Radio Shack 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

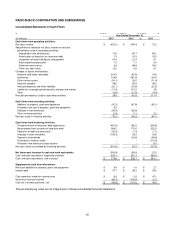

49

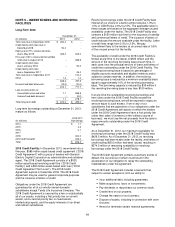

NOTE 5 – INDEBTEDNESS AND BORROWING

FACILITIES

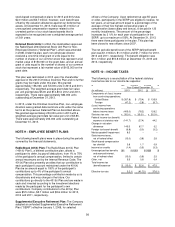

Long-Term Debt:

December 31,

(In millions) 2013 2012

Term loan due in December 2018

$

250.0

$ --

Credit facility term loan due in

December 2018 50.0

--

Eight year 6.75% unsecured notes

due in May 2019 325.0

325.0

Five year 2.50% unsecured convertible

notes due in August 2013 --

286.9

Credit facility term loan

due in January 2016 --

50.0

Credit facility term loan

due in September 2017 --

25.0

Term loan due in September 2017 --

100.0

Other 1.4

1.0

626.4

787.9

Unamortized debt discounts (12.3)

(10.2)

614.1

777.7

Less current portion of:

Convertible notes and other 1.1

286.9

Unamortized debt discount --

(8.2)

1.1

278.7

Total long-term debt

$

613.0

$ 499.0

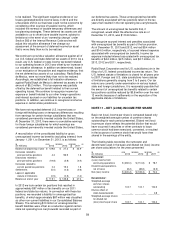

Long-term borrowings outstanding at December 31, 2013,

mature as follows:

Long-term

(In millions)

Borrowings

2014 $ 1.1

2015 0.2

2016 0.1

2017 --

2018 300.0

2019 and thereafter 325.0

Total $ 626.4

2018 Credit Facility: In December 2013, we entered into a

five-year, $585 million asset-based credit agreement (“2018

Credit Agreement”) with a group of lenders with General

Electric Capital Corporation as administrative and collateral

agent. The 2018 Credit Agreement consists of a $535

million asset-based revolving credit line (“2018 Credit

Facility”) and a $50 million asset-based term loan (“2018

Credit Agreement Term Loan”). The 2018 Credit

Agreement expires in December 2018. The 2018 Credit

Agreement may be used for general corporate purposes

and the issuance of letters of credit.

Obligations under the 2018 Credit Agreement are

guaranteed by all of our wholly-owned domestic

subsidiaries except Tandy Life Insurance Company. The

2018 Credit Agreement is secured by a lien on substantially

all of our assets, including a first priority lien on current

assets, and a second priority lien on fixed assets,

intellectual property, and the equity interests of our direct

and indirect subsidiaries.

Revolving borrowings under the 2018 Credit Facility bear

interest at our choice of a bank’s prime rate plus 1.0% to

1.5% or LIBOR plus 2.0% to 2.5%. The applicable rates in

these ranges are based on the aggregate average unused

availability under the facility. The 2018 Credit Facility also

contains a $150 million sub-limit for the issuance of standby

and commercial letters of credit. The issuance of letters of

credit reduces the amount available under the facility. Letter

of credit fees range from 2.0% to 2.5%. We pay

commitment fees to the lenders at an annual rate of 0.5%

of the unused amount of the facility.

The availability of credit under the 2018 Credit Facility is

limited at any time to the lesser of $535 million and the

amount of the revolving borrowing base at such time, in

each case, less the principal amount of loans and letters of

credit then-outstanding under the 2018 Credit Facility. The

revolving borrowing base is based on percentages of

eligible accounts receivable and eligible inventory and is

subject to certain reserves. In addition, the revolving

borrowing base is reduced by a minimum availability block

equal to approximately 10% of the revolving borrowing

base. The borrowing capacity is reduced by $35 million if

the revolving borrowing base is less than $150 million.

If at any time the outstanding revolving borrowings and

term loans under the 2018 Credit Facility exceed the

revolving borrowing base, we will be required to repay an

amount equal to such excess. If we or any of our

subsidiaries that are guarantors of our obligations under the

2018 Credit Agreement sell assets on which the lenders

under the 2018 Credit Agreement have a first priority lien

(other than sales of inventory in the ordinary course of

business), we must use the net proceeds from the sale to

repay amounts outstanding under the 2018 Credit

Agreement.

As of December 31, 2013, our maximum availability for

revolving borrowings under the 2018 Credit Facility was

$429.5 million. As of December 31, 2013, no revolving

borrowings had been made under the facility, and letters of

credit totaling $55.0 million had been issued, resulting in

$374.5 million of remaining availability for revolving

borrowings under the 2018 Credit Facility.

The 2018 Credit Agreement contains customary events of

default, the occurrence of which could result in the

acceleration of our obligation to repay the outstanding

indebtedness under the agreement.

The 2018 Credit Agreement includes covenants that,

subject to certain exceptions, limit our ability to:

• Incur additional debt, including guarantees;

• Make acquisitions, loans or investments;

• Pay dividends or repurchase our common stock;

• Create liens on our property;

• Change the nature of our business;

• Dispose of assets, including in connection with store

closures;

• Amend or terminate certain material agreements;