Radio Shack 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

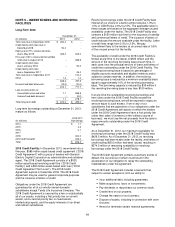

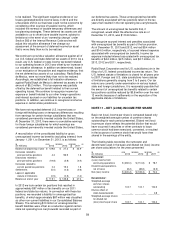

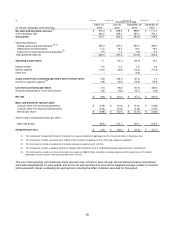

The components of income tax expense (benefit) were as

follows:

Year Ended December 31,

(In millions) 2013 2012

2011

Current:

Federal $ (15.4) $

(37.8)

$ 20.9

State (2.4)

(2.1)

5.5

Foreign 0.9 2.6

2.0

(16.9)

(37.3)

28.4

Deferred:

Federal 1.3 57.2

16.7

State -- 13.5

1.6

Foreign 2.6

(0.8)

0.8

3.9 69.9

19.1

Total income tax

(benefit)expense $ (13.0) $ 32.6

$ 47.5

The income tax benefit recognized in 2013 primarily relates

to the effective settlement of certain federal and state

income tax matters resulting in the recognition of previously

unrecognized tax benefits and the reversal of interest

accrued thereon. In 2012 we recognized an income tax

benefit with respect to our U.S. operating losses and losses

generated in certain state jurisdictions because we were

able to carry back those losses and offset prior year taxable

income.

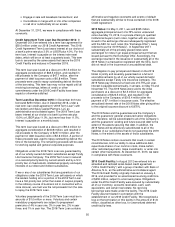

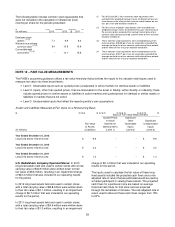

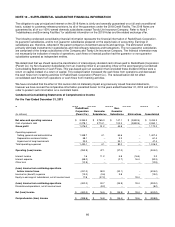

The significant components of deferred income tax assets

and liabilities were as follows:

December 31,

(In millions) 2013 2012

Deferred tax assets:

Federal net operating loss

$

132.0

$ --

Inventory valuation adjustments 19.7

15.9

Insurance reserves 15.7

14.4

Reserve for estimated

wireless service deactivations 2.8

14.1

Deferred revenue 4.5

13.4

Foreign branch net

operating losses 18.3

12.1

Indirect effect of unrecognized

tax benefits 7.9

11.6

Deferred compensation 9.1

10.1

Stock-based compensation 4.7

8.0

Accrued average rent 7.0

7.6

State net operating loss, net

of federal benefit 21.0

5.8

Other 16.6

15.0

Gross deferred tax assets 259.3

128.0

Valuation allowance (228.8)

(80.9)

Total deferred tax assets 30.5

47.1

Deferred tax liabilities:

Depreciation and amortization 13.5

29.7

Deferred taxes on foreign operations 3.9

4.0

Other 14.3

10.7

Total deferred tax liabilities 31.7

44.4

Net deferred tax (liabilities) assets

$

(1.2)

$ 2.7

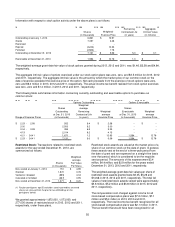

Deferred tax assets and liabilities were included in the

Consolidated Balance Sheets as follows:

December 31,

(In millions) 2013 2012

Other current assets $ --

$ 23.9

Other non-current assets 0.1

--

Other current liabilities (1.3)

--

Other non-current liabilities --

(21.2)

Net deferred tax assets $ (1.2)

$ 2.7

We had deferred tax assets associated with our federal net

operating losses, which will expire in 2033, of $132 million

as of December 31, 2013. Net operating losses generated

in 2011 and 2012 were carried back to offset prior year

taxable income. Deferred tax assets associated with U.S.

general business credits, which expire on various dates

between 2031 and 2033, were $2.8 million and $2.4 million

as of December 31, 2013 and 2012, respectively.

In addition, we had deferred tax assets associated with

state net operating loss carryforwards of $32.3 million, net

of $11.3 million federal benefit, and $9.0 million, net of $3.2

million federal benefit, as of December 31, 2013 and 2012,

respectively. The related state net operating losses expire

at various dates between 2016 and 2033. At December 31,

2013 and 2012, deferred tax assets associated with the net

operating losses of our foreign branches were $18.3 million

and $12.1 million, respectively. The net operating losses of

our foreign branches will expire on various dates between

2016 and 2033.

Our federal and certain state net operating losses and

federal general business credit carryforwards may be

subject to limitations under Section 382 of the Internal

Revenue Code if significant ownership changes occur.

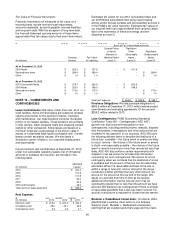

A reconciliation of the consolidated valuation allowance for

deferred tax assets from January 1, 2011, to December 31,

2013, is as follows:

(In millions) 2013 2012

2011

Balance at beginning of year $ 80.9

$

7.1

$

3.9

Additions, charged to

expense 145.3 67.7

3.2

Additions, charged to

discontinued operations 2.9 6.1

Deductions (0.3) --

--

Balance at end of year $ 228.8

$

80.9

$

7.1

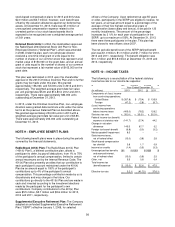

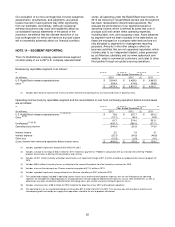

We are required to assess the available positive and

negative evidence to estimate if sufficient income will be

generated to utilize deferred tax assets. A significant piece

of negative evidence that we consider is cumulative losses

(generally defined as losses before income taxes) incurred

over the most recent three-year period. Such evidence

limits our ability to consider other subjective evidence such

as our projections for future growth. At December 31, 2013,

domestic cumulative losses were incurred over the

applicable three-year period.

In 2012 we established a valuation allowance of $68.8

million with respect to our U.S. federal deferred tax assets

and state deferred tax assets of which $6.1 million was

charged to discontinued operations. We considered all

available positive and negative evidence in evaluating

whether these deferred tax assets were more likely than not