Royal Caribbean Cruise Lines 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 ANNUAL REPORT 46

PART II

We expected a 7.4% increase in capacity, primarily

driven by a full year of service of Celebrity Eclipse, a

full year of service of Allure of the Seas and the addi-

tion of Celebrity Silhouette which will enter service

during the third quarter of 2011.

Depreciation and amortization expenses were expected

to be in the range of $695.0 million to $715.0 million

and interest expense, net was expected to be in the

range of $305.0 million to $325.0 million.

We do not forecast fuel prices and our cost calcula-

tions for fuel are based on current “at-the-pump”

prices net of any hedging impacts. If fuel prices for

the full year of 2011 remain at the level of January 27,

2011 prices, fuel expenses for the full year of 2011 would

be approximately $705.0 million. For the full year of

2011, our fuel expense is approximately 58% hedged

and a 10% change in fuel prices would result in a

change in our fuel expenses of approximately $28.0

million for the full year 2011, after taking into account

existing hedges.

Based on the expectations noted above, and assum-

ing that fuel prices remain at $533 per metric ton and

full year foreign currency exchange rates are $1.37 to

the euro and $1.59 to the British pound, we expected

full year 2011 earnings per share to be in the range of

$3.25 to $3.45. Since our January 27, 2011 announce-

ment, fuel prices and foreign currency exchange rates

have fluctuated significantly and are likely to continue

to do so. Accordingly, our forecasts are likely to change

with these fluctuations. Except for the influence of

fuel prices and foreign currency exchange rates, our

outlook remains essentially unchanged.

First Quarter 2011

As announced on January 27, 2011, we expected Net

Yields to increase in the range of 2% to 3% compared

to 2010. On a Constant Currency basis, we expected

Net Yields to increase in the range of 1% to 2% com-

pared to 2010.

We expected Net Cruise Costs per APCD to increase

approximately 1% compared to 2010. We expected

Net Cruise Costs per APCD on a Constant Currency

basis to remain consistent with Net Cruise Costs per

APCD. Excluding fuel, we expected Net Cruise Costs

per APCD to increase approximately 2% compared to

2010. On a Constant Currency basis, we expected Net

Cruise Costs per APCD excluding fuel to increase in

the range of 1% to 2% compared to 2010.

We expected a 10.2% increase in capacity, primarily

driven by the addition of Celebrity Eclipse which

entered service during the second quarter of 2010

and the addition of Allure of the Seas which entered

service during the fourth quarter of 2010.

Depreciation and amortization expenses were expected

to be in the range of $170.0 million to $175.0 million,

and interest expense, net was expected to be in the

range of $80.0 million to $85.0 million.

We do not forecast fuel prices and our cost calculations

for fuel are based on current “at-the-pump” prices

net of any hedging impacts. If fuel prices for the first

quarter of 2011 remain at the level of January 27, 2011

prices, fuel expenses for the first quarter of 2011 would

be approximately $168.0 million. For the first quarter

of 2011, our fuel expense is approximately 63% hedged

and a 10% change in fuel prices would result in a

change in our fuel expenses of approximately $7.0

million for the first quarter of 2011, after taking into

account existing hedges.

Based on the expectations noted above, and assuming

that fuel prices remain at $515 per metric ton and first

quarter foreign currency exchange rates are $1.37 to

the euro and $1.59 to the British pound, we expected

first quarter 2011 earnings per share to be in the range

of $0.10 to $0.15. Since our January 27, 2011 announce-

ment, fuel prices and foreign currency exchange rates

have fluctuated significantly and are likely to continue

to do so. Accordingly, our forecasts are likely to change

with these fluctuations. Except for the influence of

fuel prices and foreign currency exchange rates, our

outlook remains essentially unchanged.

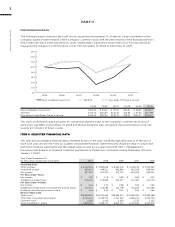

YEAR ENDED DECEMBER 31, 2010 COMPARED TO

YEAR ENDED DECEMBER 31, 2009

In this section, references to 2010 refer to the year

ended December 31, 2010 and references to 2009

refer to the year ended December 31, 2009.

Revenues

Total revenues for 2010 increased $862.7 million or

14.6% to $6.8 billion from $5.9 billion in 2009. Approx-

imately $654.1 million of this increase is attributable

to an 11.1% increase in capacity. The increase in capac-

ity is primarily due to a full year of service of Oasis of

the Seas, which entered service in December 2009,

the addition of Celebrity Eclipse which entered ser-

vice in April 2010, a full year of service of Celebrity

Equinox which entered service in July 2009, a full

year of service of Pacific Dream, which entered ser-

vice in May 2009 and the addition of Allure of the

Seas, which entered service in December 2010. This

increase in capacity was partially offset by the sale of

Celebrity Galaxy to TUI Cruises in March 2009, the

removal of the Atlantic Star from operation in August

2009 and the sale of Oceanic in April 2009. In addi-

tion, approximately $208.6 million of the increase in

total revenues was driven by increases in ticket prices

and an increase in occupancy from 102.5% in 2009 to

104.3% in 2010. The increase in occupancy is primarily

due to improving market conditions, certain itinerary