Radio Shack 2013 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2013 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

These platforms include the following product categories:

Mobility: The mobility platform includes postpaid and

prepaid wireless handsets, commissions, residual income,

prepaid wireless airtime, e-readers, and tablet devices. Our

wireless accessories and tablet accessories, which were

previously included in our signature platform, are now also

included in this platform.

Retail: Our retail platform includes our remaining

consumer electronics product categories and related

accessories; batteries and power products; and technical

products. This platform now also consists of products that

were previously included in our signature and consumer

electronics platforms, except wireless accessories and

tablet accessories, which are now included in the mobility

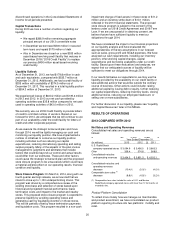

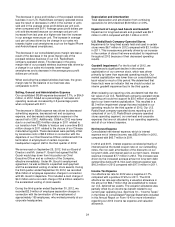

platform. The following table provides a summary of our

consolidated net sales and operating revenues by platform

and as a percent of net sales and operating revenues. Prior

period amounts have been reclassified to conform to our

current presentation.

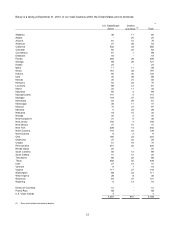

Consolidated Net Sales and Operating Revenues

Year Ended December 31,

(In millions) 2013 2012 2011

Mobility

(1)

$ 1,799.7 52.4 % $ 2,008.6 52.4

% $ 2,014.8 50.0

%

Retail 1,612.2 46.9 1,794.0 46.8

1,992.1 49.4

Other sales

(2)

22.4 0.7 28.7 0.8

25.2 0.6

Consolidated net sales and operating revenues $ 3,434.3 100.0 % $ 3,831.3 100.0

% $ 4,032.1 100.0

%

(1) The aggregate amounts of upfront commission revenue and residual income received from wireless service providers and recorded in this platform were

$851.1 million, $1,029.6 million and $1,233.1 million for 2013, 2012 and 2011, respectively.

(2) Other sales include outside sales from repair services and outside sales of our global sourcing operations and domestic and overseas manufacturing

facilities. We closed our overseas manufacturing facility in June 2011.

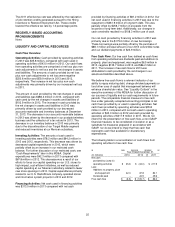

U.S. RadioShack Company-Operated Stores Segment

The following table provides a summary of our net sales and operating revenues by platform and as a percent of net sales and

operating revenues for the U.S. RadioShack company-operated stores segment.

U.S. RadioShack Company-Operated Stores Segment

Net Sales and Operating Revenues

Year Ended December 31,

(In millions) 2013 2012 2011

Mobility $ 1,706.2 55.1 % $ 1,923.0 55.6

% $ 1,935.3 52.8

%

Retail 1,388.7 44.9 1,533.5 44.4

1,728.0 47.2

Net sales and operating revenues $ 3,094.9 100.0 % $ 3,456.5 100.0

% $ 3,663.3 100.0

%

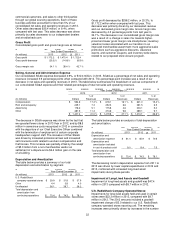

Sales in our U.S. RadioShack company-operated stores

segment decreased $361.6 million or 10.5% in 2013. These

decreases in sales were driven by decreased sales in our

mobility and retail platforms. Additionally, we operated 98

fewer stores at December 31, 2013, than we did at

December 31, 2012, which contributed to a decrease in

consolidated sales and affected the sales results for each

platform discussed below.

Sales in our mobility platform (which includes postpaid and

prepaid wireless handsets, commissions and residual

income, prepaid wireless airtime, e-readers, tablet devices,

wireless accessories, and tablet accessories) decreased

11.3% in 2013. This decrease in sales was primarily driven

by decreased sales in our postpaid wireless business,

which were partially offset by increased sales in our prepaid

wireless business. Comparable store sales in this platform

decreased 9.0% in 2013.

The sales decrease in our postpaid wireless business was

driven by a decrease in the number of postpaid units sold,

which was partially offset by an increase in the average

revenue per unit sold. The decrease in the number of

postpaid wireless handsets sold was primarily driven by

decreased unit sales in our postpaid wireless business.

The increase in the average revenue per postpaid unit was

primarily driven by a change in our sales mix towards

higher-priced smartphones, which was partially offset by an

increase in commissions repaid to wireless service

providers related to wireless handset deactivations. See the

executive summary of this MD&A for further discussion of

these wireless handset deactivations.

Sales in our retail platform (which includes our remaining

consumer electronics product categories and related

accessories; batteries and power products; and technical

products) decreased 9.4% in 2013. This sales decrease

was primarily driven by decreased sales of laptop

computers, batteries, internet telephone devices, home

entertainment accessories, digital music players,

headphones, and GPS devices. These sales decreases

were partially offset by increased sales of portable

speakers and sales of Apple Lightning compatible cables

and adaptors. Comparable store sales in this platform

decreased 8.5% in 2013.

Other Sales

Amounts in other sales reflect our business activities that

are not separately reportable, including sales to our

independent dealers, sales generated by our Mexican

subsidiary and our www.radioshack.com website, sales to