Radio Shack 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

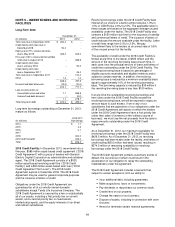

56

stock-based compensation plans for 2013 and 2012 was

$2.0 million and $2.7 million; however, such benefit was

offset by the valuation allowance against our deferred tax

assets. At December 31, 2013, there was $7.0 million of

unrecognized compensation expense related to the

unvested portion of our stock-based awards that is

expected to be recognized over a weighted-average period

of 3.61 years.

Deferred Stock Units: In 2004, the stockholders approved

the RadioShack 2004 Deferred Stock Unit Plan for Non-

Employee Directors (“Deferred Plan”), which was amended

in 2008. Under the plan, each non-employee director

received a one-time initial grant of units equal to the

number of shares of our common stock that represent a fair

market value of $150,000 on the grant date, and an annual

grant of units equal to the number of shares of our common

stock that represent a fair market value of $105,000 on the

grant date.

This plan was terminated in 2013 upon the shareholder

approval of the 2013 Omnibus Incentive Plan and no further

grants may be made under this plan. We granted

approximately 156,000, and 53,000 units in 2012 and 2011,

respectively. The weighted-average grant-date fair value

per unit granted was $5.00 and $14.80 in 2012 and 2011,

respectively. There were approximately 382,000 units

outstanding at December 31, 2013.

In 2013, under the Omnibus Incentive Plan, non–employee

directors were granted deferred stock units under the same

terms as the previous Deferred Plan as described above.

We granted approximately 230,000 units in 2013 with a

weighted average grant-date fair value per unit of $3.65.

There were approximately 202,000 units outstanding at

December 31, 2013.

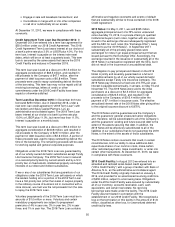

NOTE 9 – EMPLOYEE BENEFIT PLANS

The following benefit plans were in place during the periods

covered by the financial statements.

RadioShack 401(k) Plan: The RadioShack 401(k) Plan

(“401(k) Plan”), a defined contribution plan, allows a

participant to defer, by payroll deductions, from 1% to 75%

of the participant’s annual compensation, limited to certain

annual maximums set by the Internal Revenue Code. The

401(k) Plan also presently provides that our contribution to

each participant’s account maintained under the 401(k)

Plan be an amount equal to 100% of the participant’s

contributions up to 4% of the participant’s annual

compensation. This percentage contribution made by us is

discretionary and may change in the future. Our

contributions go directly to the 401(k) Plan and are made in

cash and invested according to the investment elections

made by the participant for the participant’s own

contributions. Company contributions to the 401(k) Plan

were $5.5 million, $5.7 million and $5.6 million for 2013,

2012 and 2011, respectively.

Supplemental Executive Retirement Plan: The Company

adopted an unfunded Supplemental Executive Retirement

Plan (“SERP”) effective January 1, 2006, for selected

officers of the Company. Upon retirement at age 55 years

or older, participants in the SERP are eligible to receive, for

ten years, an annual amount equal to a percentage of the

average of their five highest consecutive years of

compensation (base salary and bonus), to be paid in 120

monthly installments. The amount of the percentage

increases by 2 ½% for each year of participation in the

SERP, up to a maximum of 50%. At December 31, 2013,

there were three participants in the plan. This plan has

been closed to new officers since 2007.

The net periodic benefit cost of the SERP defined benefit

plan was $1.0 million, $1.3 million and $1.7 million for 2013,

2012 and 2011, respectively. The benefit obligation was

$13.1 million and $16.6 million at December 31, 2013 and

2012, respectively.

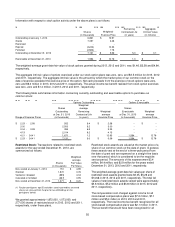

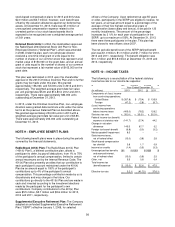

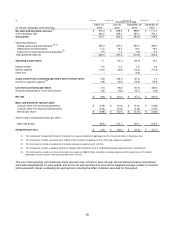

NOTE 10 – INCOME TAXES

The following is a reconciliation of the federal statutory

income tax rate to our income tax expense:

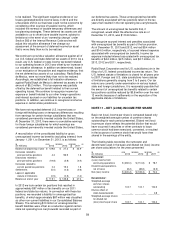

Year Ended December 31,

(In millions) 2013 2012

2011

Components of (loss) income

from continuing operations:

United States $ (357.8) $ (75.4) $ 135.9

Foreign (47.2) (2.8) (9.7)

(Loss) income from

continuing operations

before income taxes (405.0) (78.2) 126.2

Statutory tax rate x

35.0% x

35.0% x

35.0%

Federal income tax (benefit)

expense at statutory rate (141.7) (27.4) 44.2

Change in valuation

allowance 145.3 67.7 3.2

Foreign tax branch benefit (6.8) (5.0) (3.2)

Mexico goodwill impairment 8.3 -- --

State income taxes,

net of federal effect (13.0) (3.8) 2.8

Stock-based compensation

tax shortfall 3.8 1.7 0.9

Income tax credits (1.4) (0.5) (3.3)

Unrecognized tax benefits

and accrued interest,

net of indirect effect (13.0) (0.9) 2.5

Other, net 5.5 0.8 0.4

Total income tax

(benefit)expense $ (13.0) $ 32.6 $ 47.5

Effective tax rate 3.2 % (41.7)% 37.6 %