Radio Shack 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

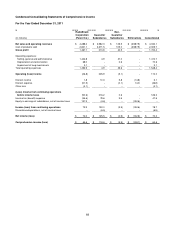

71

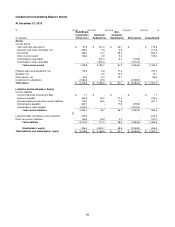

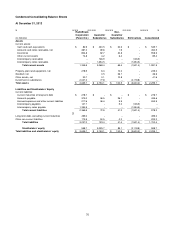

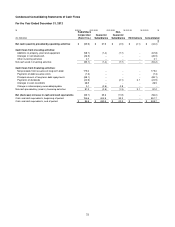

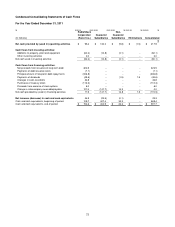

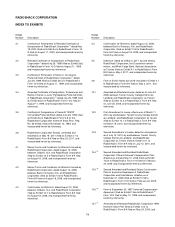

Condensed Consolidating Statements of Cash Flows

For the Year Ended December 31, 2013

RadioShack

Non-

Corporation

Guarantor

Guarantor

(In millions) (Parent Co.)

Subsidiaries

Subsidiaries

Eliminations

Consolidated

Net cash (used in) provided by operating activities $ (142.9) $ 176.6

$

3.8

$

(1.7)

$

35.8

Cash flows from investing activities:

Additions to property, plant and equipment (40.2) -- (2.1) -- (42.3)

Proceeds from sale of property, plant and equipment 6.5 -- -- -- 6.5

Changes in restricted cash (39.5) -- -- -- (39.5)

Other investing activities (2.9) (2.9) (2.9) 5.8 (2.9)

Return of capital from subsidiary 6.0 6.0 -- (12.0) --

Net cash (used in) provided by investing activities (70.1) 3.1 (5.0) (6.2) (78.2)

Cash flows from financing activities:

Net proceeds from issuance of long-term debt 289.2 -- -- -- 289.2

Payments of debt issuance costs (32.5) -- -- -- (32.5)

Principal amount of long-term debt repayments (461.9) -- -- -- (461.9)

Payments of dividends -- -- (1.7) 1.7 --

Changes in cash overdrafts (108.3) -- -- -- (108.3)

Payment of capital distribution -- (6.0) (6.0) 12.0 --

Capital contribution -- 2.9 2.9 (5.8) --

Change in intercompany receivable/payable 479.5 (485.9) 6.4 -- 0.0

Net cash provided by (used in) financing activities 166.0 (489.0) 1.6 7.9 (313.5)

Net (decrease) increase in cash and cash equivalents (47.0) (309.3) 0.4 -- (355.9)

Cash and cash equivalents, beginning of period 84.9 430.5 20.3 -- 535.7

Cash and cash equivalents, end of period $ 37.9 $ 121.2

$

20.7

$

--

$

179.8