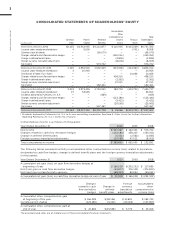

Royal Caribbean Cruise Lines 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

ROYAL CARIBBEAN CRUISES LTD. 75

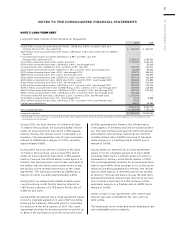

The fair value of each stock option grant is estimated

on the date of grant using the Black-Scholes option-

pricing model. The estimated fair value of stock

options, less estimated forfeitures, is amortized over

the vesting period using the graded-vesting method.

The assumptions used in the Black-Scholes option-

pricing model are as follows:

Dividend yield

Expected stock price

volatility

Risk-free interest rate

Expected option life 6 years 5 years 5 years

Expected volatility was based on a combination of

historical and implied volatilities. The risk-free interest

rate was based on United States Treasury zero coupon

issues with a remaining term equal to the expected

option life assumed at the date of grant. The expected

term was calculated based on historical experience

and represents the time period options actually remain

outstanding. We estimate forfeitures based on histori-

cal pre-vesting forfeiture rates and revise those esti-

mates as appropriate to reflect actual experience. In

2008, we increased our estimated forfeiture rate from

4% for options and 8.5% for restricted stock units to

20% to reflect changes in employee retention rates.

This resulted in a benefit of approximately $9.2 million

in 2008, of which approximately $8.2 million and

$1.0 million was included within marketing, selling

and administrative expenses and payroll and related

expenses, respectively.

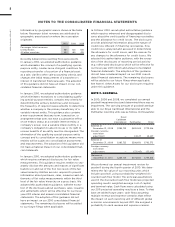

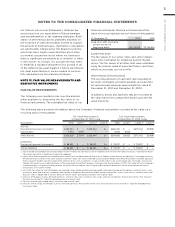

Stock options activity and information about stock options outstanding are summarized in the following tables:

Stock Options Activity

Weighted-

Weighted- Average

Average Remaining Aggregate

Number of Exercise Contractual Intrinsic Value1

Options Price Term (years) (in thousands)

Outstanding at January 1, 2010

Granted

Exercised ()

Canceled ()

Outstanding at December 31, 2010

Vested and expected to vest at December 31, 2010

Options Exercisable at December 31, 2010

1 The intrinsic value represents the amount by which the fair value of stock exceeds the option exercise price as of December 31, 2010.

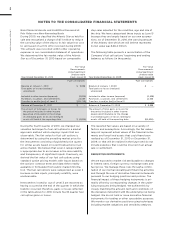

The weighted-average estimated fair value of stock

options granted was $11.69, $3.68 and $8.72 during

the years ended December 31, 2010, 2009 and 2008,

respectively. The total intrinsic value of stock options

exercised during the years ended December 31, 2010,

2009 and 2008 was $26.9 million, $0.5 million and

$2.0 million, respectively. As of December 31, 2010,

there was approximately $7.2 million of total unrecog-

nized compensation cost, net of estimated forfeitures,

related to stock options granted under our stock

incentive plans which is expected to be recognized

over a weighted-average period of 1.2 years.

Restricted stock units are converted into shares of

common stock upon vesting on a one-for-one basis.

The cost of these awards is determined using the fair

value of our common stock on the date of the grant,

and compensation expense is recognized over the

vesting period. Restricted stock activity is summarized

in the following table:

Restricted Stock Activity

Weighted-

Average

Number Grant Date

of Awards Fair Value

Non-vested share units at

January 1, 2010

Granted

Vested ()

Canceled ()

Non-vested share units

expected to vest as of

December 31, 2010

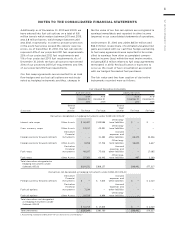

The weighted-average estimated fair value of restricted

stock units granted during the year ended December 31,

2009, and 2008 were $18.26 and $36.24, respectively.

As of December 31, 2010, we had $8.5 million of total

unrecognized compensation expense, net of estimated

forfeitures, related to restricted stock unit grants,

which will be recognized over the weighted-average

period of 1.2 years.