Royal Caribbean Cruise Lines 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 ANNUAL REPORT 84

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

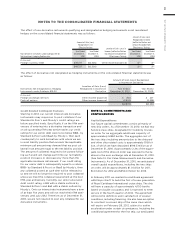

overall capital expenditures will be approximately

$1.0 billion for 2011, $1.0 billion for 2012, $350.0 million

for 2013 and $1.1 billion for 2014.

Litigation

We commenced an action in June 2010 in the United

States District Court for Puerto Rico seeking a declar-

atory judgment that Puerto Rico’s distributorship laws

do not apply to our relationship with an international

representative located in Puerto Rico. In September

2010, that international representative filed a number

of counterclaims against Royal Caribbean Cruises Ltd.

and Celebrity Cruises Inc. alleging violations of Puerto

Rico’s distributorship laws, bad faith breach of con-

tract, tortious interference with contract, violations of

various federal and state antitrust and unfair competi-

tion laws. The international representative is seeking

in excess of $40.0 million on each of these counter-

claims together with treble damages in the amount

of $120.0 million on several of the counterclaims as

well as injunctive relief and declaratory judgment. We

believe that the claims made against us are without

merit and we intend to vigorously defend ourselves

against them.

In September 2010, the United States District Court

for the Western District of Washington denied motions

seeking permission by the Court to rename Royal

Caribbean Cruises Ltd., Celebrity Cruises Inc. and

other cruise lines as defendants in five actions, one of

which is a pending class action, being brought against

Park West Galleries, Inc., doing business as Park West

Gallery, PWG Florida, Inc., Fine Art Sales, Inc., Vista

Fine Art LLC, doing business as Park West At Sea

(together, “Park West”), and other named and unnamed

parties. Royal Caribbean Cruises Ltd. and Celebrity

Cruises Inc. had previously been dismissed from these

actions on the basis that the claims against them were

not timely filed and/or properly pled. The actions are

being brought on behalf of purchasers of artwork at

shipboard art auctions conducted by Park West on

the named cruise lines alleging that the artwork Park

West sells is not what it represents to its customers

and that Royal Caribbean Cruises Ltd., Celebrity Cruises

Inc. and other named cruise lines are complicit in the

activities of Park West, including engaging in a con-

spiracy with Park West in violation of the Racketeer

Influenced and Corrupt Organizations Act (“RICO”),

and are being enriched unjustly from the sale of the

artwork. The actions seek refund and restitution of all

monies acquired from the sale of artwork at shipboard

auctions, recovery for the amount of payments for the

purchased artwork, damages on the RICO claims in an

indeterminate amount, and other permitted statutory

damages and equitable relief. We will vigorously

oppose any attempt by plaintiffs to rename either

Royal Caribbean Cruises Ltd. or Celebrity Cruises Inc.

as defendants and, if we are so renamed, we believe

we have meritorious defenses to the claims against us

which we will vigorously pursue. Under the current

facts and circumstances, we no longer consider this

matter to be a material proceeding.

Commencing in September 2009 and through August

2010 demands for arbitration were made under our

collective bargaining agreement covering Celebrity

Cruises’ crewmembers on behalf of twenty nine cur-

rent and/or former Celebrity Cruises’ cabin stewards

and others similarly situated. These demands, all

brought by the same counsel, contend that between

2001 and 2005 Celebrity Cruises improperly required

the named cabin stewards to share guest gratuities

with assistant cabin stewards. The demands seek pay-

ment of damages, including penalty wages, under the

U.S. Seaman’s Wage Act of approximately $0.6 million

for the named crewmembers and estimates damages

in excess of $200.0 million, for the entire class of

other similarly situated crewmembers. In the fourth

quarter of 2010, all but five of the demands were dis-

missed for failure to file the claims timely and the

other five are pending determination. Counsel has

brought an action in the United States District Court

for the Southern District of Florida seeking to over-

turn these arbitration awards, and is also appealing

the dismissal of a similar action brought in October

2009 on behalf of ten crew members and others

similarly situated in the United States District Court

for the Southern District of Florida making the same

contentions and seeking the same damages as the

arbitration demands. We believe we have meritorious

defenses to the pending arbitration demands and

actions which we intend to vigorously pursue. Under

the current facts and circumstances, we no longer

consider this matter to be a material proceeding.

We are routinely involved in other claims typical

within the cruise vacation industry. The majority of

these claims are covered by insurance. We believe the

outcome of such claims, net of expected insurance

recoveries, will not have a material adverse impact on

our financial condition or results of operations.

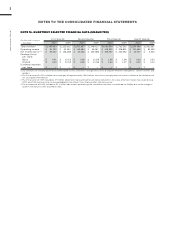

Operating Leases

In 2002, we entered into an operating lease denomi-

nated in British pound sterling for the Brilliance of

the Seas. The lease payments vary based on sterling

LIBOR. The lease has a contractual life of 25 years;

however, the lessor has the right to cancel the lease

at years 10 and 18. Accordingly, the lease term for

accounting purposes is 10 years. In the event of early

termination at year 10, we have the option to cause

the sale of the vessel at its fair value and use the pro-

ceeds toward the applicable termination obligation

plus any unpaid amounts due under the contractual

term of the lease. Alternatively, we can make a termi-

nation payment of approximately £126.0 million, or

approximately $196.7 million based on the exchange

rate at December 31, 2010, if the lease is canceled in