Royal Caribbean Cruise Lines 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

ROYAL CARIBBEAN CRUISES LTD. 77

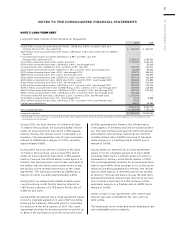

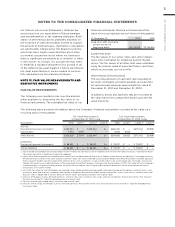

not that we will recover Pullmantur’s deferred tax

assets based on our expectation of future earnings

and implementation of tax planning strategies. Reali-

zation of deferred tax assets ultimately depends on

the existence of sufficient taxable income to support

the amount of deferred taxes. Pullmantur’s operations

are significantly influenced by the Spanish economy

which has been harder impacted than most other

economies around the world where we trade and

there is significant uncertainty as to whether or when

it will recover. As a result, it is possible we may need

to establish a valuation allowance for a portion or all

of the deferred tax asset balance if future earnings do

not meet expectations or we are unable to success-

fully implement our tax planning strategies.

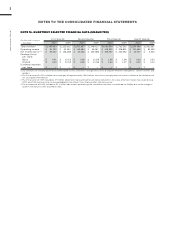

NOTE 13. FAIR VALUE MEASUREMENTS AND

DERIVATIVE INSTRUMENTS

FAIR VALUE MEASUREMENTS

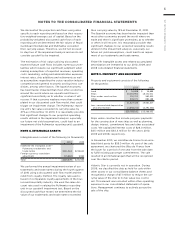

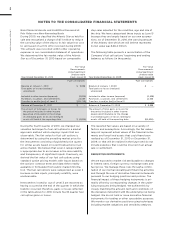

The Company uses quoted prices in active markets

when available to determine the fair value of its

financial instruments. The estimated fair value of our

financial instruments that are not measured at fair

value on a recurring basis are as follows (in thousands):

At December 31,

Long-term debt (including

current portion of

long-term debt)

Long-Term Debt

The fair values of our senior notes and senior deben-

tures were estimated by obtaining quoted market

prices. The fair values of all other debt were estimated

using the present value of expected future cash flows

which incorporates our risk profile.

Other Financial Instruments

The carrying amounts of cash and cash equivalents,

accounts receivable, accounts payable, accrued inter-

est and accrued expenses approximate fair value at

December 31, 2010 and December 31, 2009.

In addition, assets and liabilities that are recorded at

fair value have been categorized based upon the fair

value hierarchy.

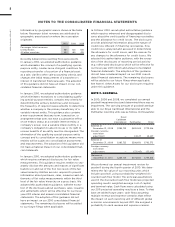

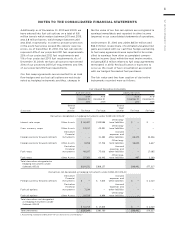

The following table presents information about the Company’s financial instruments recorded at fair value on a

recurring basis (in thousands):

Fair Value Measurements Fair Value Measurements

at December 31, 2010 Using at December 31, 2009 Using

Description Total Level 11Level 22Level 33Total Level 11Level 22Level 33

Assets:

Derivative financial instruments4 — — —

Investments5 — — — —

Total Assets —

Liabilities:

Derivative financial instruments6 — — — —

Total Liabilities — — — —

Inputs based on quoted prices (unadjusted) in active markets for identical assets or liabilities that we have the ability to access. Valuation of these

items does not entail a significant amount of judgment.

2. Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly. For foreign currency

forward contracts, interest rate, cross currency and fuel swaps, fair value is derived using valuation models that utilize the income valuation approach.

These valuation models take into account the contract terms such as maturity, as well as other inputs such as exchange rates, fuel types, fuel curves,

interest rate yield curves, creditworthiness of the counterparty and the Company. Starting in the fourth quarter of 2010, fair value for fuel call options

is determined by using the prevailing market price for the instruments consisting of published price quotes for similar assets based on recent

transactions in an active market.

3. For 2009, fair value for fuel call options was derived using standard option pricing models with inputs based on the options’ contract terms, such

as exercise price and maturity, and data either readily available or derived from public market information, such as fuel curves, volatility levels and

discount rates. Categorized as Level 3 because certain inputs (principally volatility) are unobservable.

4. Consists of foreign currency forward contracts, interest rate, cross currency, fuel swaps and fuel call options. Please refer to the “Fair Value of

Derivative Instruments” table for breakdown by instrument type.

5. Consists of exchange-traded equity securities and mutual funds.

6. Consists of fuel swaps and foreign currency forward contracts. Please refer to the “Fair Value of Derivative Instruments” table for breakdown by

instrument type.