Radio Shack 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

NOTE 4 – GOODWILL

During the fourth quarter of 2013, we conducted our annual

review of goodwill balances. Included in Other business

activities in our segment reporting we have goodwill

assigned to our Mexican subsidiary reporting unit which is

the primary component of our consolidated goodwill

balance.

In step 1 of the two-step impairment test we compared the

carrying amount, including assigned goodwill, to the fair

value of the Mexican subsidiary. We estimated fair value by

equally weighting the results from the income approach and

market approach. The significant assumptions employed in

determining fair value include, but were not limited to,

projected financial information, growth rates, terminal value,

discount rates, and multiples from publicly traded

companies that were comparable to our Mexican

subsidiary. We did a multi-year projection based upon our

normal annual planning process for the upcoming year

during the fourth quarter of 2013. Due to the less than

anticipated operating results of the Mexican subsidiary in

the fourth quarter of 2013 and a review of operations in our

normal planning process for the upcoming year, the

projected operating results of our Mexican subsidiary for

2014 were reduced and the timing of a planned expansion

was delayed to future years. The result of these actions

was a significant reduction in sales and gross profits in our

multi-year projection which was the primary factor in the

calculation that determined the fair value of the goodwill of

the Mexican subsidiary was less than the carrying amount.

As a result, step 2 of the two-step impairment test was

required in order to measure the amount of goodwill

impairment, if any.

In step 2, the fair value of the Mexican subsidiary measured

in step 1 was allocated to its assets and liabilities to

determine the implied fair value of the goodwill. This

process calculated the implied fair value of the goodwill of

the Mexican subsidiary to be $12.2 million compared to a

carrying value of the goodwill of $35.9 million. The

difference between the fair value and carrying amount of

$23.7 was recorded in the fourth quarter of 2013 in the

“Impairment of long-lived assets and goodwill” line within

our Consolidated Statements of Income.

If future actual results or performance of our Mexican

subsidiary are not consistent with our projections, estimates

and assumptions, we may incur additional goodwill

impairment charges.

For the first half of 2012, we experienced a significant

decline in the market capitalization of our common stock,

which was driven primarily by lower than expected

operating results. Our market capitalization was lower than

our consolidated net book value for much of this period. We

determined that these facts were an indicator that we

should conduct an interim goodwill impairment test in the

third quarter.

After reviewing our reporting units, we determined that the

fair value of our U.S. RadioShack company-operated stores

reporting unit could not support its $3.0 million of goodwill

due to our lower market capitalization. This resulted in a

$3.0 million impairment charge that was included in our

operating results for the third quarter of 2012. Our U.S.

RadioShack company-operated stores reporting unit is

comprised of our U.S. RadioShack company-operated

stores operating segment, our overhead and corporate

expenses that are not allocated to our operating segments,

and all of our interest expense.

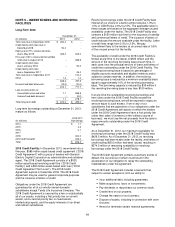

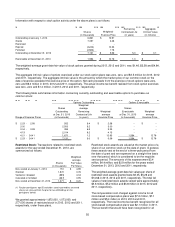

The changes in the carrying amount of goodwill by reportable segment were as follows for the years ended December 31,

2013 and 2012:

U.S.

RadioShack

(In millions) Stores

Other

(1)

Total

Balances at December 31, 2011

Goodwill $ 2.9 $ 34.1 $ 37.0

Accumulated impairment losses -- -- --

2.9 34.1 37.0

Acquisition of dealer 0.1 -- 0.1

Goodwill impairment (3.0) -- (3.0)

Foreign currency translation adjustment -- 2.5 2.5

Balances at December 31, 2012

Goodwill 3.0 36.6 39.6

Accumulated impairment losses (3.0) -- (3.0)

-- 36.6 36.6

Foreign currency translation adjustment -- (0.2) (0.2)

Goodwill impairment -- (23.7) (23.7)

Balances at December 31, 2013

Goodwill 3.0 36.4 39.4

Accumulated impairment losses (3.0) (23.7) (26.7)

$ -- $ 12.7 $ 12.7

(1) Goodwill classified as Other in the above table primarily relates to goodwill recorded on our Mexican subsidiary reporting unit.