Radio Shack 2013 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2013 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

The 2011 effective tax rate was affected by the realization

of job retention credits generated pursuant to the Hiring

Incentives to Restore Employment Act. These credits

lowered the effective tax rate by 1.0 percentage points.

RECENTLY ISSUED ACCOUNTING

PRONOUNCEMENTS

None.

LIQUIDITY AND CAPITAL RESOURCES

Cash Flow Overview

Operating Activities: Cash provided by operating activities

in 2013 was $35.8 million, compared with cash used in

operating activities of $43.0 million in 2012. Our cash flows

from operating activities are comprised of net loss plus non-

cash adjustments to net loss and the net changes in assets

and liabilities. The amounts of cash provided by net loss

plus non-cash adjustments to net loss were negative

$250.6 million and $59.9 million in 2013 and 2012,

respectively. The increase in net loss plus non-cash

adjustments was primarily driven by our increased net loss

in 2013.

The amount of cash provided by the net changes in assets

and liabilities was $286.4 million in 2013, compared with

cash used by the net changes in assets and liabilities of

$102.9 million in 2012. The increase in cash provided by

the net changes in assets and liabilities in 2013 was

primarily driven by cash provided by our decreased

accounts receivable and inventory balances at December

31, 2013. The decrease in our accounts receivable balance

in 2013 was driven by the decrease in our postpaid wireless

business and the collection of a tax refund in 2013. The

decrease in our inventory balance in 2013 was primarily

due to the discontinuation of our Target Mobile segment

and reduced inventories at our Mexican subsidiary.

Investing Activities: The amounts of cash used in

investing activities were $78.2 million and $94.2 million in

2013 and 2012, respectively. This decrease was driven by

decreased capital expenditures in 2013, which were

partially offset by an increase in our restricted cash

balance. For further discussion of our restricted cash, see

“Cash Requirements” later in this MD&A. Capital

expenditures were $42.3 million in 2013 compared with

$67.8 million in 2012. This decrease was a result of our

efforts to focus our capital spending on our U.S. stores to

high-impact, cost-efficient initiatives, as well as reduced

capital spending at our Mexican subsidiary related to fewer

new store openings in 2013. Capital expenditures primarily

related to our U.S. RadioShack company-operated stores

and information system projects in 2013 and 2012.

Financing Activities: Net cash used in financing activities

was $313.5 million in 2013 compared with net cash

provided by financing activities of $81.2 million in 2012. Our

net cash used in financing activities in 2013 was due to the

repayment of $461.9 million of long-term debt. This was

partially offset by $256.7 million in proceeds from the

issuance of long-term debt. Additionally, our changes in

cash overdrafts resulted in a $108.3 million use of cash.

Our net cash provided by financing activities in 2012 was

primarily due to the $175.0 million of new borrowings.

These borrowings were partially offset by the purchase of

$88.1 million principal amount of our 2013 convertible notes

and our dividend payments of $24.9 million.

Free Cash Flow: Our free cash flow, defined as cash flows

from operating activities less dividends paid and additions to

property, plant and equipment, was negative $6.5 million in

2013, negative $135.7 million in 2012, and $86.2 million in

2011. The increase in free cash flow for 2013 was

attributable to cash provided by the net changes in our

assets and liabilities described above.

We believe free cash flow is a relevant indicator of our

ability to repay maturing debt, change dividend payments or

fund other uses of capital that management believes will

enhance shareholder value. See “Liquidity Outlook” in the

executive summary of this MD&A for further discussion of

our sources of liquidity and our cash requirements in future

periods. The comparable financial measure to free cash

flow under generally accepted accounting principles is net

cash flows provided by or used in operating activities. Net

cash flows provided by operating activities was $35.8

million in 2013, compared with net cash used in operating

activities of $43.0 million in 2012 and cash provided by

operating activities of $217.9 million in 2011. We do not

intend for the presentation of free cash flow, a non-GAAP

financial measure, to be considered in isolation or as a

substitute for measures prepared in accordance with

GAAP, nor do we intend to imply that free cash flow

represents cash flow available for discretionary

expenditures.

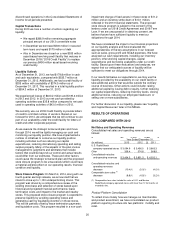

The following table is a reconciliation of cash flows from

operating activities to free cash flow.

Year Ended December 31,

(In millions) 2013 2012

2011

Net cash

provided by (used in)

operating activities $ 35.8 $

(43.0)

$ 217.9

Less:

Additions to property, plant

and equipment 42.3 67.8

82.1

Dividends paid -- 24.9

49.6

Free cash flow $

(6.5) $

(135.7)

$

86.2