 2011 interim and annual consolidated

financial statements. The adoption of this guidance

did not have a material impact on our 2010 consoli-

dated financial statements. The remaining disclosures

will be added to our future filings when applicable.

See Note 6. Other Assets for our disclosures required

under this guidance.

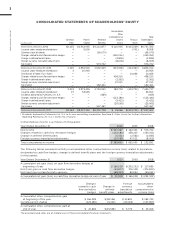

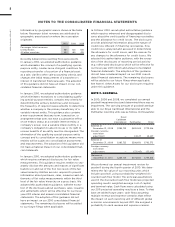

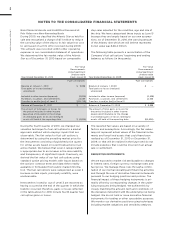

NOTE 3. GOODWILL

In 2010, 2009 and 2008, we completed our annual

goodwill impairment test and determined there was no

impairment. The carrying amount of goodwill attribut-

able to our Royal Caribbean International and the

Pullmantur reporting units was as follows (in thousands):

Royal

Caribbean

International

Pullmantur Total

Balance at

December 31, 2008

Foreign currency

translation

adjustment —

Balance at

December 31, 2009

Foreign currency

translation

adjustment — () ()

Balance at

December 31, 2010

We performed our annual impairment review for

goodwill during the fourth quarter of 2010. We deter-

mined the fair value of our reporting units which

include goodwill, using a probability-weighted dis-

counted cash flow model. The principal assumptions

used in the discounted cash flow model are projected

operating results, weighted-average cost of capital,

and terminal value. Cash flows were calculated using

our 2011 projected operating results as a base. To that

base we added future years’ cash flows assuming

multiple revenue and expense scenarios that reflect

the impact on each reporting unit of different global

economic environments beyond 2011. We assigned a

probability to each revenue and expense scenario.