Radio Shack 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50

• Engage in sale and leaseback transactions; and

• Consolidate or merge with or into other companies

or sell all or substantially all our assets.

At December 31, 2013, we were in compliance with these

covenants.

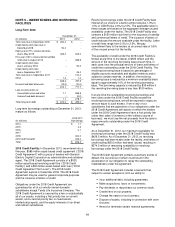

Credit Agreement Term Loan Due December 2018: In

December 2013 we entered into a term loan agreement for

$50.0 million under our 2018 Credit Agreement. The 2018

Credit Agreement Term Loan bears interest at our choice of

a bank’s prime rate plus 3.0% or LIBOR plus 4.0%. For this

term loan, interest is payable on the interest rate reset

dates, which will be on at least a quarterly basis. This term

loan is secured by the same assets that secure the 2018

Credit Facility and matures in December 2018.

This term loan was issued at a discount of $1.5 million for

aggregate consideration of $48.5 million, and resulted in

net proceeds to the Company of $47.7 million, after the

payment of debt issuance costs of $0.8 million. These

proceeds were used to repay outstanding debt at the time

of the borrowing. This term loan may not be repaid until all

revolving borrowings, letters of credit, or other

commitments under the 2018 Credit Facility have been

repaid or otherwise satisfied.

Term Loan Due December 2018: In December 2013 we

borrowed $250 million, due in December 2018, under a

new term loan credit agreement (“2018 Term Loan”) with

two lenders and Salus Capital Partners, LLC as

administrative and collateral agent. The 2018 Term Loan

bears interest at our choice of a bank’s prime rate plus

10.0% or LIBOR plus 11.0%, but never less than 11.5%.

Interest is payable on a monthly basis.

This term loan was issued at a discount of $9.2 million for

aggregate consideration of $240.8 million, and resulted in

net proceeds to the Company of $237.0 million, after the

payment of debt issuance costs of $3.8 million. A portion of

these proceeds was used to repay outstanding debt at the

time of the borrowing. The remaining proceeds will be used

for working capital and general corporate purposes.

Obligations under the 2018 Term Loan are guaranteed by

all of our wholly-owned domestic subsidiaries except Tandy

Life Insurance Company. The 2018 Term Loan is secured

on a second priority basis by current assets and by a first

priority lien on fixed assets, intellectual property and equity

interests of our direct and indirect subsidiaries.

If we or any of our subsidiaries that are guarantors of our

obligations under the 2018 Term Loan sell assets on which

the lenders holding all or a portion of the 2018 Term Loan

have a first priority lien (other than sales of surplus property

in the ordinary course of business not in connection with a

store closure), we must use the net proceeds from the sale

to repay the 2018 Term Loan.

Voluntary prepayments of the 2018 Term Loan must be in

amounts of $1.0 million or more. Voluntary and certain

mandatory prepayments are subject to prepayment

premiums of 4% in year one, 3% in year two, 2% in year

three, and 1% in year four. The 2018 Term Loan contains

affirmative and negative covenants and events of default

that are substantially similar to those contained in the 2018

Credit Agreement.

2019 Notes: On May 3, 2011, we sold $325 million

aggregate principal amount of 6.75% senior unsecured

notes due May 15, 2019, in a private offering to qualified

institutional buyers (such notes, together with any notes

issued in the exchange offer we subsequently registered

with the SEC for such notes (the “Exchange Offer”), being

referred to as the “2019 Notes”). In September 2011

substantially all of the privately placed notes were

exchanged for notes in an equal principal amount that we

issued pursuant to the Exchange Offer. Accordingly, the

exchange resulted in the issuance of substantially all of the

2019 Notes in a transaction registered with the SEC, but it

did not result in the incurrence of any additional debt.

The obligation to pay principal and interest on the 2019

Notes is jointly and severally guaranteed on a full and

unconditional basis by all of our wholly-owned domestic

subsidiaries except Tandy Life Insurance Company. The

2019 Notes pay interest at a fixed rate of 6.75% per year.

Interest is payable semiannually, in arrears, on May 15 and

November 15. The 2019 Notes were sold to the initial

purchasers at a discount of $2.5 million for aggregate

consideration of $322.5 million, and resulted in net

proceeds to the Company of $315.4 million after the

payment of $7.1 million in issuance costs. The effective

annualized interest rate of the 2019 Notes after giving effect

to the original issuance discount is 6.875%.

The 2019 Notes and the guarantees are the Company’s

and the guarantors’ general unsecured senior obligations

and, therefore, will be subordinated to all of the Company’s

and the guarantors’ existing and future secured debt to the

extent of the assets securing that debt. In addition, the

2019 Notes will be effectively subordinated to all of the

liabilities of our subsidiaries that do not guarantee the 2019

Notes, to the extent of the assets of those subsidiaries.

The 2019 Notes contain covenants that could, in certain

circumstances, limit our ability to issue additional debt,

repurchase shares of our common stock, make certain

other restricted payments, make investments, or enter into

certain other transactions. At December 31, 2013, we were

in compliance with these covenants.

2016 Credit Facility: In August 2012 we entered into an

amended and restated asset-based credit agreement

(“2016 Credit Facility”) with a group of lenders with Bank of

America, N.A., as the administrative and collateral agent.

The 2016 Credit Facility originally matured on January 4,

2016, and provided for an asset-based revolving credit line

of $450 million, subject to a borrowing base. Obligations

under the 2016 Credit Facility were secured by substantially

all of our inventory, accounts receivable, cash, cash

equivalents, and certain real estate. No revolving

borrowings were made under the facility. The 2016 Credit

Facility was terminated in connection with the

establishment of our 2018 Credit Facility. We recognized a

loss on the termination of this facility in the amount of $1.8

million, classified as other loss, for unamortized deferred

credit facility fees.