Radio Shack 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

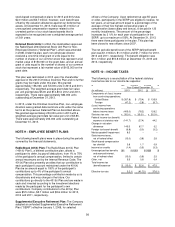

58

to be realized. The significant negative evidence of our

losses generated before income taxes in 2012 and the

unfavorable shift in our business could not be overcome by

considering other sources of taxable income, which

included the reversal of taxable temporary differences and

tax-planning strategies. These deferred tax assets are still

available to us to offset future taxable income, subject to

limitations in the event of an “ownership change” under

Section 382 of the Internal Revenue Code and we will

adjust this valuation allowance if we change our

assessment of the amount of deferred income tax asset

that is more likely than not to be realized.

We continue to provide a valuation allowance against all of

our U.S. federal and state deferred tax assets in 2013. As a

result, any U.S. federal or state income tax benefit related

to our operating losses in 2013 was offset by an increase in

our valuation allowance. In addition we determined, based

on an evaluation of the positive and negative evidence, that

the net deferred tax assets of our subsidiary, RadioShack

de Mexico, were not more likely than not to be realized.

Accordingly, we established a full valuation allowance

against RadioShack de Mexico’s deferred tax assets in the

amount of $5.2 million. This tax expense was partially

offset by the deferred tax benefit related to their current

operating losses. We continue to recognize income tax

expense or benefit related to our other foreign operations

and interest accrued on our liabilities for uncertain tax

positions. In addition, we continue to recognize income tax

expense in certain state jurisdictions.

We have not recorded deferred U.S. income taxes or

foreign withholding taxes on temporary differences resulting

from earnings for certain foreign subsidiaries that are

considered permanently invested outside the United States.

At December 31, 2013, there were no cumulative earnings

for those foreign subsidiaries for which earnings are

considered permanently invested outside the United States.

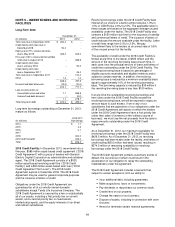

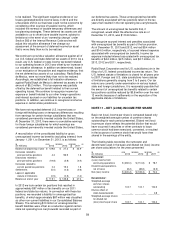

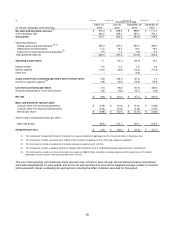

A reconciliation of the consolidated liability for gross

unrecognized income tax benefits (excluding interest) from

January 1, 2011, to December 31, 2013, is as follows:

(In millions) 2013 2012

2011

Balance at beginning of year $ 139.8 $ 27.3

$

25.9

Increases related to

prior period tax positions 4.3 96.9 1.8

Decreases related to

prior period tax positions (19.8) (2.9) (0.4)

Increases related to

current period tax positions 0.3 19.3 1.8

Settlements (5.0) (0.3) (0.6)

Lapse in applicable

statute of limitations (0.5) (0.5) (1.2)

Balance at end of year $ 119.1 $ 139.8

$

27.3

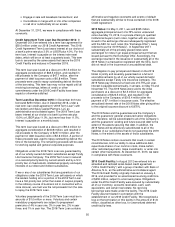

In 2012 we took certain tax positions that resulted in

approximately $97 million of tax benefits on our 2011

federal and state tax returns. In connection with these tax

positions, we recorded a liability for unrecognized tax

benefits, of which approximately $87 million was classified

as other non-current liabilities in our Consolidated Balance

Sheets. The remaining $10 million of unrecognized tax

benefit liabilities were offset as a reduction against certain

state net operating loss carryforwards recorded as part of

our deferred tax assets. These unrecognized tax benefits

are directly associated with tax positions taken in the tax

years that resulted in the net operating loss carryforwards.

The amount of unrecognized tax benefits that, if

recognized, would affect the effective tax rate as of

December 31, 2013, was $113.8 million.

We recognize accrued interest and penalties associated

with unrecognized tax benefits as part of the tax provision.

As of December 31, 2013 and 2012, we had $9.4 million

and $14.0 million, respectively, of accrued interest expense

associated with unrecognized tax benefits. Income tax

expense included interest associated with unrecognized tax

benefits of $4.2 million, $2.5 million, and $2.7 million, in

2013, 2012 and 2011, respectively.

RadioShack Corporation and its U.S. subsidiaries join in the

filing of a U.S. federal consolidated income tax return. The

U.S. federal statute of limitations is closed for all years prior

to 2007. Foreign and U.S. state jurisdictions have statutes

of limitations generally ranging from 3 to 5 years. Our tax

returns are currently under examination in various federal,

state and foreign jurisdictions. It is reasonably possible that

the amount of unrecognized tax benefits related to certain

tax positions could be reduced by $0.8 million over the next

12 months because of settlements or the expiration of the

applicable statute of limitations.

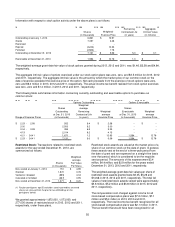

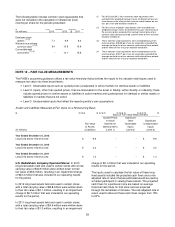

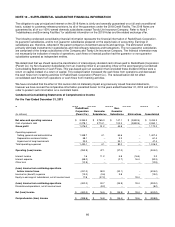

NOTE 11 – NET (LOSS) INCOME PER SHARE

Basic net (loss) income per share is computed based only

on the weighted-average number of common shares

outstanding for each period presented. Diluted net (loss)

income per share reflects the potential dilution that would

have occurred if securities or other contracts to issue

common stock had been exercised, converted, or resulted

in the issuance of common stock that would have then

shared in the earnings of the entity.

The following table reconciles the numerator and

denominator used in the basic and diluted net (loss) income

per share calculations for the years presented:

(In millions) 2013 2012

2011

Numerator:

(Loss) income from

continuing operations $ (392.0)

$

(110.8)

$

78.7

Discontinued operations,

net of taxes (8.2) (28.6)

(6.5)

Net (loss) income $ (400.2)

$

(139.4)

$

72.2

Denominator:

Weighted-average

common shares

outstanding 100.7 100.1

102.5

Dilutive effect of

stock-based awards -- --

0.8

Weighted-average shares

for diluted net

(loss) income per share 100.7 100.1

103.3