Radio Shack 2013 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2013 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

discontinued operations in the Consolidated Statements of

Income for all periods presented.

Capital Transactions

During 2013 we took a number of actions regarding our

liquidity:

• We repaid $286.9 million remaining aggregate

principal amount of our 2013 convertible notes

• In December we borrowed $300 million in secured

term loans and repaid $175 million of debt

• Also in December we closed on a new $535 million

asset-based revolving credit facility that matures in

December 2018 (“2018 Credit Facility”) to replace

our previous $450 million asset-based revolving

credit facility

Liquidity Outlook

As of December 31, 2013, we had $179.8 million in cash

and cash equivalents, compared with $535.7 million at

December 31, 2012. Additionally, we had a credit facility of

$535 million with availability of $374.5 million as of

December 31, 2013. This resulted in a total liquidity position

of $554.3 million at December 31, 2013.

We experienced losses of $400.2 million and $139.4 million

in 2013 and 2012. In 2013 our net cash provided by

operating activities was $35.8 million compared to net cash

used in operating activities of $43.0 million in 2012.

We currently use our 2018 Credit Facility to provide letters

of credit to a limited number of vendors. Based on our

forecast for 2014, we anticipate that we will continue to use

part of our availability under the credit facility for letters of

credit and other corporate purposes.

As we execute the strategic turnaround plan and move

through 2014, we will be tightly managing our cash and

monitoring our liquidity position. We have implemented a

number of initiatives to conserve our liquidity position

including activities such as reducing our capital

expenditures, reducing discretionary spending and selling

surplus property. Many of the aspects of the plan involve

management’s judgments and estimates that include

factors that could be beyond our control and actual results

could differ from our estimates. These and other factors

could cause the strategic turnaround plan and the proposed

store closure program to be unsuccessful which could have

a material adverse effect on our operating results, financial

condition and liquidity.

Store Closure Program: On March 4, 2014, along with our

fourth quarter earnings release, we announced that we

intend to close up to 1,100 underperforming stores. This

program was driven by a comprehensive review of the

existing store base and selection of stores based upon

historical and projected financial performance, lease

termination costs, and impact to the market and nearby

stores. This proposed store closure program is expected to

preserve liquidity by avoiding operating losses and

generating cash by liquidating inventory in those stores.

This will be partially offset by lease termination payments

and liquidation costs. This program resulted in a non-cash

impairment charge of fixed assets in these stores of $11.2

million and an inventory write down of $10.1 million,

reflected in the 2013 financial statements. The proposed

store closure program is subject to the consent of the

lenders under our 2018 Credit Agreement and 2018 Term

Loan. If we are unsuccessful in obtaining consent, we

believe that we have sufficient liquidity to meet our

obligations through 2014.

We have considered the impact of our financial projections

on our liquidity analysis and have evaluated the

appropriateness of the key assumptions in our forecast

such as sales, gross profit and SG&A expenses. We have

analyzed our cash requirements, including our inventory

position, other working capital changes, capital

expenditures and borrowing availability under our credit

facility. Based upon these evaluations and analyses, we

expect that our anticipated sources of liquidity will be

sufficient to meet our obligations through 2014.

If our results fall below our expectations, we may use the

liquidity provided by the availability on our credit facility or

take additional actions that would be outside the ordinary

course of business. Other actions could include: raising

additional capital by issuing debt or equity, further reducing

our capital expenditures, reducing inventory levels, closing

additional stores, reducing our employee headcount, or

selling one or more subsidiaries.

For further discussion of our liquidity, please see “Liquidity

and Capital Resources” later in this MD&A.

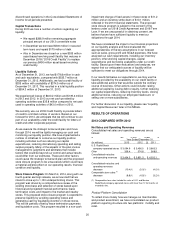

RESULTS OF OPERATIONS

2013 COMPARED WITH 2012

Net Sales and Operating Revenues

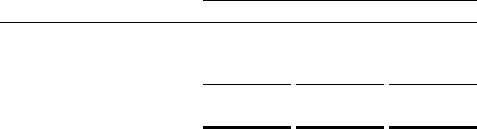

Consolidated net sales and operating revenues are as

follows:

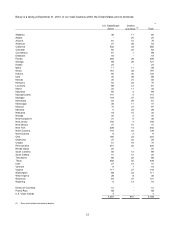

Year Ended December 31,

(In millions) 2013

2012

2011

U.S. RadioShack

company-operated stores

$

3,094.9

$ 3,456.5

$ 3,663.3

Other 339.4

374.8

368.8

Consolidated net sales

and operating revenues

$

3,434.3

$ 3,831.3

$ 4,032.1

Consolidated net sales and

operating revenues

decrease (10.4)%

(5.0)%

(4.0)%

Comparable store sales (1)

decrease (8.8)%

(4.5)%

(3.2)%

1

(1)

Comparable store sales include the sales of U.S. and Mexico

RadioShack company-operated stores with more than 12 full months of

recorded sales.

Product Platform Consolidation

To reflect more closely how we manage our merchandise

and product assortment, we have consolidated our product

platform reporting structure into two platforms: mobility and

retail.