Royal Caribbean Cruise Lines 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROYAL CARIBBEAN CRUISES LTD. 1

2010

Annual

Report

I enjoy authoring this letter to you annually as it

provides me with an opportunity to reflect on

the past year and to communicate our goals for

the coming ones. With that in mind, I am pleased

to report that over the past year we have made

significant strides in improving our returns while

at the same time maintaining the exceptionally

high product standards that our guests have

come to expect from us. We are executing well

on our strategic objectives of global growth,

controlled costs and revenue margin expansion

and we are committed to carrying this momen-

tum forward into the coming years. It is still a

tough operating environment, macroeconomic

improvement has been modest and there are

significant geopolitical events unfolding before us,

but we are managing through these challenges

effectively and the improvement in our financial

results is tangible.

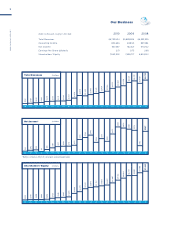

Net Income in 2010 increased 240% to $548

million, or $2.51 per share. Revenue yields grew

by over 4% while we were able to simultaneously

reduce corresponding cruise costs by almost

2%. Liquidity at year end was a very healthy

$1.6 billion, buoyed by strong cash generation

throughout the year and the addition of a sup-

plemental $525 million revolving credit facility

in the fourth quarter. These improved financial

results dovetailed a number of operational

accomplishments including the opening of addi-

tional International Offices as we march forward

globally, two extremely successful new ship

launches with the Allure of the Seas and the

Celebrity Eclipse and the delivery of amazing

vacation experiences to over 4 million guests.

Importantly, through all of this growth our guest

satisfaction ratings have risen to historical highs.

While our total returns are still below where they

need to be, we have been making rapid progress

in the right direction and are determined to con-

tinue to do so. Our progress has also been further

evidenced by our recent ratings upgrades by

Dear Fellow Shareholders

We are executing well on our strategic objectives of global growth, controlled costs and revenue margin expansion

and we are committed to carrying this momentum forward into the coming years.