Royal Caribbean Cruise Lines 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ROYAL CARIBBEAN CRUISES LTD. 43

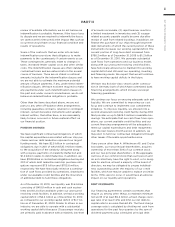

quite strong with our newest vessels performing well

and our management team effectively controlling

costs. During 2010, our Net Yields increased 4.2% and

our Net Cruise Costs per APCD decreased by 1.8%

despite experiencing travel disruptions, extreme

weather conditions and currency related issues during

the year. Even though the economy remains a chal-

lenge our outlook remains encouraging.

During 2011, we will work to further enhance our reve-

nues with the overall goal of maximizing our return

on invested capital. We will also continue to improve

our cost efficiency through various cost-containment

initiatives while ensuring we continue to deliver an

outstanding guest experience. We note the potential

for an increasing role of our tour operations which

include Royal Celebrity Tours and Pullmantur’s tour

businesses and other operations on our Net Yields

and Net Cruise Costs. We realize that revenues and

expenses associated with such operations tend to be

more volatile and less predictable than our main cruise

business. Because the tour businesses have relatively

low margins, this volatility has little impact on our

results of operations but can cause fluctuations in our

Net Yields and Net Cruise Costs.

Our international expansion also remains a key focus

going into 2011 and we continue to invest in mature

markets while strategically focusing on developing

markets. As a result, we are experiencing an increased

demand in these markets. We also continue to tacti-

cally invest in our fleet to ensure we maintain class

and brand standards including the addition of new

venues and other popular amenities across our fleet.

In addition, we recently reached a conditional agree-

ment with Meyer Werft to build the first of a new gen-

eration of Royal Caribbean International cruise ships.

Lastly, we have experienced a significant improve-

ment in our liquidity during 2010 due to the increase

in our operating cash flows coupled with the steps we

have taken so far to further reduce refinancing risk,

including obtaining an additional unsecured revolving

credit facility in 2010 with the goal of maintaining two

separate revolving credit facilities with staggered

maturity dates going forward. We also have committed

bank financing arrangements for our two Solstice-

class vessels under construction. We anticipate

funding our scheduled maturities in 2011 and other

obligations through operating cash flows and do not

foresee a need to access the capital markets during

2011 although we may opportunistically decide to do

so. We are also continuing to pursue our long-term

objective of returning to investment grade rating.

During 2010, Standard and Poor’s upgraded our cor-

porate credit rating and our senior unsecured debt

credit rating to BB with a stable outlook from BB– with

a stable outlook. In January 2011, Moody’s upgraded

our corporate credit rating to Ba1 with a stable out-

look from Ba2 with a stable outlook and our senior

unsecured debt credit rating to Ba2 with a stable out-

look from Ba3 with a stable outlook.

RESULTS OF OPERATIONS

Summary

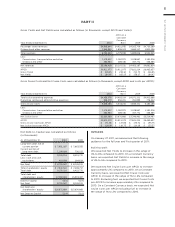

YEAR ENDED DECEMBER 31, 2010

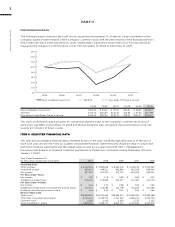

Total revenues increased 14.6% to $6.8 billion in 2010

from total revenues of $5.9 billion in 2009 primarily

due to an 11.1% increase in capacity (measured by

APCD for such period) and a 4.2% increase in Net

Yields. The increase in Net Yields was primarily due

to increases in ticket prices and occupancy, partially

offset by the adverse effect of changes in foreign cur-

rency exchange rates. This increase in total revenues

was also partially offset by higher operating expenses

primarily due to the increase in capacity, in part offset

by the favorable effect of changes in foreign currency

exchange rates. In addition, during 2010, we recorded

a one-time gain of approximately $89.0 million, net of

costs and payments to insurers, related to the settle-

ment of our case against Rolls Royce. As a result, our

net income was $547.5 million or $2.51 per share on a

diluted basis for 2010 compared to $162.4 million or

$0.75 per share on a diluted basis for 2009.

Significant items for 2010 include:

• Net Cruise Costs per APCD decreased by 1.8% com-

pared to 2009.

• Fuel expenses per APCD, net of the financial impact

of fuel swap agreements, decreased 3.0% per APCD

as compared to the same period in 2009.

• Our Net Debt-to-Capital ratio increased to 52.4% in

2010 from 52.0% in 2009. Similarly, our Debt-to-

Capital ratio increased to 53.5% in 2010 from 52.9%

in 2009.