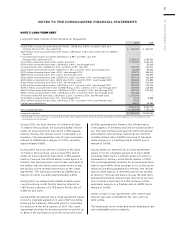

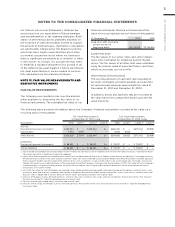

Royal Caribbean Cruise Lines 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

ROYAL CARIBBEAN CRUISES LTD. 71

We discounted the projected cash flows using rates

specific to each reporting unit based on their respec-

tive weighted-average cost of capital. Based on the

probability-weighted discounted cash flows of each

reporting unit we determined the fair values of Royal

Caribbean International and Pullmantur exceeded

their carrying values. Therefore, we did not proceed

to step two of the impairment analysis and we do not

consider goodwill to be impaired.

The estimation of fair value utilizing discounted

expected future cash flows includes numerous uncer-

tainties which require our significant judgment when

making assumptions of expected revenues, operating

costs, marketing, selling and administrative expenses,

interest rates, ship additions and retirements as well

as assumptions regarding the cruise vacation industry

competition and general economic and business con-

ditions, among other factors. The Spanish economy

has been harder impacted than most other economies

around the world where we operate and there is

significant uncertainty as to whether or when it will

recover. If that economy weakens more than contem-

plated in our discounted cash flow model, that could

trigger an impairment charge. The Pullmantur report-

ing unit’s fair value exceeded its carrying value by

37% as of December 31, 2010. It is reasonably possible

that significant changes to our projected operating

results utilized in the impairment analysis, especially

our future net yield assumptions, could lead to an

impairment of the Pullmantur reporting unit’s goodwill.

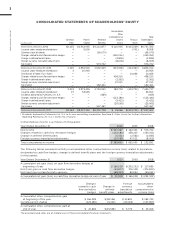

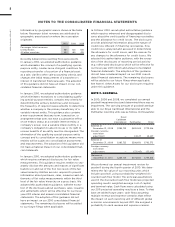

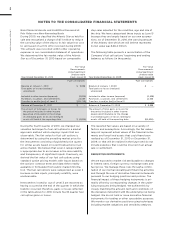

NOTE 4. INTANGIBLE ASSETS

Intangible assets consist of the following (in thousands):

Indefinite-life intangible asset—

Pullmantur trademarks and

trade names

Foreign currency translation

adjustment ()

Total

We performed the annual impairment review of our

trademarks and trade names during the fourth quarter

of 2010 using a discounted cash flow model and the

relief-from-royalty method. The royalty rate used is

based on comparable royalty agreements in the tour-

ism and hospitality industry. We used the same dis-

count rate used in valuing the Pullmantur reporting

unit in our goodwill impairment test. Based on the

discounted cash flow model, we determined the fair

value of our trademarks and trade names exceeded

their carrying value by 19% at December 31, 2010.

The Spanish economy has been harder impacted than

most other economies around the world where we

trade and there is significant uncertainty as to whether

or when it will recover. It is reasonably possible that

significant changes to our projected operating results

utilized in the impairment analysis, especially our

future net yield assumptions, could lead to an impair-

ment of our trademarks and trade names.

Finite-life intangible assets and related accumulated

amortization are immaterial to our 2010, 2009, and

2008 consolidated financial statements.

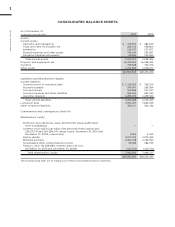

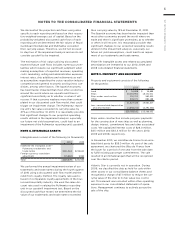

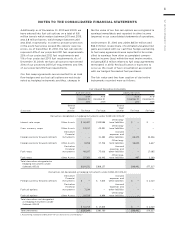

NOTE 5. PROPERTY AND EQUIPMENT

Property and equipment consists of the following

(in thousands):

Land

Ships

Ships under construction

Other

Less—accumulated depreciation

and amortization () ()

Ships under construction include progress payments

for the construction of new ships as well as planning,

design, interest, commitment fees and other associated

costs. We capitalized interest costs of $26.0 million,

$41.1 million and $44.4 million for the years 2010,

2009 and 2008, respectively.

In November 2010, we sold Bleu de France to an unre-

lated third party for $55.0 million. As part of the sale

agreement, we chartered the Bleu de France from

the buyer for a period of one year from the sale date

to fulfill existing passenger commitments. The sale

resulted in an immaterial gain that will be recognized

over the charter period.

Atlantic Star is currently not in operation. During

2009, we classified the ship as held for sale within

other assets in our consolidated balance sheets and

recognized a charge of $7.1 million to reduce the car-

rying value of the ship to its fair value less cost to

sell. This amount was recorded within other operating

expenses in our consolidated statements of opera-

tions. Management continues to actively pursue the

sale of the ship.