Royal Caribbean Cruise Lines 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 ANNUAL REPORT 80

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

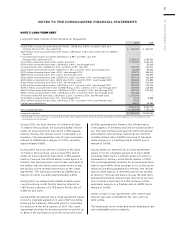

is being amortized as a reduction to interest expense

over the remaining life of the debt. The increase to

the carrying amount of the debt is reported in long-

term debt.

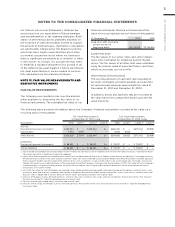

During the years ended December 31, 2010 and 2009,

we recognized in earnings, a net gain of approximately

$7.0 million and a net loss of approximately $9.4 mil-

lion, respectively, which represented the total ineffec-

tiveness of the fair value hedges pertaining to interest

rate and cross currency swaps. The amount for 2009

includes an out of period adjustment of approximately

$7.1 million which represents the cumulative reduction

in the fair value of certain interest rate swaps during

2007 and 2008 due to an error in data embedded in

the software we use to assist with calculating the fair

value of our interest rate swaps.

The notional amount of outstanding debt related

to interest rate swaps as of December 31, 2010 and

2009 was $350.0 million and $1.8 billion, respectively.

The notional amount of outstanding debt related to

cross currency swaps as of December 31, 2009 was

$389.1 million.

Foreign Currency Exchange Rate Risk

Our primary exposure to foreign currency exchange

rate risk relates to our ship construction firm commit-

ments denominated in euros and a portion of our euro-

denominated debt. We enter into euro-denominated

forward contracts and cross currency swap agree-

ments to manage our exposure to movements in

foreign currency exchange rates. During 2010, we

entered into cross currency swap agreements that

effectively changed €400.0 million of the €1.0 billion

debt with a fixed rate of 5.625% to $509.0 million of

debt at a weighted-average fixed rate of 6.625%.

Approximately 2.2% and 9.0% of the aggregate cost

of the ships on order was exposed to fluctuations in

the euro exchange rate at December 31, 2010 and

December 31, 2009, respectively. The majority of our

foreign exchange contracts and our cross currency

swap agreements are accounted for as fair value or

cash flow hedges depending on the designation of

the related hedge.

The notional amount of outstanding foreign exchange

contracts including our cross currency swap agree-

ments as of December 31, 2010 and 2009 was $2.5

billion and $3.4 billion, respectively.

We consider our investments in our foreign operations

to be denominated in relatively stable currencies

and of a long-term nature. We partially address the

exposure of our investments in foreign operations by

denominating a portion of our debt in our subsidiar-

ies’ and investments’ functional currencies. As of

December 31, 2010 and 2009, we have assigned debt

of approximately €327.7 million and €346.8 million,

or approximately $438.7 million and $496.8 million,

respectively, as a hedge of our net investment in

Pullmantur. As of December 31, 2010 and 2009, we

have assigned debt of approximately €141.6 million

and €142.9 million, or approximately $189.5 million

and $204.7 million, respectively, as a hedge of our net

investment in TUI Cruises.

Fuel Price Risk

Our exposure to market risk for changes in fuel prices

relates to the consumption of fuel on our ships. We

use fuel swap agreements and fuel call options to miti-

gate the financial impact of fluctuations in fuel prices.

During 2010, we terminated 22.9% of our fuel swap

agreements as of June 30, 2010 due to a counter-

party no longer meeting our guidelines and entered

into new fuel swap agreements with a different coun-

terparty. Upon termination of the fuel swaps, we

received net cash proceeds of approximately $57.5

million. The swaps were designated as cash flow

hedges and terminating the swaps did not result in

the recognition of a gain or loss in our consolidated

statement of operations. We accounted for the termi-

nation of the swaps by recording the cash received

and removing the fair value of the instruments from

our consolidated balance sheets. At December 31,

2010, $37.2 million of deferred gains associated with

the terminated swaps remain in accumulated other

comprehensive income (loss) and will be reclassified

into earnings during 2011 as this is the period that the

hedged forecasted transactions affect earnings.

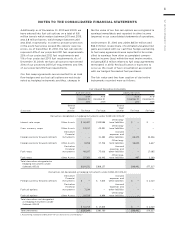

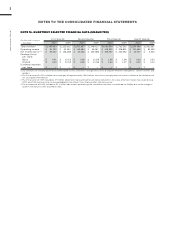

As of December 31, 2010 and 2009, we have entered

into the following fuel swap agreements:

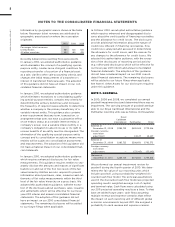

Fuel Swap Agreements

As of As of

Projected fuel purchases December 31, December 31,

for year:

(metric tons)

—

—

Fuel Swap Agreements

As of As of

Projected fuel purchases December 31, December 31,

for year:

(% hedged)

—

—