Radio Shack 2013 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2013 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.19

ITEM 7. MANAGEMENT'S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (“MD&A”).

This MD&A section discusses our results of operations,

liquidity and financial condition, risk management practices,

critical accounting policies and estimates, and certain

factors that may affect our future results, including

economic and industry-wide factors. Our MD&A should be

read in conjunction with our consolidated financial

statements and accompanying notes included in this

Annual Report on Form 10-K, as well as the Risk Factors

set forth in Item 1A above.

EXECUTIVE SUMMARY

Strategic Turnaround Plan

In February 2013 we hired a new Chief Executive Officer to

lead a turnaround of the business by focusing on an initial

set of strategic initiatives (“Strategic Plan”):

• Reposition our brand to reignite our customer base

and connect to a new generation of shoppers

through a modernized and relevant brand position.

• Revamp our product assortment to focus on

relevant categories and higher-margin private

brands.

• Reinvigorate our store experience through the use

of high-touch, interactive content in strategic

locations and the use of key design and aesthetic

elements on a cost-effective basis.

• Increase operational efficiency by evaluating our

retail operations, supply chain, and corporate

functions and reengineering our processes to

emphasize efficiencies.

• Increase our financial flexibility by providing the

necessary capital and liquidity to fund the turnaround

of the business. Refer to Note 5 to our Consolidated

Financial Statements included elsewhere in this

report for further discussion.

The implementation of these strategic initiatives will

continue throughout 2014.

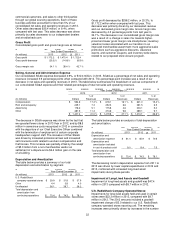

2013 Summary

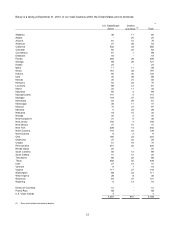

Net sales and operating revenues decreased $397.0

million, or 10.4%, to $3,434.3 million when compared with

last year. This decrease was primarily driven by an 8.8%

decrease in comparable store sales. We experienced soft

sales in many of our product categories. Areas showing

sales growth were prepaid wireless, portable speakers,

music accessories, and AC adaptors.

Gross profit decreased by $298.2 million, or 20.3%, to

$1,172.2 million when compared with last year. This

decrease was primarily driven by our lower revenue and

our lower gross margin rate. The gross margin rate

decreased from last year by 4.3 percentage points to

34.1%. This was a result of: a change in sales mix towards

higher-priced and lower gross margin rate smartphones; an

inventory write off of $46.6 million in the third quarter

associated with product we have removed from our

assortment; and more aggressive sales promotions such as

aggressive discounts, clearance events, and customer

coupons.

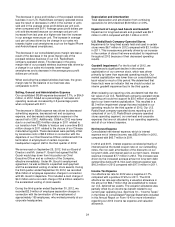

Selling, general and administrative (“SG&A”) expense

decreased $12.4 million, or 0.9%, when compared with last

year. The decrease in SG&A expense was driven primarily

by fewer stores in operation during 2013 versus 2012, and

by lower severance costs in 2013 when compared to 2012

primarily due to severance paid in 2012 to our former Chief

Executive Officer and other corporate headquarters staff

reductions. These decreases were partially offset by

increased professional fees and increased self-insurance

costs related to workers compensation and theft losses.

As a result of the factors above, we incurred an operating

loss of $344.0 million, compared with an operating loss of

$25.0 million last year. Operating income for our U.S.

company-operated stores segment was $73.8 million,

compared with $337.7 million last year.

Loss from continuing operations was $392.0 million, or

$3.89 per diluted share, in 2013, compared with a loss from

continuing operations of $110.8 million, or $1.11 per diluted

share, in 2012.

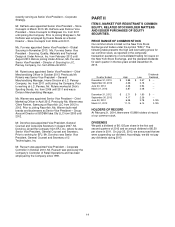

Update on Postpaid Wireless Business

The combination of the following factors at our U.S.

company-operated stores contributed to the substantial

decrease in consolidated gross profit over the past two

years:

• Total postpaid units sold decreased by 23% in 2013

and decreased by 20% in 2012

• The average cost per unit sold increased by 14.3%

in 2013 and increased by 36% in 2012

• The average revenue per unit sold increased by 7%

in 2013 and increased 19% in 2012

The decrease in the number of postpaid units sold at our

U.S. company-operated stores was primarily driven by

lower than anticipated adoption of new handsets.

The increase in the average revenue per postpaid unit was

primarily driven by a change in our sales mix towards

higher-priced smartphones, partially offset by an increase in

commissions repaid to wireless service providers related to

customers whose wireless handsets were deactivated from

a wireless network. This deactivation took place either

because they could not afford to, or chose not to, pay the

monthly payments for wireless service associated with their

smartphones. For further discussion of our accounting for

these service deactivations, see “Critical Accounting

Policies and Estimates” later in this MD&A.

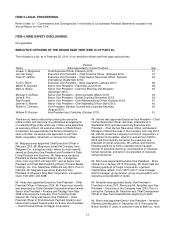

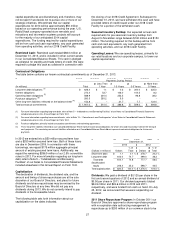

Discontinued Operations

We ceased operating all of our Target Mobile centers prior

to March 31, 2013, and since then have concluded that the

cash flows from these centers were eliminated from our

ongoing operations. Therefore, the results of these

operations, net of income taxes, have been presented as