Royal Caribbean Cruise Lines 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 ANNUAL REPORT 74

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

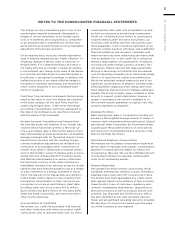

Our financing agreements contain covenants that

require us, among other things, to maintain minimum

net worth of at least $5.4 billion, a fixed charge cover-

age ratio of at least 1.25x and limit our net debt-to-

capital ratio to no more than 62.5%. The fixed charge

coverage ratio is calculated by dividing net cash from

operations for the past four quarters by the sum of

dividend payments plus scheduled principal debt pay-

ments in excess of any new financings for the past

four quarters. Our minimum net worth and maximum

net debt-to-capital calculations exclude the impact of

accumulated other comprehensive income (loss) on

total shareholders’ equity. We are currently well in

excess of all debt covenant requirements. The specific

covenants and related definitions can be found in the

applicable debt agreements, the majority of which

have been previously filed with the Securities and

Exchange Commission.

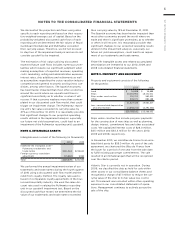

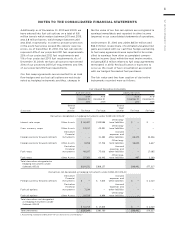

Following is a schedule of annual maturities on long-

term debt including capital leases as of December 31,

2010 for each of the next five years (in thousands):

Year

Thereafter

NOTE 8. SHAREHOLDERS’ EQUITY

We declared cash dividends on our common stock

of $0.15 per share in the first three quarters of 2008.

Commencing in the fourth quarter 2008, our Board of

Directors discontinued the issuance of quarterly divi-

dends. As a result, we did not declare cash dividends

in 2010 or 2009.

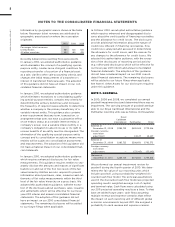

NOTE 9. STOCK-BASED EMPLOYEE

COMPENSATION

We have four stock-based compensation plans, which

provide for awards to our officers, directors and key

employees. The plans consist of a 1990 Employee

Stock Option Plan, a 1995 Incentive Stock Option Plan,

a 2000 Stock Award Plan, and a 2008 Equity Plan.

The 1990 Stock Option Plan and the 1995 Incentive

Stock Option Plan terminated by their terms in March

2000 and February 2005, respectively. The 2000

Stock Award Plan, as amended, and the 2008 Equity

Plan, as amended, provide for the issuance of up to

13,000,000 and 11,000,000 shares of our common

stock, respectively, pursuant to grants of (i) incentive

and non-qualified stock options, (ii) stock appreciation

rights, (iii) restricted stock, (iv) restricted stock units

and (v) performance shares. Each of these stock-based

compensation plans has stock awards outstanding as

of December 31, 2010, with the exception of stock

awards issued under the 1990 Employee Stock Option

Plan as remaining awards outstanding under this plan

expired during 2009. During any calendar year, no

one individual shall be granted awards of more than

500,000 shares. Options and restricted stock units

outstanding as of December 31, 2010 vest in equal

installments over four to five years from the date of

grant. Options and restricted stock units are forfeited

if the recipient ceases to be a director or employee

before the shares vest. Options are granted at a price

not less than the fair value of the shares on the date

of grant and expire not later than ten years after the

date of grant.

We also provide an Employee Stock Purchase Plan

(“ESPP”) to facilitate the purchase by employees of

up to 800,000 shares of common stock in the aggre-

gate. Offerings to employees are made on a quarterly

basis. Subject to certain limitations, the purchase

price for each share of common stock is equal to 90%

of the average of the market prices of the common

stock as reported on the New York Stock Exchange

on the first business day of the purchase period and

the last business day of each month of the purchase

period. Shares of common stock of 30,054, 65,005

and 36,836 were issued under the ESPP at a weighted-

average price of $27.87, $12.78 and $20.97 during

2010, 2009 and 2008, respectively.

Under the chief executive officer’s employment

agree ment we contributed 10,086 shares of our

common stock quarterly to a trust on his behalf.

In January 2009, the employment agreement and

related trust agreement were amended. Consequently,

in January 2009, 768,018 shares were distributed

from the trust and beginning in January 2009 quar-

terly share distributions are issued directly to the

chief executive officer.

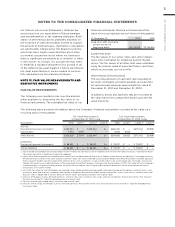

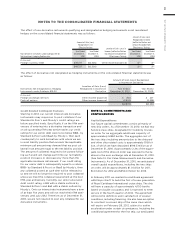

Total compensation expense recognized for employee

stock-based compensation for the years ended

December 31, 2010, 2009 and 2008 were as follows:

Location of expense

Employee Stock-Based

Compensation

(income)

In thousands

Marketing, selling and

administrative expenses

Payroll and related

expenses (income) ()

Total Compensation

Expense