Royal Caribbean Cruise Lines 2010 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2010 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART I

ROYAL CARIBBEAN CRUISES LTD. 11

guests, including exercise facilities, swimming pools,

beauty salons, gaming facilities, shopping, dining,

certain complimentary beverages, and entertainment

venues. Pullmantur’s tour operations sell land-based

travel packages to Spanish guests including hotels

and flights primarily to Caribbean resorts, and land-

based tour packages to Europe aimed at Latin

American guests.

CDF Croisières de France

We currently operate one ship, Bleu de France, with

approximately 750 berths under our CDF Croisières

de France brand, offering four to ten night cruise itin-

eraries. CDF Croisières de France is designed to serve

the contemporary segment of the French cruise market

by providing us with a brand custom-tailored for

French cruise guests. In November 2010, Bleu de

France was sold to an unrelated party. As part of the

sale agreement, we chartered Bleu de France from

the buyer for a period of one year from the sale date

in order to fulfill existing guest commitments. At the

end of the charter period, Pullmantur will redeploy

Horizon to CDF Croisières de France and prior to its

redeployment the ship will undergo renovations to

incorporate signature brand elements.

CDF Croisières de France offers seasonal itineraries

to the Mediterranean. CDF Croisières de France offers

a variety of onboard services, amenities and activities,

including entertainment venues, exercise and spa

facilities, fine dining, and gaming facilities.

TUI Cruises

In 2008, we formed a joint venture with TUI AG, a

European tourism and shipping company which owns

51% of TUI Travel. The joint venture operates TUI

Cruises, designed to serve the contemporary and

premium segments of the German cruise market by

offering a custom-tailored product for German guests.

All onboard activities, services, shore excursions and

menu offerings are designed to suit the preferences

of this target market. TUI Cruises operates one ship,

Mein Schiff, with a total of approximately 1,850 berths.

As previously announced, we will be selling Celebrity

Mercury to TUI Cruises to serve as its second ship.

The sale is expected to close at the end of February

2011 and the ship will enter service with TUI Cruises

in the second quarter of 2011, under the name Mein

Schiff 2, following an extensive refurbishment.

INDUSTRY

Cruising is considered a well established vacation sec-

tor in the North American market, a growing sector in

the European market and a developing but promising

sector in several other emerging markets. Industry

data indicates that a significant portion of cruise guests

carried are first-time cruisers. We believe this could

present an opportunity for long-term growth and a

potential for increased profitability.

We estimate that the global cruise industry carried

18.7 million cruise passengers in 2010 compared to

17.3 million cruise passengers carried in 2009. We

estimate that the global cruise fleet was served by

approximately 400,000 berths on approximately 281

ships by the end of 2010. There are approximately

20 ships with an estimated 53,000 berths that are

expected to be placed in service in the global cruise

market between 2011 and 2014. The majority of cruise

passengers in the cruise vacation industry have his-

torically been sourced from North America, and to a

lesser extent, Europe.

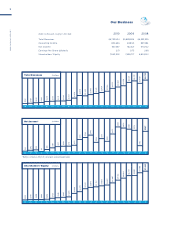

North America

Although the North American cruise market has his-

torically experienced significant growth, the compound

annual growth rate in cruise passengers for this market

was approximately 0.9% from 2006 to 2010. This

more limited growth is attributable in large part to the

recent international expansion within the cruise indus-

try. We estimate that North America was served by

136 ships with approximately 190,000 berths at the

beginning of 2006 and by 151 ships with approximately

241,000 berths by the end of 2010. There are approxi-

mately 13 ships with an estimated 36,000 berths that

are expected to be placed in service in the North

American cruise market between 2011 and 2014.

Europe

In Europe, cruising represents a much smaller sector

of the vacation industry; however, it has experienced

a compound annual growth rate in cruise passengers

of approximately 12.4% from 2006 to 2010 and we

believe this market has significant continued growth

potential. We estimate that Europe was served by 100

ships with approximately 94,000 berths at the begin-

ning of 2006 and by 114 ships with approximately

144,000 berths by the end of 2010. There are approx-

imately seven ships with an estimated 16,000 berths

that are expected to be placed in service in the

European cruise market between 2011 and 2014.