Royal Caribbean Cruise Lines 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

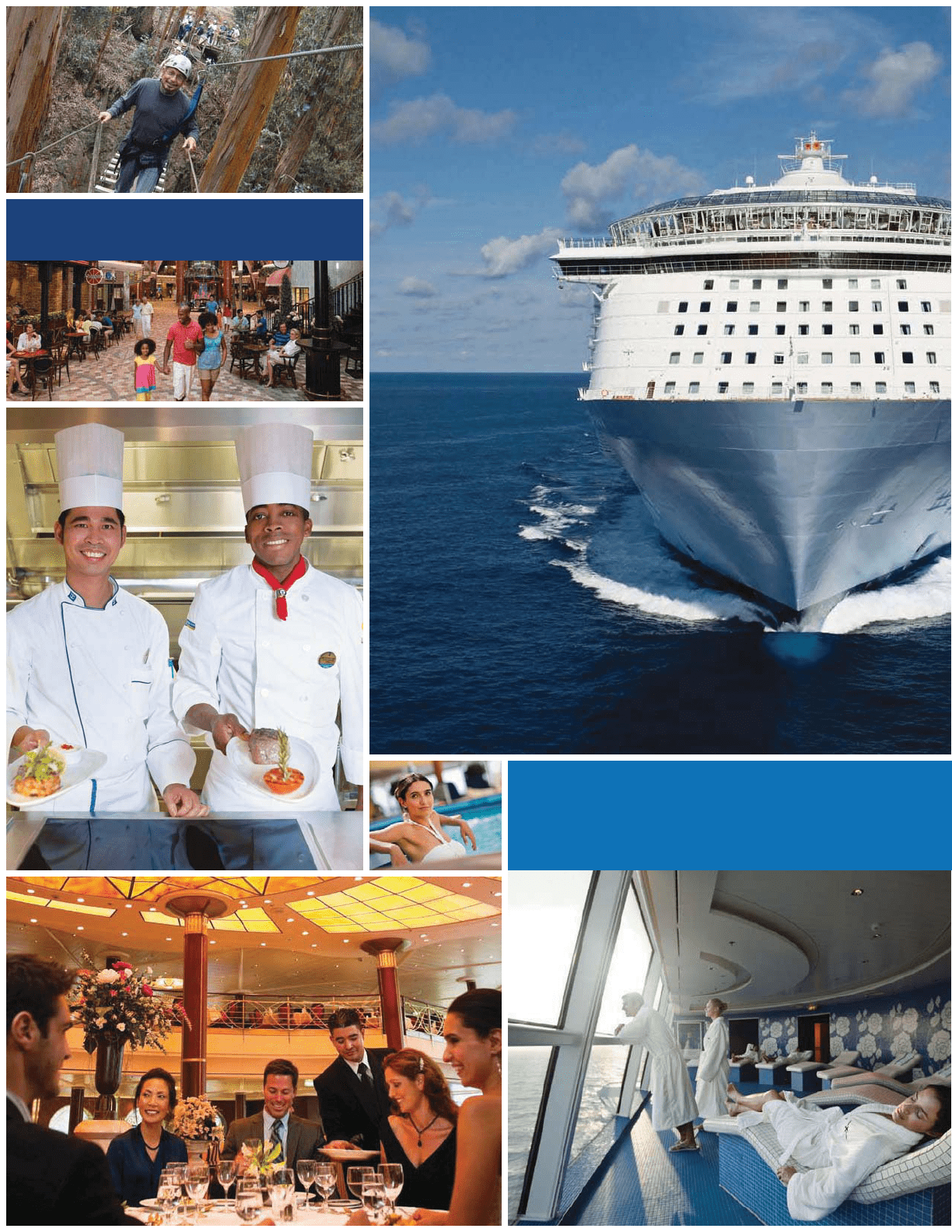

Diversifying GLOBALLY

Royal Caribbean Cruises Ltd.

2010 ANNUAL REPORT

Table of contents

-

Page 1

Royal Caribbean Cruises Ltd. Diversifying GLOBALLY 2 01 0 A N N UA L R E P O RT -

Page 2

OUR VISION Our vision is to empower and enable our EMPLOYEES to deliver the best vacation experience to our GUESTS, thereby generating superior returns to our SHAREHOLDERS and enhancing the well-being of our COMMUNITIES. -

Page 3

... Class ships scheduled to join the fleet: Celebrity Silhouette in July 2011, and Celebrity Reflection in Fall 2012. For more information, call your travel agent, dial 1-800-437-3111 or visit www.celebritycruises.com Azamara Club Cruises is a destination-immersive cruise line for up-market travelers... -

Page 4

... is the cruise industry's market leader. There is a relaxed and comfortable atmosphere onboard its five ships, which visit the Mediterranean, Baltic, Caribbean, Mexico, and South America. Acquired by Royal Caribbean Cruises Ltd. in 2006, the company also provides tour operations in Europe and Africa... -

Page 5

... a number of operational accomplishments including the opening of additional International Offices as we march forward globally, two extremely successful new ship launches with the Allure of the Seas and the Celebrity Eclipse and the delivery of amazing vacation experiences to over 4 million guests... -

Page 6

... of increasing demand and slowing supply has terrific implications on our pricing power going forward. Another significant component of our strategy is smart capital deployment. We delivered two amazing vessels during 2010, Allure of the Seas for our Royal Caribbean International brand and Celebrity... -

Page 7

...ship innovations have allowed us to reduce our fuel consumption by an astounding 20% per guest day since 2005. For additional information regarding our efforts regarding Safety and the Environment I would encourage you to review our third annual Stewardship Report which is available on our corporate... -

Page 8

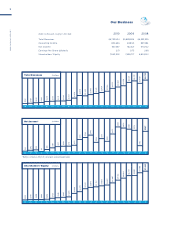

...Business 2 01 0 A N N UA L R E P O RT dollars in thousands, except per share data Total Revenues Operating Income Net Income Earnings Per Share (diluted) Shareholders' Equity 2010... 07 08 09 $162 *Before cumulative effect of a change in accounting principle 88 $295 89 $348 90 $400 91 $... -

Page 9

R OYA L C A R I B B E A N C R U I S E S LT D. 2010 FORM 10-K 5 -

Page 10

... Caribbean Way, Miami, Florida 33132 (Address of principal executive offices) (zip code) (305) 539-6000 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Common Stock, par value $.01 per share Securities registered... -

Page 11

... Market Risk ...Financial Statements and Supplementary Data ...Changes In and Disagreements With Accountants on Accounting and Financial Disclosure ...Controls and Procedures ...Other Information ...PART III Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security... -

Page 12

... worldwide, including Alaska, Asia, Australia, Bahamas, Bermuda, Canada, the Caribbean, Europe, Hawaii, the Middle East, the Panama Canal, South America and New Zealand. Royal Caribbean International is positioned at the upper end of the contemporary segment of the cruise vacation industry... -

Page 13

...by providing a variety of cruise lengths and itineraries to premium destinations throughout the world, including Alaska, Australia, Bermuda, the Caribbean, Europe, New Zealand, the Panama Canal and South America. Celebrity Cruises is also the only major cruise line to operate a ship in the Galapagos... -

Page 14

... shipping company which owns 51% of TUI Travel. The joint venture operates TUI Cruises, designed to serve the contemporary and premium segments of the German cruise market by offering a custom-tailored product for German guests. All onboard activities, services, shore excursions and menu offerings... -

Page 15

... of global cruise passengers, and the weighted-average supply of berths marketed globally, in North America and Europe are based on a combination of data that we obtain from various publicly available cruise industry trade information sources including Seatrade Insider and Cruise Line International... -

Page 16

... brands. Fleet Development, Maintenance and Innovation We currently have signed agreements with a shipyard providing for the construction of two new state-ofthe-art Solstice-class cruise ships scheduled to enter service in the third quarter of 2011 and the fourth quarter of 2012. These additions are... -

Page 17

... bedroom/two bathroom suites and balcony staterooms facing some of the distinct neighborhoods. In 2011, Royal Caribbean International will introduce some of the most popular features of the Oasis-class ships on certain Freedom-class and Radiance-class ships, including the addition of new specialty... -

Page 18

...Cruises and is sailing under the name Azamara Quest. Before redeployment to the Azamara Club Cruises brand, each ship underwent renovations including the upgrade of guest suites and staterooms, and the addition of two new specialty restaurants. Pullmantur. Pullmantur was founded in 1971. We acquired... -

Page 19

... in port. In 2011, Azamara Club Cruises' deployment feature sailings in Western and Northern Europe, Asia, the Mediterranean, the Panama Canal and the less-traveled islands of the Caribbean. In the winter, Azamara will return to South America, adding new cruises to the Amazon. Also, Pullmantur and... -

Page 20

... an increase in the use of our internet sites and consumer outreach centers as a source of our overall bookings. Guests can also book their cruise vacations onboard our ships. GUEST SERVICES We offer to handle virtually all travel aspects related to guest reservations and transportation, including... -

Page 21

... on 2011 itineraries (subject to change). It does not include Pullmantur's Atlantic Star which is currently not in operation and which we plan to sell. Ship Royal Caribbean International Allure of the Seas Oasis of the Seas Independence of the Seas Liberty of the Seas Freedom of the Seas Jewel of... -

Page 22

...2004 2006 Ship Azamara Club Cruises Azamara Journey 3 Azamara Quest4 Pullmantur Ocean Dream 5 Zenith Empress Sovereign Horizon 6 CDF Croisières de France Bleu de France 7 Total Approximate Berths 700 700 Primary Areas of Operation Europe, Caribbean, Panama Canal, South America Europe, Asia 2008... -

Page 23

... America through our cruise-tour operations, Royal Celebrity Tours. Pullmantur also offers landbased travel packages to Spanish and European vacation travelers including hotels and flights to Caribbean resorts and sells land based tour packages to Europe aimed at Latin American guests. In addition... -

Page 24

...given that affordable and secure insurance markets will be available to provide the level of coverage required under the 2002 Protocol. TRADEMARKS We own a number of registered trademarks related to the Royal Caribbean International, Celebrity Cruises, Azamara Club Cruises, Pullmantur and CDF Croisi... -

Page 25

... pursuant to international treaties governing the safety of our ships, guests and crew as well as environmental protection. Each country of registry conducts periodic inspections to verify compliance with these regulations as discussed more fully below. Ships operating out of United States ports are... -

Page 26

... all aspects of crew management for ships in international commerce, including additional requirements relating to the health, safety and status of crewmembers not previously in effect. The Convention is expected to be ratified sometime in 2011, in which case it would enter into force in 2012. Our... -

Page 27

...the Internal Revenue Service to be incidental to the international operation of ships. The activities listed in the regulations as not being incidental to the international operation of ships include income from the sale of air and land transportation, shore excursions and pre- and post-cruise tours... -

Page 28

...to the international operation of our ships. Because we and Celebrity Cruises Inc. conduct a trade or business in the United States, we and Celebrity Cruises Inc. would be taxable at regular corporate rates on our separate company taxable income (i.e., without regard to the income of our ship-owning... -

Page 29

... corporate income tax. STATE TAXATION EXECUTIVE OFFICERS OF THE COMPANY As of February 24, 2011, our executive officers are: Name Richard D. Fain Adam M. Goldstein Age 63 51 Position Chairman, Chief Executive Officer and Director President and Chief Executive Officer, Royal Caribbean International... -

Page 30

... management, air/sea, groups, international operations, decision support, reservations and customer service for both Royal Caribbean International and Celebrity Cruises. Harri U. Kulovaara has served as Executive Vice President, Maritime, since January 2005. Mr. Kulovaara is responsible for fleet... -

Page 31

... and tours. We face significant competition from other cruise lines on the basis of cruise pricing, travel agent preference and also in terms of the nature of ships and services we offer to guests. Our principal competitors within the cruise vacation industry include Carnival Corporation & plc... -

Page 32

...Pullmantur brand. Other risks attendant to operating internationally include volatile local political conditions, potential increases in duties and taxes, changes in laws and policies affecting cruising, vacation or maritime businesses or governing the operations of foreign-based companies, currency... -

Page 33

... fuel prices or disruptions in fuel supplies could have a material adverse effect on our results of operations, financial condition and liquidity. Our other operating costs, including food, payroll, airfare for our shipboard personnel, taxes, insurance and security costs are all subject to increases... -

Page 34

... business may adversely affect our results of operations. Our principal executive office and shoreside operations are located at the Port of Miami, Florida and we have call centers for reservations throughout the world. Although we have developed disaster recovery and similar contingency plans... -

Page 35

... to the benefit of Section 883, we and our subsidiaries would be subject to United States taxation on a portion of the income derived from or incidental to the international operation of our ships, which would reduce our net income. See "Item 1. Business- Taxation of the Company " for a discussion... -

Page 36

... cruise ships, including their size and primary areas of operation, may be found within the Operating Strategies-Fleet Development and Maintenance section and the Operations-Cruise Ships and Itineraries section in Item 1. Business. Information regarding our cruise ships under construction, estimated... -

Page 37

...class action, being brought against Park West Galleries, Inc., doing business as Park West Gallery, PWG Florida, Inc., Fine Art Sales, Inc., Vista Fine Art LLC, doing business as Park West At Sea (together, "Park West"), and other named and unnamed parties. Royal Caribbean Cruises Ltd. and Celebrity... -

Page 38

... MARKET INFORMATION Our common stock is listed on the New York Stock Exchange ("NYSE") and the Oslo Stock Exchange ("OSE") under the symbol "RCL." The table below sets forth the high and low sales prices of our common stock as reported by the NYSE and the OSE for the two most recent years by quarter... -

Page 39

... the Dow Jones United States Travel and Leisure Index for a five year period by measuring the changes in common stock prices from December 31, 2005 to December 31, 2010. $160 $140 $120 $100 $80 $60 $40 $20 $0 12/05 12/06 12/07 S&P 500 12/08 12/09 12/10 Royal Caribbean Cruises Ltd. Dow Jones... -

Page 40

... our goal of satisfying guest expectations it may adversely impact our business success; • the uncertainties of conducting business internationally and expanding into new markets; • changes in operating and financing costs, including changes in foreign exchange rates, interest rates, fuel, food... -

Page 41

...-line method over estimated service lives of primarily 30 years. Our service life and residual value estimates take into consideration the impact of anticipated technological changes, long-term cruise and vacation market conditions and historical useful lives of similarlybuilt ships. In addition... -

Page 42

... impaired. We performed our annual impairment review for goodwill during the fourth quarter of 2010. We determined the fair value of our two reporting units which include goodwill, Royal Caribbean International and Pullmantur, using a probability-weighted discounted cash flow model. The principal... -

Page 43

... implement our tax planning strategies. Derivative Instruments We enter into forward and swap contracts to manage our interest rate exposure and to limit our exposure to fluctuations in foreign currency exchange rates and fuel prices. The majority of these instruments are designated as hedges and... -

Page 44

... from the sale of goods and/or services onboard our ships not included in passenger ticket prices, cancellation fees, sales of vacation protection insurance, pre- and post-cruise tours, Pullmantur's land-based tours and hotel and air packages. Onboard and other revenues also include revenues we... -

Page 45

... by changes in currency exchange rates. Although such changes in local currency prices is just one of many elements impacting our revenues and expenses, it can be an important element. For this reason, we also monitor Net Yields and Net Cruise Costs as if the current periods' currency exchange rates... -

Page 46

... our fleet. In addition, we recently reached a conditional agreement with Meyer Werft to build the first of a new generation of Royal Caribbean International cruise ships. Lastly, we have experienced a significant improvement in our liquidity during 2010 due to the increase in our operating cash... -

Page 47

... two separate revolving credit facilities with staggered maturity dates. • We took delivery of Allure of the Seas, the second Oasis-class ship for Royal Caribbean International and Celebrity Eclipse, the third Solstice-class ship for Celebrity Cruises. To finance the purchases, we borrowed a total... -

Page 48

...): 2010 on a Constant Currency Basis $4,493,014 850,201 5,343,215 1,182,971 489,436 $3,670,808 30,911,073 $ 172.86 $ 118.75 Year Ended December 31, Total cruise operating expenses Marketing, selling and administrative expenses Gross Cruise Costs Less: Commissions, transportation and other Onboard... -

Page 49

... a change in our fuel expenses of approximately $28.0 million for the full year 2011, after taking into account existing hedges. Based on the expectations noted above, and assuming that fuel prices remain at $533 per metric ton and full year foreign currency exchange rates are $1.37 to the euro and... -

Page 50

... fuel prices. The increase in cruise operating expenses was also partially offset an estimated $34.9 million decrease related to the favorable effect of changes in foreign currency exchange rates related to our cruise operating expenses denominated in currencies other than the United States... -

Page 51

... full year of service of Independence of the Seas and the addition of Celebrity Equinox. To a lesser extent, the increase is also due to depreciation associated with shipboard and shore-side additions. These increases were partially offset by the sale of Celebrity Galaxy to TUI Cruises. Other Income... -

Page 52

... discounts on our ticket prices, the decrease in onboard spending, a stronger United States dollar compared to the euro, British pound and Canadian dollar as well as the impact of the itinerary modifications and diminished demand for our cruises and tours to Mexico and the Caribbean as mentioned... -

Page 53

... with initial terms in excess of one year. As a normal part of our business, depending on market conditions, pricing and our overall growth strategy, we continuously consider opportunities to enter into contracts for the building of additional ships. We may also consider the sale of ships or the... -

Page 54

... our financial condition and results of operations. Some of the contracts that we enter into include indemnification provisions that obligate us to make payments to the counterparty if certain events occur. These contingencies generally relate to changes in taxes, increased lender capital costs and... -

Page 55

...consolidated financial statements under Item 8. Financial Statements and Supplementary Data.) Interest Rate Risk Our exposure to market risk for changes in interest rates relates to our long-term debt obligations and our operating lease for Brilliance of the Seas. At December 31, 2010, approximately... -

Page 56

...us to an increasing level of foreign currency exchange risk. Movements in foreign currency exchange rates may affect the translated value of our earnings and cash flows associated with our international operations. Fuel Price Risk Our exposure to market risk for changes in fuel prices relates to the... -

Page 57

... are effective to provide reasonable assurance that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is accumulated and communicated to management, including our Chairman and Chief Executive Officer and our Executive Vice President and Chief... -

Page 58

... AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE AND PRINCIPAL ACCOUNTANT FEES AND SERVICES. The information required by Items 10, 11, 12, 13 and 14 is incorporated herein by reference to the Royal Caribbean Cruises Ltd. definitive proxy statement to be filed with the Securities and Exchange... -

Page 59

... of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. ROYAL CARIBBEAN CRUISES LTD. (Registrant) By: /s/ BRIAN J. RICE Brian J. Rice Executive Vice President and Chief Financial Officer (Principal... -

Page 60

...dated as of January 25, 2007 among the Company, as issuer, The Bank of New York, as trustee, transfer agent, principal paying agent and security registrar, and AIB/ BNY Fund Management (Ireland) Limited, as Irish paying agent (incorporated by reference to Exhibit 10.1 to the Company's Current Report... -

Page 61

... to Exhibit 10.1 to the Company's Current Report on Form 8-K filed with the Commission on December 2, 2009). Exhibit Description 10.7 -Credit Agreement dated as of March 15, 2010, as amended, among Allure of the Seas Inc., as borrower, Royal Caribbean Cruises Ltd. as guarantor, various financial... -

Page 62

...10.16 to the Company's 2004 Annual Report on Form 10-K). 10.26 -Royal Caribbean Cruises Ltd. Executive ShortTerm Bonus Plan dated as of September 12, 2008 (incorporated by reference to Exhibit 10.2 to the Company's Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2008). 10... -

Page 63

... 10.2 to the Company's Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2007). 10.31* -Form of Royal Caribbean Cruises Ltd. 2008 Equity Incentive Plan Restricted Stock Unit Agreement-2011 Director Grants. 12.1* -Statement regarding computation of fixed charge coverage ratio... -

Page 64

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Page Report of Independent Registered Certified Public Accounting Firm ...Consolidated Statements of Operations...Consolidated Balance Sheets ...Consolidated Statements of Cash Flows ...Consolidated Statements of Shareholders' Equity ...Notes to the ... -

Page 65

... of Royal Caribbean Cruises, Ltd. and its subsidiaries at December 31, 2010 and 2009, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2010 in conformity with accounting principles generally accepted in the United States of America... -

Page 66

...,236 6,532,525 Passenger ticket revenues Onboard and other revenues Total revenues Cruise operating expenses: Commissions, transportation and other Onboard and other Payroll and related Food Fuel Other operating Total cruise operating expenses Marketing, selling and administrative expenses... -

Page 67

... of long-term debt Accounts payable Accrued interest Accrued expenses and other liabilities Customer deposits Total current liabilities Long-term debt Other long-term liabilities Commitments and contingencies (Note 14) Shareholders' equity Preferred stock ($0.01 par value; 20,000,000 shares... -

Page 68

... of common stock options Other, net Net cash provided by financing activities Effect of exchange rate changes on cash Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year Supplemental Disclosures Cash paid during... -

Page 69

... regarding Pullmantur Air, S.A.'s ownership structure. Comprehensive income is as follows (in thousands): Year Ended December 31, Net income Changes related to cash flow derivative hedges Change in defined benefit plans Foreign currency translation adjustments Total comprehensive income 2010 $ 547... -

Page 70

... STATEMENTS NOTE 1. GENERAL Description of Business We are a global cruise company. We own five cruise brands, Royal Caribbean International, Celebrity Cruises, Pullmantur, Azamara Club Cruises, and CDF Croisières de France with a combined total of 40 ships in operation at December 31, 2010... -

Page 71

... operating capability. Repairs and maintenance activities are charged to expense as incurred. Goodwill Goodwill represents the excess of cost over the fair value of net tangible and identifiable intangible assets acquired. We review goodwill for impairment at the reporting unit level annually... -

Page 72

... related tax effects are recognized as they vest. We use the estimated amount of expected forfeitures to calculate compensation costs for all outstanding awards. Segment Reporting We operate five wholly-owned cruise brands, Royal Caribbean International, Celebrity Cruises, Pullmantur, Azamara Club... -

Page 73

... our annual impairment review for goodwill during the fourth quarter of 2010. We determined the fair value of our reporting units which include goodwill, using a probability-weighted discounted cash flow model. The principal assumptions used in the discounted cash flow model are projected operating... -

Page 74

... consolidated statements of operations. Management continues to actively pursue the sale of the ship. $241,563 (15,884) $225,679 $235,610 5,953 $241,563 We performed the annual impairment review of our trademarks and trade names during the fourth quarter of 2010 using a discounted cash flow model... -

Page 75

... not disclose the assets and liabilities of Pullmantur Air as they are immaterial to our December 31, 2010 consolidated financial statements. We have determined that our 50% interest in the TUI Cruises GmbH joint venture with TUI AG, which operates the brand TUI Cruises, is a VIE. As of December 31... -

Page 76

... agreed to in April 2008 providing financing for Celebrity Reflection which is scheduled for delivery in the fourth quarter of 2012. The credit agreement provides for an unsecured term loan for up to 80% of the purchase price of the vessel which will be 95% guaranteed by Hermes, the official... -

Page 77

... employees are made on a quarterly basis. Subject to certain limitations, the purchase price for each share of common stock is equal to 90% of the average of the market prices of the common stock as reported on the New York Stock Exchange on the first business day of the purchase period and the last... -

Page 78

... increased our estimated forfeiture rate from 4% for options and 8.5% for restricted stock units to 20% to reflect changes in employee retention rates. This resulted in a benefit of approximately $9.2 million in 2008, of which approximately $8.2 million and $1.0 million was included within marketing... -

Page 79

... $17.3 million for the years ended December 31, 2010, 2009 and 2008, respectively. NOTE 12. INCOME TAXES We and the majority of our subsidiaries are currently exempt from United States corporate tax on United States source income from the international operation of ships pursuant to Section 883 of... -

Page 80

...into account the contract terms such as maturity, as well as other inputs such as exchange rates, fuel types, fuel curves, interest rate yield curves, creditworthiness of the counterparty and the Company. Starting in the fourth quarter of 2010, fair value for fuel call options is determined by using... -

Page 81

... in the future and do not include expenses that could be incurred in an actual sale or settlement. DERIVATIVE INSTRUMENTS We are exposed to market risk attributable to changes in interest rates, foreign currency exchange rates and fuel prices. We manage these risks through a combination of our... -

Page 82

...hedge accounting is discontinued, cash flows subsequent to the date of discontinuance are classified consistent with the nature of the instrument. Interest Rate Risk Our exposure to market risk for changes in interest rates relates to our long-term debt obligations including future interest payments... -

Page 83

...the aggregate cost of the ships on order was exposed to fluctuations in the euro exchange rate at December 31, 2010 and December 31, 2009, respectively. The majority of our foreign exchange contracts and our cross currency swap agreements are accounted for as fair value or cash flow hedges depending... -

Page 84

... are accounted for as cash flow hedges and our fuel call options are not designated as hedging instruments and thus, changes in the fair value of our fuel call options are recognized in earnings immediately and reported in other income (expense) in our consolidated statements of operations. At... -

Page 85

...Year Ended December 31, 2009 Derivatives and related Hedged Items under Subtopic 815-20 Fair Value Hedging Relationships In thousands Interest rate swaps Cross currency swaps Interest rate swaps Cross currency swaps Foreign currency forward contracts Location of Gain (Loss) Recognized in Income... -

Page 86

..., including the two ships on order, will be approximately $1.0 billion for 2011, $1.0 billion for 2012 and $350.0 million for 2013. In February 2011, we reached a conditional agreement with Meyer Werft to build the first of a new generation of Royal Caribbean International cruise ships. The ship... -

Page 87

...Court to rename Royal Caribbean Cruises Ltd., Celebrity Cruises Inc. and other cruise lines as defendants in five actions, one of which is a pending class action, being brought against Park West Galleries, Inc., doing business as Park West Gallery, PWG Florida, Inc., Fine Art Sales, Inc., Vista Fine... -

Page 88

... extent its after-tax return is negatively impacted by unfavorable changes in corporate tax rates, capital allowance deductions and certain unfavorable determinations which may be made by United Kingdom tax authorities. These indemnifications could result in an increase in our lease payments. We are... -

Page 89

... on the demand for cruises. Demand is strongest for cruises during the Northern Hemisphere's summer months and holidays. 2 The first quarter of 2010 included a one-time gain of approximately $85.6 million, net of costs and payments to insurers, related to the settlement of our case against Rolls... -

Page 90

... own the Royal Caribbean Cruises Ltd. stock at time of sailing. Onboard credit is calculated in U.S. dollars except on sailings where the onboard currency used is a foreign currency (in which case the onboard credit will be converted at a currency exchange rate determined by the cruise line) and is... -

Page 91

... contacting the Investor Relations Department at our corporate headquarters. PricewaterhouseCoopers LLP 1441 Brickell Avenue Suite 1100 Miami, Florida 33131-2330 Transfer Agent & Registrar American Stock Transfer & Trust Company, LLC 6201 15th Avenue Brooklyn, New York 11219 www.amstock.com 2010... -

Page 92

Royal Caribbean Cruises Ltd. 1050 Caribbean Way, Miami, Florida 33132-2096 USA