Radio Shack 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

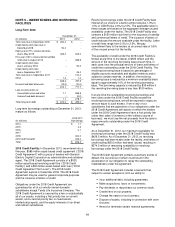

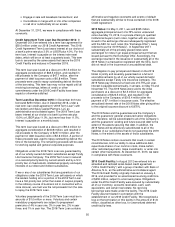

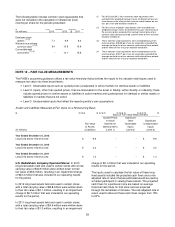

Accumulated Other Comprehensive Loss: The components of accumulated other comprehensive loss were as follows at

December 31, 2013, 2012 and 2011:

Foreign

Currency

Pension

(In millions) Translation Adjustments

Total

Balances at December 31, 2011 $ (11.3) $ (0.6) $ (11.9)

Foreign currency translation adjustments 4.1 -- 4.1

Defined benefit pension plan adjustments -- 0.3 0.3

Balances at December 31, 2012 (7.2) (0.3) (7.5)

Foreign currency translation adjustments 0.6 -- 0.6

Defined benefit pension plan adjustments -- 0.8 0.8

Balances at December 31, 2013 $ (6.6) $ 0.5 $ (6.1)

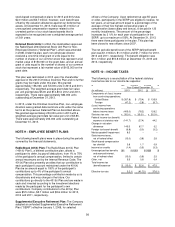

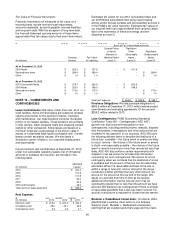

NOTE 7 – SEVERANCE COSTS AND EXIT

ACTIVITIES

Executive Severance: We announced on September 25,

2012, that our Board of Directors and Mr. James F. Gooch

had agreed that Mr. Gooch would step down from his

position as Chief Executive Officer and as a director of the

Company, effective immediately. Under Mr. Gooch’s

employment agreement, he was entitled to a specified cash

payment and the accelerated vesting of certain stock

awards. During the third quarter ended September 30,

2012, we recorded $5.6 million of employee separation

charges classified as selling, general and administrative

expense in connection with Mr. Gooch’s departure. This

included a cash charge of $4.0 million that was paid in the

fourth quarter of 2012 and a non-cash charge of $1.6

million related to the accelerated vesting of stock awards.

Headcount Reduction: During the third quarter ended

September 30, 2012, we recorded $2.9 million of employee

separation charges classified as selling, general and

administrative expense in connection with the termination of

the employment of approximately 150 employees, who

worked primarily at our corporate headquarters.

Plant Closure: During the second quarter of 2011, we

ceased production operations in our Chinese manufacturing

plant. Since production operations ceased, we have

continued to acquire inventory similar to that previously

produced by this facility from alternative product sourcing

channels. In conjunction with the plant closing, we incurred

total costs of $11.4 million in 2011. We incurred $7.7 million

in compensation expense for severance packages for the

termination of the employment of approximately 1,500

employees. We recorded a foreign currency exchange loss

of $1.5 million related to the reversal of our foreign currency

cumulative translation adjustment, which is classified as a

selling, general and administrative expense. The remaining

$2.2 million related to an inventory valuation loss,

accelerated depreciation, and other general and

administrative costs. Substantially all of these costs were

incurred in the second quarter of 2011.

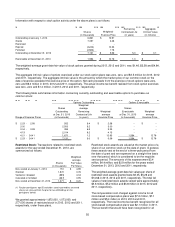

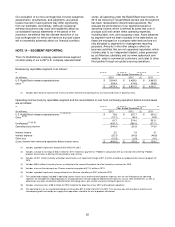

NOTE 8 – STOCK-BASED INCENTIVE PLANS

We have implemented several plans to award employees

with stock-based compensation, which are described

below.

Incentive Plans: Under the Incentive Stock Plans (“ISPs”)

and 2013 Omnibus Incentive Plan described below, the

exercise price of options must be equal to or greater than

the fair market value of a share of our common stock on the

date of grant. The Management Development and

Compensation Committee of our Board of Directors

(“MD&C”) specifies the terms for grants of options under

these plans; terms of these options may not exceed ten

years. Grants of options generally vest over three years

and grants typically have a term of seven or ten years.

Option agreements issued under these plans generally

provide that, in the event of a change in control, all options

become immediately and fully exercisable. Repricing or

exchanging options for lower priced options is not permitted

under the plans without shareholder approval. A brief

description of each of our incentive plans with awards still

outstanding is included below:

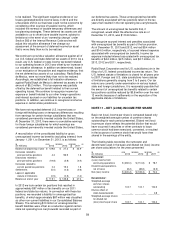

1997 Incentive Stock Plan (“1997 ISP”): The 1997

ISP permitted the grant of up to 11.0 million shares in

the form of incentive stock options (“ISOs”), non-

qualified stock options (options which are not ISOs)

(“NQs”) and restricted stock. The 1997 ISP expired on

February 27, 2007, and no further grants may be made

under this plan. At December 31, 2013, zero stock

options were outstanding under this plan.

1999 Incentive Stock Plan (“1999 ISP”): The 1999

ISP permitted the grant of up to 9.5 million shares in

the form of NQs. Grants of restricted stock,

performance awards and options intended to qualify as

ISO’s under the Internal Revenue Code were not

authorized under this plan. The 1999 ISP also

permitted directors to elect to receive shares in lieu of

cash payments for their annual retainer fees and board

and committee meeting fees. The 1999 ISP expired on

February 23, 2009, and no further grants may be made