Radio Shack 2013 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2013 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

capital expenditures are discretionary and, therefore, may

not be spent if we decide not to pursue one or more of our

strategic initiatives. We estimate that our capital

expenditures for 2014 will be approximately $50 million

based on our operating performance during the year. U.S.

RadioShack company-operated store remodels and

relocations and information systems projects will account

for the majority of our anticipated 2014 capital

expenditures. The funding required for capital expenditures

will be from cash and cash equivalents, any cash generated

from operating activities, and our 2018 Credit Facility.

Restricted Cash: Restricted cash totaled $66.0 million at

December 31, 2013, and is included in other current assets

in our Consolidated Balance Sheets. This cash is pledged

as collateral for standby and trade letters of credit. We were

required to pledge this cash as collateral in connection with

the closing of our 2018 Credit Agreement. Subsequent to

December 31, 2013, we have withdrawn this cash and have

provided letters of credit issued under our 2018 Credit

Facility for a portion of the withdrawn cash.

Seasonal Inventory Buildup: Our expected annual cash

requirements for pre-seasonal inventory buildup from

August to November range between $100 million and $150

million. The funding required for this buildup will be from

cash and cash equivalents, any cash generated from

operating activities, and our 2018 Credit Facility.

Operating Leases: We use operating leases, primarily for

our retail locations and our corporate campus, to lower our

capital requirements.

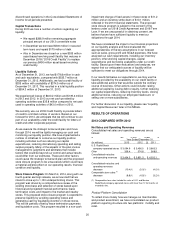

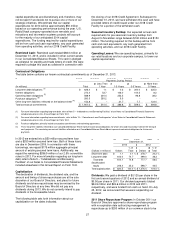

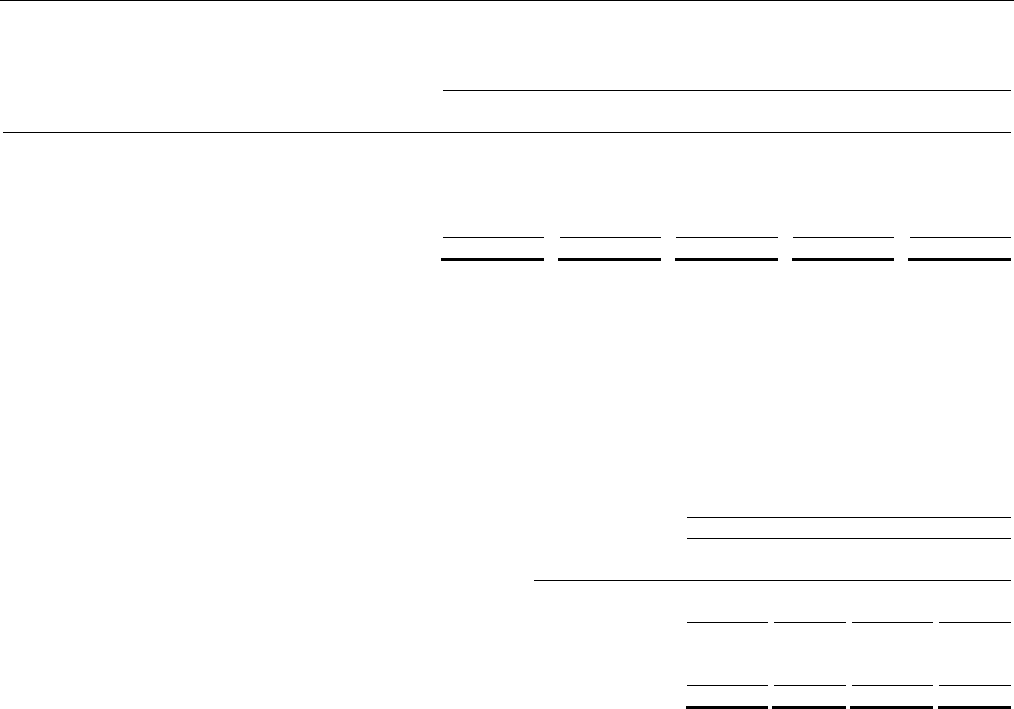

Contractual Obligations

The table below contains our known contractual commitments as of December 31, 2013.

Payments Due by Period

Less Than

More than

(In millions) Total

1 Year

1-3 Years

3-5 Years

5 Years

Long

-

term debt obligations

(1)

$

626.4

$ 1.1 $ 0.3 $ 300.0

$ 325.0

Interest obligations

272.4

53.7 106.0 104.5

8.2

Operating lease obligations

(2)

588.9

200.4 253.5 96.8

38.2

Purchase obligations

(3)

260.5

255.2 5.3 --

--

Other long

-

term liabilities reflected on the balance sheet

(4)

152.8

-- 21.7 7.7

123.4

Total contractual commitments $

1,901.0

$ 510.4 $ 386.8 $ 509.0

$ 494.8

(1) For more information regarding long-term debt, refer to Note 5 – “Indebtedness and Borrowing Facilities” of our Notes to Consolidated Financial Statements

included elsewhere in this Annual Report on Form 10-K.

(2) For more information regarding lease commitments, refer to Note 13 – “Commitments and Contingencies” of our Notes to Consolidated Financial Statements

included elsewhere in this Annual Report on Form 10-K.

(3) Purchase obligations primarily include our product commitments and marketing agreements.

(4) These long-term liabilities reflected on our Consolidated Balance Sheet represent contractual obligations for which we could reasonably estimate the timing of

cash payments. The remaining non-current liabilities reflected on our Consolidated Balance Sheet did not represent contractual obligations for future cash

payments.

In 2013 we entered into a $50 million secured term loan

and a $250 million secured term loan. Both of these loans

are due in December 2018. In connection with these

borrowings, we repaid $175 million aggregate principal

amount of existing secured term loans. Additionally, we

repaid the remaining $286.9 million of our 2.5% convertible

notes in 2013. For more information regarding our long-term

debt, refer to Note 5 – “Indebtedness and Borrowing

Facilities” of our Notes to Consolidated Financial Statements

included elsewhere in this Annual Report on Form 10-K.

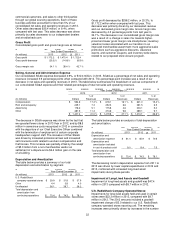

Capitalization

The declaration of dividends, the dividend rate, and the

amount and timing of share repurchases are at the sole

discretion of our Board of Directors, and plans for future

dividends and share repurchases may be revised by the

Board of Directors at any time. We did not pay any

dividends during 2013. We do not currently intend to pay

dividends in the foreseeable future.

The following table sets forth information about our

capitalization on the dates indicated.

December 31,

2013

2012

% of

% of

(Dollars in millions) Dollars

Total

Dollars

Total

Short-term debt

$

1.1

0.1 %

$ 278.7

20.2 %

Long-term debt 613.0

74.7

499.0

36.3

Total debt 614.1

74.8

777.7

56.5

Stockholders'

equity 206.4

25.2

598.7

43.5

Total capitalization

$

820.5

100.0 %

$ 1,376.4

100.0 %

Dividends: We paid a dividend of $0.125 per share in the

first and second quarters of 2012 and an annual dividend of

$0.50 per share in 2011. Our dividend payments totaled

$24.9 million and $49.6 million in 2012 and 2011,

respectively, and were funded from cash on hand. On July

25, 2012, we announced that we were suspending our

dividend.

2011 Share Repurchase Program: In October 2011 our

Board of Directors approved a share repurchase program

with no expiration date authorizing management to

repurchase up to $200 million of our common stock to be