Royal Caribbean Cruise Lines 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 ANNUAL REPORT 44

PART II

• As of December 31, 2010, our liquidity was $1.6 bil-

lion, including cash and the undrawn portion of our

unsecured revolving credit facilities. During 2010,

we entered into a $525.0 million unsecured revolv-

ing credit facility bearing interest at LIBOR plus a

margin of 2.75% and a facility fee of 0.6875% due

2014. Going forward, we anticipate maintaining two

separate revolving credit facilities with staggered

maturity dates.

• We took delivery of Allure of the Seas, the second

Oasis-class ship for Royal Caribbean International

and Celebrity Eclipse, the third Solstice-class ship

for Celebrity Cruises. To finance the purchases, we

borrowed a total of $1.7 billion under unsecured

term loans.

• In an effort to increase our fixed percentage of debt,

we terminated certain of our interest rate and cross

currency swap agreements which resulted in net

cash proceeds of approximately $115.4 million. In

addition, we terminated 22.9% of our fuel swap

agreements as of June 30, 2010 which resulted in

net cash proceeds of $57.5 million.

Other Items:

• During 2010, we sold Bleu de France to an unrelated

party for $55.0 million and in the first quarter of

2011, we entered into an agreement to sell Celebrity

Mercury to TUI Cruises for €234.3 million. We exe-

cuted certain forward contracts to lock in the sales

price at approximately $290.0 million. The sale of

Bleu de France resulted in an immaterial deferred

gain. We anticipate recognizing a gain on the sale of

Celebrity Mercury which we do not expect will have

a material effect on our 2011 results of operations.

• In February 2011, we reached a conditional agreement

with Meyer Werft to build the first of a new genera-

tion of Royal Caribbean International cruise ships.

The ship will have a capacity of approximately 4,100

berths based on double occupancy and is expected

to enter service in the fourth quarter of 2014. We

also have an option to construct a second ship of

the same class which will expire on February 28,

2012, subject to earlier acceleration under certain

circumstances.

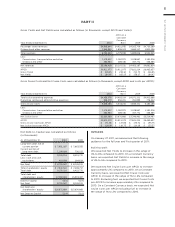

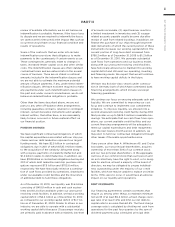

We reported historical total revenues, operating income,

net income and earnings per share as shown in the

following table (in thousands, except per share data):

Year Ended

December 31,

Total revenues

Operating income

Net income

Basic earnings

per share:

Net income

Diluted earnings

per share:

Net income

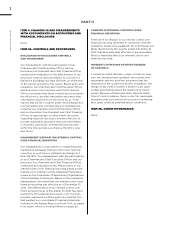

The following table presents historical operating

data as a percentage of total revenues for the last

three years:

Year Ended December 31,

Passenger ticket revenues

Onboard and other revenues

Total revenues

Cruise operating expenses

Commissions, transportation

and other

Onboard and other

Payroll and related

Food

Fuel

Other operating

Total cruise operating expenses

Marketing, selling and

administrative expenses

Depreciation and amortization

expenses

Operating income

Other expense () () ()

Net income

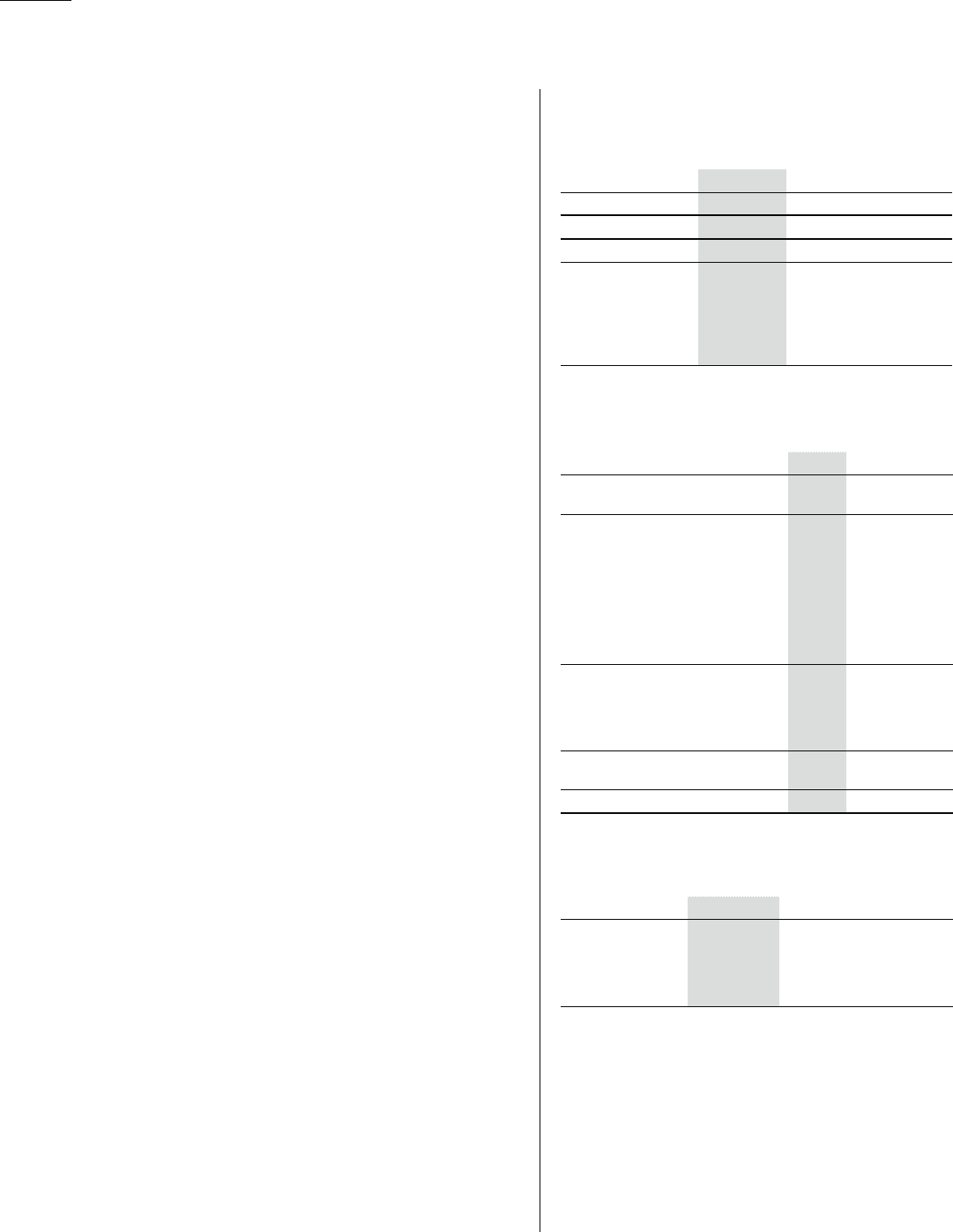

Selected historical statistical information is shown in

the following table:

Year Ended

December 31,

Passengers Carried

Passenger Cruise

Days

APCD

Occupancy