Royal Caribbean Cruise Lines 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

ROYAL CARIBBEAN CRUISES LTD. 81

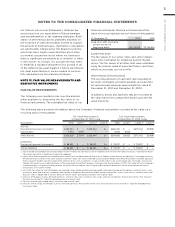

Additionally, as of December 31, 2010 and 2009, we

have entered into fuel call options on a total of 6.6

million barrels which mature between 2011 and 2013,

and 2.8 million barrels, which mature between 2011

and 2012, respectively, in order to provide protection

in the event fuel prices exceed the options’ exercise

prices. As of December 31, 2010, the fuel call options

represent 41% of our projected 2011 fuel requirements,

25% of our projected 2012 fuel requirements and

11% of our projected 2013 fuel requirements. As of

December 31, 2009, the fuel call options represented

20% of our projected 2011 fuel requirements and 10%

of our projected 2012 fuel requirements.

Our fuel swap agreements are accounted for as cash

flow hedges and our fuel call options are not desig-

nated as hedging instruments and thus, changes in

the fair value of our fuel call options are recognized in

earnings immediately and reported in other income

(expense) in our consolidated statements of operations.

At December 31, 2010 and 2009, $83.6 million and

$56.9 million, respectively, of estimated unrealized net

gains associated with our cash flow hedges pertaining

to fuel swap agreements were expected to be reclas-

sified to earnings from other accumulated compre-

hensive income (loss) within the next twelve months,

including $37.2 million related to fuel swap agreements

terminated in 2010. Reclassification is expected to

occur as the result of fuel consumption associated

with our hedged forecasted fuel purchases.

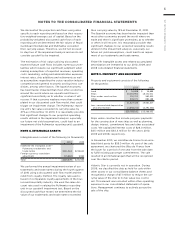

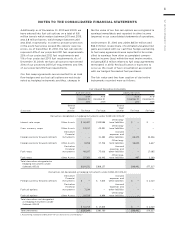

The fair value and line item caption of derivative

instruments recorded were as follows:

Fair Value of Derivative Instruments

Asset Derivatives Liability Derivatives

As of As of As of As of

December 31, December 31, December 31, December 31,

2010 2009 2010 2009

Balance Balance

Sheet Sheet

In thousands

Location Fair Value Fair Value Location Fair Value Fair Value

Derivatives designated as hedging instruments under FASB ASC 815-201

Interest rate swaps Other Assets

Other long-

term liabilities — —

Cross currency swaps Other Assets

Other long-

term liabilities — —

Foreign currency forward contracts

Derivative

Financial

Instruments —

Accrued

expenses and

other liabilities

Foreign currency forward contracts Other Assets

Other long-

term liabilities

Fuel swaps

Derivative

Financial

Instruments

Accrued

expenses and

other liabilities —

Fuel swaps Other Assets

Other long-

term liabilities

Total derivatives designated as

hedging instruments under

Subtopic 815-20

Derivatives not designated as hedging instruments under FASB ASC 815-20

Foreign currency forward contracts

Derivative

Financial

Instruments —

Accrued

expenses and

other liabilities —

Fuel call options

Derivative

Financial

Instruments —

Accrued

expenses and

other liabilities — —

Fuel call options Other Assets

Other long-

term liabilities — —

Total derivatives not designated

as hedging instruments under

Subtopic 815-20

—

Total derivatives

1 Accounting Standard Codification 815-20 “Derivatives and Hedging.”