Royal Caribbean Cruise Lines 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 ANNUAL REPORT 72

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

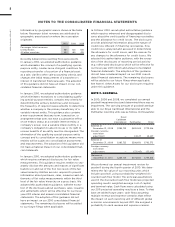

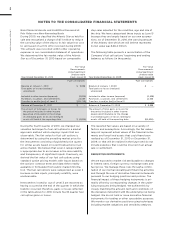

NOTE 6. OTHER ASSETS

Variable Interest Entities

Variable Interest Entities (“VIEs”), are entities in which

the equity investors have not provided enough equity

to finance its activities or the equity investors (1) can-

not directly or indirectly make decisions about the

entity’s activities through their voting rights or similar

rights; (2) do not have the obligation to absorb the

expected losses of the entity; (3) do not have the

right to receive the expected residual returns of the

entity; or (4) have voting rights that are not propor-

tionate to their economic interests and the entity’s

activities involve or are conducted on behalf of an

investor with a disproportionately small voting interest.

We have determined that our 40% noncontrolling

interest in Grand Bahamas Shipyard Ltd., a ship repair

and maintenance facility which we initially invested in

2001, is a VIE. The facility serves cruise and cargo

ships, oil and gas tankers, and offshore units. We uti-

lize this facility, among other ship repair facilities, for

our regularly scheduled drydocks and certain emer-

gency repairs as may be required. As of December 31,

2010, we had loans and interest due from this facility

of approximately $64.1 million which is also our maxi-

mum exposure to loss as we are not contractually

required to provide any financial or other support to

the facility. The majority of these loans are in non-

accrual status. We monitor credit risk associated with

these loans through our participation on the facility’s

board of directors along with our review of the facility’s

financial statements and projected cash flows. Based

on this review, we believe the risk of loss associated

with these loans is remote as of December 31, 2010.

We have determined we are not the primary benefi-

ciary of this facility as we do not have the power to

direct the activities that most significantly impact the

facility’s economic performance. Accordingly, we do

not consolidate this entity and account for this invest-

ment under the equity method of accounting.

In conjunction with our acquisition of Pullmantur in

2006, we obtained a 49% noncontrolling interest in

Pullmantur Air, S.A. (“Pullmantur Air”), a small air

business that operates four aircrafts in support of

Pullmantur’s operations. We have determined Pullmantur

Air is a VIE for which we are the primary beneficiary

as we have the power to direct the activities that

most significantly impact its economic performance

and are obligated to absorb its losses. In accordance

with authoritative guidance, we have consolidated the

assets and liabilities of Pullmantur Air. We do not dis-

close the assets and liabilities of Pullmantur Air as

they are immaterial to our December 31, 2010 consoli-

dated financial statements.

We have determined that our 50% interest in the TUI

Cruises GmbH joint venture with TUI AG, which oper-

ates the brand TUI Cruises, is a VIE. As of December 31,

2010, our investment in this entity which is substan-

tially our maximum exposure to loss, was approxi-

mately $190.8 million and was included within other

assets in our consolidated balance sheets. We have

determined that we are not the primary beneficiary of

TUI Cruises. We believe that the power to direct the

activities that most significantly impact TUI Cruises’

economic performance are shared between ourselves

and TUI AG. All the significant operating and financial

decisions of TUI Cruises require the consent of both

parties which we believe creates shared power over

TUI Cruises. Accordingly, we do not consolidate this

entity and account for this investment under the

equity method of accounting.