Radio Shack 2013 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2013 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

commercial customers, and sales to other third parties

through our global sourcing operations. Each of these

business activities accounted for less than 5% of our

consolidated net sales and operating revenues in 2013.

Other sales decreased $35.4 million, or 9.4%, when

compared with last year. This sales decrease was driven

primarily by sales decreases to our independent dealers

and at radioshack.com.

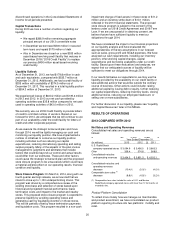

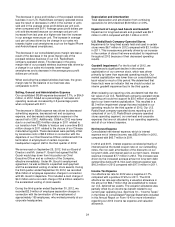

Gross Profit

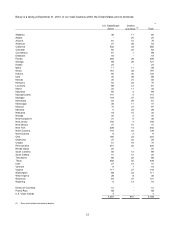

Consolidated gross profit and gross margin are as follows:

Year Ended December 31,

(In millions) 2013

2012

2011

Gross profit

$

1,172.2

$ 1,470.4

$ 1,722.4

Gross profit decrease (20.3)%

(14.6)%

(8.9)%

Gross margin rate 34.1 %

38.4 %

42.7 %

Gross profit decreased by $298.2 million, or 20.3%, to

$1,172.2 million when compared with last year. This

decrease was primarily driven by our decreased revenue

and our decreased gross margin rate. Gross margin rate

decreased by 4.3 percentage points from last year to

34.1%. The decrease in our consolidated gross margin rate

was a result of: a change in sales mix towards higher-

priced and lower gross margin rate smartphones; inventory

valuation losses associated with our transition to an

improved merchandise assortment; more aggressive sales

promotions such as aggressive discounts, clearance

events, and customer coupons; and inventory write downs

related to our proposed store closure program.

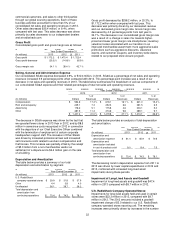

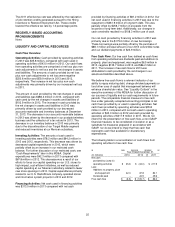

Selling, General and Administrative Expense

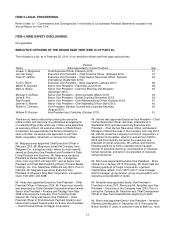

Our consolidated SG&A expense decreased 0.9%, or $12.4 million, in 2013. SG&A as a percentage of net sales and operating

revenues increased 3.9 percentage points when compared with 2012. This percentage point increase was a result of our

decrease in net sales and operating revenues in 2013. The table below summarizes the breakdown of various components of

our consolidated SG&A expense and their related percentages of total net sales and operating revenues.

Year Ended December 31,

2013 2012 2011

% of % of % of

(In millions) Dollars Revenues

Dollars Revenues

Dollars Revenues

Compensation $ 594.6 17.3 % $ 618.1 16.1

% $ 621.0 15.4

%

Rent and occupancy 249.1 7.3 252.3 6.6

261.5 6.5

Advertising 176.2 5.1 175.8 4.6

203.1 5.0

Other 387.5 11.3 373.6 9.8

389.1 9.7

$ 1,407.4 41.0 % $ 1,419.8 37.1

% $ 1,474.7 36.6

%

The decrease in SG&A expense was driven by the fact that

we operated fewer stores in 2013 than in 2012, and by $8.5

million in severance costs recognized in 2012 in connection

with the departure of our Chief Executive Officer combined

with the termination of employment of certain corporate

headquarters support staff. The increase in Other SG&A

was driven by increased professional fees and increased

self-insurance costs related to workers compensation and

theft losses. This increase was partially offset by the receipt

of $5.3 million from a non-merchandise vendor as

settlement of a dispute and a $2.4 million gain on the sale

of a building.

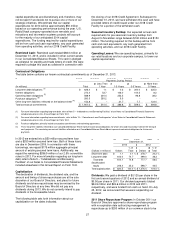

Depreciation and Amortization

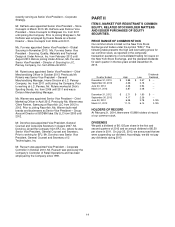

The table below provides a summary of our total

depreciation and amortization by segment.

Year Ended December 31,

(In millions) 2013 2012

2011

U.S. RadioShack

company-operated stores $ 29.9 $ 31.8

$ 37.9

Other 4.4 3.8

4.0

Unallocated 36.1 38.7

36.2

Total depreciation and

amortization from

continuing operations $

70.4 $

74.3

$

78.1

The table below provides an analysis of total depreciation

and amortization.

Year Ended December 31,

(In millions) 2013 2012

2011

Depreciation and

amortization expense $ 61.4 $ 65.9

$ 70.6

Depreciation and

amortization included

in cost of products sold 9.0 8.4

7.5

Total depreciation and

amortization from

continuing operations $

70.4 $

74.3

$

78.1

The decreasing trend in depreciation expense from 2011 to

2013 was driven by lower capital expenditures in 2012 and

2013, combined with increased long-lived asset

impairments during these periods.

Impairment of Long-Lived Assets and Goodwill

Impairment of long-lived assets and goodwill was $47.4

million in 2013 compared with $9.7 million in 2012.

U.S. RadioShack Company-Operated Stores:

Impairments for long-lived assets held and used in certain

stores were $23.3 million in 2013, compared with $9.7

million in 2012. The 2012 amounts included a goodwill

impairment charge of $3.0 related to our U.S. RadioShack

company-operated stores reporting unit. The remaining

increases were primarily driven by increases in the number