Royal Caribbean Cruise Lines 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 ANNUAL REPORT 42

PART II

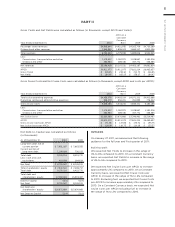

Gross Cruise Costs represent the sum of total cruise

operating expenses plus marketing, selling and admin-

istrative expenses.

Gross Yields represent total revenues per APCD.

Net Cruise Costs represent Gross Cruise Costs exclud-

ing commissions, transportation and other expenses

and onboard and other expenses (each of which is

described above under the Description of Certain Line

Items heading). In measuring our ability to control

costs in a manner that positively impacts net income,

we believe changes in Net Cruise Costs to be the most

relevant indicator of our performance. A reconciliation

of historical Gross Cruise Costs to Net Cruise Costs is

provided below under Results of Operations. We have

not provided a quantitative reconciliation of projected

Gross Cruise Costs to projected Net Cruise Costs due

to the significant uncertainty in projecting the costs

deducted to arrive at this measure. Accordingly, we

do not believe that reconciling information for such

projected figures would be meaningful.

Net Debt-to-Capital is a ratio which represents total

long-term debt, including current portion of long-term

debt, less cash and cash equivalents (“Net Debt”)

divided by the sum of Net Debt and total shareholders’

equity. We believe Net Debt and Net Debt-to-Capital,

along with total long-term debt and shareholders’

equity are useful measures of our capital structure.

A reconciliation of historical Debt-to-Capital to Net

Debt-to-Capital is provided below under Results of

Operations.

Net Revenues represent total revenues less commis-

sions, transportation and other expenses and onboard

and other expenses (each of which is described under

the Description of Certain Line Items heading).

Net Yields represent Net Revenues per APCD. We uti-

lize Net Revenues and Net Yields to manage our busi-

ness on a day-to-day basis as we believe that it is the

most relevant measure of our pricing performance

because it reflects the cruise revenues earned by us

net of our most significant variable costs, which are

commissions, transportation and other expenses and

onboard and other expenses. A reconciliation of his-

torical Gross Yields to Net Yields is provided below

under Results of Operations. We have not provided a

quantitative reconciliation of projected Gross Yields

to projected Net Yields due to the significant uncer-

tainty in projecting the costs deducted to arrive at

this measure. Accordingly, we do not believe that rec-

onciling information for such projected figures would

be meaningful.

Occupancy, in accordance with cruise vacation indus-

try practice, is calculated by dividing Passenger

Cruise Days by APCD. A percentage in excess of 100%

indicates that three or more passengers occupied

some cabins.

Passenger Cruise Days represent the number of pas-

sengers carried for the period multiplied by the number

of days of their respective cruises.

We believe Net Yields and Net Cruise Costs are our

most relevant non-GAAP financial measures. However,

a significant portion of our revenue and expenses are

denominated in currencies other than the United

States dollar. Because our reporting currency is the

United States dollar, the value of these revenues and

expenses can be affected by changes in currency

exchange rates. Although such changes in local cur-

rency prices is just one of many elements impacting

our revenues and expenses, it can be an important

element. For this reason, we also monitor Net Yields

and Net Cruise Costs as if the current periods’ cur-

rency exchange rates had remained constant with the

comparable prior periods’ rates, or on a “Constant

Currency” basis.

It should be emphasized that Constant Currency is

primarily used for comparing short-term changes

and/or projections. Over the longer term, changes in

guest sourcing and shifting the amount of purchases

between currencies significantly change the impact

of the purely currency based fluctuations.

The use of certain significant non-GAAP measures,

such as Net Yields and Net Cruise Costs, allow us to

perform capacity and rate analysis to separate the

impact of known capacity changes from other less

predictable changes which affect our business. We

believe these non-GAAP measures provide expanded

insight to measure revenue and cost performance in

addition to the standard United States GAAP based

financial measures. There are no specific rules or reg-

ulations for determining non-GAAP measures, and as

such, there exists the possibility that they may not be

comparable to other companies within the industry.

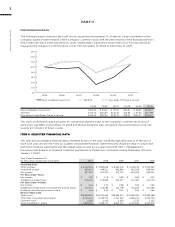

EXECUTIVE OVERVIEW

During 2010, we saw a slight improvement in the

economy which led to pricing increases as described

below. Although we are not back at pre-recession

levels, the current demand for our brands is improv-

ing and we expect this trend to continue through 2011.

Profitability momentum and yield accretion are also