Royal Caribbean Cruise Lines 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

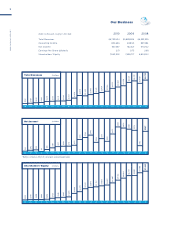

both Moody’s and Standard & Poors. Looking

forward, I am encouraged regarding the sus-

tainability of this “rising tide” of our company’s

returns, credit metrics and product quality. The

primary components of our strategic framework

all have great momentum behind them; targeted

global expansion, slower capacity growth and

cost containment. This momentum, combined

with our fuel hedging program is allowing us to

drive continued product innovation and guest

satisfaction while simultaneously improving our

corporate returns.

Globalization, Brand Expansion and Satisfaction

One important component of our strategy is our

ever diversifying global sourcing of guests. By

next year, we expect that more than 50% of our

customers will come from markets outside of

the United States and importantly, our interna-

tional guests love our product just as much as

our U.S. sourced guests. As we expand globally

we are generating incremental demand for our

cruises which helps to both fill our new berths

and improve our overall pricing power. We see

opportunity for further expansion in Europe,

Asia and the Southern Hemisphere. While these

opportunities increase the demand for our cruises,

we are at the same time slowing our growth

of new berths. The combination of increasing

demand and slowing supply has terrific implica-

tions on our pricing power going forward.

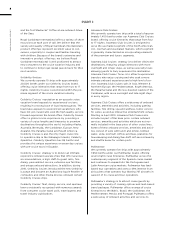

Another significant component of our strategy

is smart capital deployment. We delivered two

amazing vessels during 2010, Allure of the Seas

for our Royal Caribbean International brand and

Celebrity Eclipse for the Celebrity Cruises brand.

Both vessels have lived up to the extraordinary

standards of their predecessors and the Oasis-

and Solstice-class vessels continue to command

pricing and ratings premiums to their peers. As

our capacity growth slows (with only one vessel

delivery in 2011, Celebrity Silhouette and one in

2012, Celebrity Reflection), we are incorporating

some of the innovations from these newest ves-

sels into some of the existing ships in the fleet.

In particular, creative dining concepts, consumer

partnerships and even the addition of new state-

rooms will be carried back to select members

of the existing fleet. These retrofit projects will

enhance our guests’ experiences onboard but

will improve our ticket and onboard revenue

opportunities as well.

Additionally, as we announced in February, we

have undertaken the development of a new class

of vessel for the Royal Caribbean International

brand. “Project Sunshine” will deliver an entirely

new product platform to the company during

LETTER TO SHAREHOLDERS 2

By next year, we expect that more than 50% of our customers will come from markets outside of the United States

and importantly, our international guests love our product just as much as our U.S. sourced guests.