Radio Shack 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

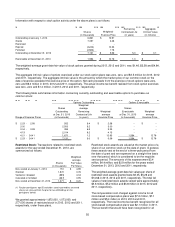

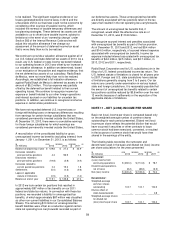

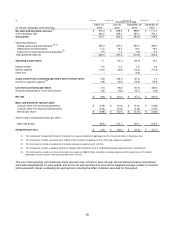

The following table includes common stock equivalents that

were not included in the calculation of diluted net (loss)

income per share for the periods presented:

(In millions) 2013 2012

2011

Employee stock

options

(1) (2)

7.1 6.9 6.3

Warrants to purchase

common stock

(1) (3)

8.4 15.8 15.8

Convertible debt

instruments

(1) (4)

-- 12.1 15.8

(1) For 2013 and 2012, these common stock equivalents were

excluded from weighted-average shares for diluted net loss per

share because the effect of their inclusion would reduce our net

loss per share and would be antidilutive.

(2) For 2011 these employee stock options were excluded from

weighted-average shares for diluted net loss per share because

the exercise prices exceeded the average market price of our

common stock during the period, and the effect of their inclusion

would be antidilutive.

(3) These common stock equivalents were excluded because the

exercise prices ($35.88 per share for all periods) exceeded the

average market price of our common stock during these periods,

and the effect of their inclusion would be antidilutive.

(4) These common stock equivalents were excluded because the

exercise prices ($23.77 per share for all periods) exceeded the

average market price of our common stock during these periods,

and the effect of their inclusion would be antidilutive.

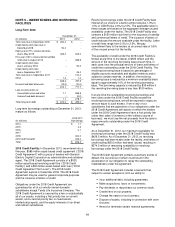

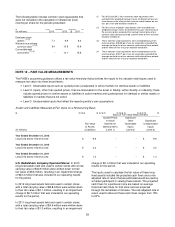

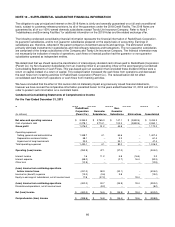

NOTE 12 – FAIR VALUE MEASUREMENTS

The FASB’s accounting guidance utilizes a fair value hierarchy that prioritizes the inputs to the valuation techniques used to

measure fair value into three broad levels:

• Level 1: Observable inputs such as quoted prices (unadjusted) in active markets for identical assets or liabilities

• Level 2: Inputs, other than quoted prices, that are observable for the asset or liability, either directly or indirectly; these

include quoted prices for similar assets or liabilities in active markets and quoted prices for identical or similar assets or

liabilities in markets that are not active

• Level 3: Unobservable inputs that reflect the reporting entity’s own assumptions

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

Basis of Fair Value Measurements

Quoted Prices Significant

in Active Other Significant

Fair Value Markets for Observable Unobservable

of Assets Identical Items Inputs Inputs

(In millions) (Liabilities) (Level 1) (Level 2) (Level 3)

Year Ended December 31, 2013

Long-lived assets held and used $ 9.6

--

-- $ 9.6

Year Ended December 31, 2012

Long-lived assets held and used $ 3.2

--

-- $ 3.2

Year Ended December 31, 2011

Long-lived assets held and used $ 1.3

--

-- $ 1.3

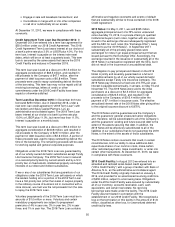

U.S. RadioShack Company-Operated Stores: In 2013

long-lived assets held and used in certain stores with a total

carrying value of $32.9 million were written down to their

fair value of $9.6 million, resulting in an impairment charge

of $23.3 million that was included in our operating results

for the period.

In 2012 long-lived assets held and used in certain stores

with a total carrying value of $8.8 million were written down

to their fair value of $2.1 million, resulting in an impairment

charge of $6.7 million that was included in our operating

results for the period.

In 2011 long-lived assets held and used in certain stores

with a total carrying value of $4.4 million were written down

to their fair value of $1.3 million, resulting in an impairment

charge of $3.1 million that was included in our operating

results for the period.

The inputs used to calculate the fair value of these long-

lived assets included the projected cash flows and a risk-

adjusted rate of return that we estimated would be used by

a market participant in valuing these assets. The projected

cash flows for a particular store are based on average

historical cash flows for that store and are projected

through the remainder of its lease. The risk-adjusted rate of

return used to discount these cash flows ranges from 15%

to 20%.